To the latter point, as a share of global personal consumption, the developing nations now account for roughly 42% of the total versus a share of 23% at the start of the century; total consumption expenditures of the developing nations rose from $4.6 trillion in 2000 to an estimated $18.9 trillion in 2017. That’s more than a 300% increase—and reflects a number of factors including rising per capita incomes, greater female participation rates in the formal economy, the diffusion and declining cost of technology, higher rates of education, and shifting demographics in such places as China and India. It also mirrors the “catch-up” phase of personal consumption in the developing nations relative to the wealthier, mature and satiated developed markets, and the global convergence in tastes, wants, desires and dreams among consumers around the world—whether in Boston or Bangalore.

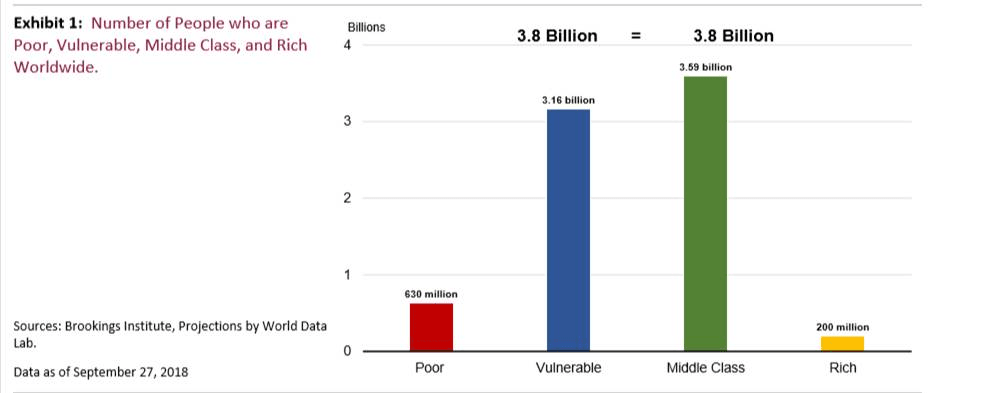

Taking the long view, roughly 150 years after the Industrial Revolution in Europe, the global middle class reached 1 billion in 1985. It then took another 21 years for the middle class to add a second billion (2006); thereafter, it took nine years to achieve three billion (2015). A fourth billion is expected to be added in seven years (2022) and yet a fifth billon in six years, or 2028.3

Against this backdrop, with half of humanity now considered middle class, a “third wave” of consumerism is taking hold in the EMs, one that presents unique opportunities for investors.

Riding The Waves Of Consumption

Wave One

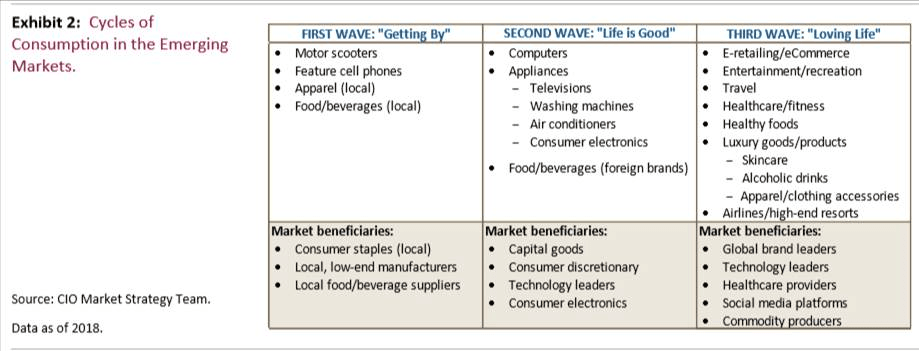

While roughly 700 million people have been lifted out of poverty since the start of the century, some 1 billion people still toil in poverty today, eking out a subsistence existence. Because their incomes are limited, so is their spending power. They get by, but barely in many cases. Consumption in the “first wave” is elementary, revolving around basic consumer staples, a motor scooter and a simple cell phone (Exhibit 2). The majority of these goods is sourced locally.

Wave Two

We dubbed the “second wave” of consumption as “life is good” because it is just that. Per capita incomes in this “wave” are sufficient enough for consumers to afford many durable goods that can be found in the average U.S. household. This middle class cohort has the financial wherewithal to buy stuff—think computers, automobiles, and time-saving, easier-living appliances like color televisions, washing machines and air conditioners. Cell phones are ubiquitous among this cohort, and internet penetration is deep. Folks in this cohort also have enough discretionary income to indulge in fast food (think large global chains) or specialty beverages like foreign beers and liquors. This wave continues to swell as more consumers in the first wave gain the employment and incomes to move up the consumption curve. Today, this is where the majority of middle class consumers in the EMs are found, enjoying “life is good” comforts that spring from rising per capita incomes and rising educational levels, among other things.

Wave Three

That said, a “third wave” of consumption is taking shape in various parts of the world as more educated, highly skilled, tech-savvy and global-minded consumers emerge to drive sales not only in goods like cell phones and autos but also in high-end services like fitness, on-demand entertainment, skincare, travel and leisure, and related activities. This cohort, for the most part, is “Loving Life.” and why not? These consumers, young and old, male and female, have solidified their status in the global middle class and reached income levels that are light years ahead of past generations. Many are entrepreneurs, female executives, first-generation college graduates, real estate developers, leaders of tech startups—you name it, they come from all walks of life and are increasingly adding to the dynamics of global consumption.

Notably, the weight of consumption in the “third wave” is shifting towards services. In possession of basic material goods, the “Loving Life” cohort not only desires and demands more high-end products but also more value-added services like health care, fitness accessories and health foods. These consumers are very tech-savvy and use their smart phones for banking, for ordering food and for transportation, among other things. They purchase goods and services online, including airline tickets and hotel reservations since this cohort loves to travel. Entertainment and education are other hot wants of this consuming group.

The “third wave” is about the consumption of high-end goods and services, complemented by “second wave” consumers. Combined, these consumers are part of the 3.8 billion people who make up the global middle class. This cohort has now reached the size and scale whereby they are the main drivers of global trends, global fashion, and increasingly, global growth and earnings.

Portfolio Positioning Around The Global Middle Class

There is no single investment strategy that best leverages the rise of the global middle class. The most effective strategy is multi-faceted—at the core, Western multinationals with strong global brands, expanding exposure in key EMs, and unique core competencies are the best positioned to tap the future wants and needs of the burgeoning global middle class. Key sectors include technology, materials, health care, industrials, travel and leisure. We remain bullish on agricultural commodities as well due to shifting/improving diets among the EM middle class.

In the end, the world has taken a decided turn for the better—in a tectonic shift in global prosperity, half the world now has income levels that place them with the “middle class” cohort. That’s worth thinking about amid all the negative headlines of today.