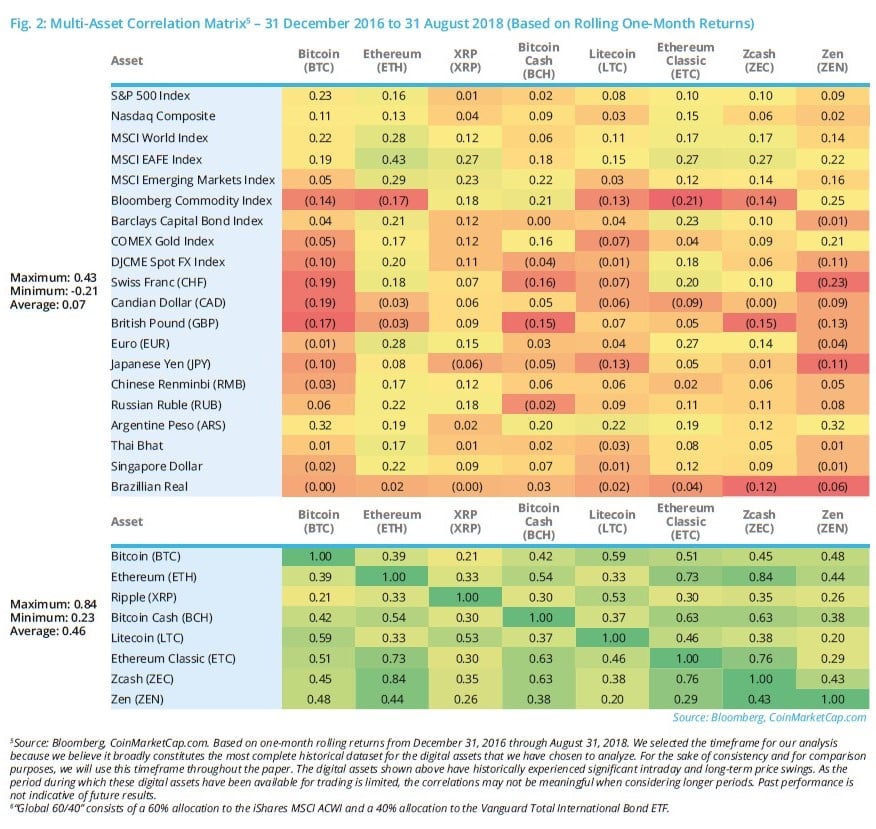

In Fig. 2, we examine the relationship that some established digital assets have to traditional assets and each other through a correlation matrix constructed from rolling one-month returns over the past >1.5 years.

![]()

From the previous tables, we can see that the correlations of rolling one-month returns range from negative to slightly positive, with an average of zero. This provides evidence that digital assets can be considered a diversifying component in multi-asset portfolios. Moreover, many digital assets are imperfectly correlated to one another, which indicates there may be diversification benefits within the asset class itself.

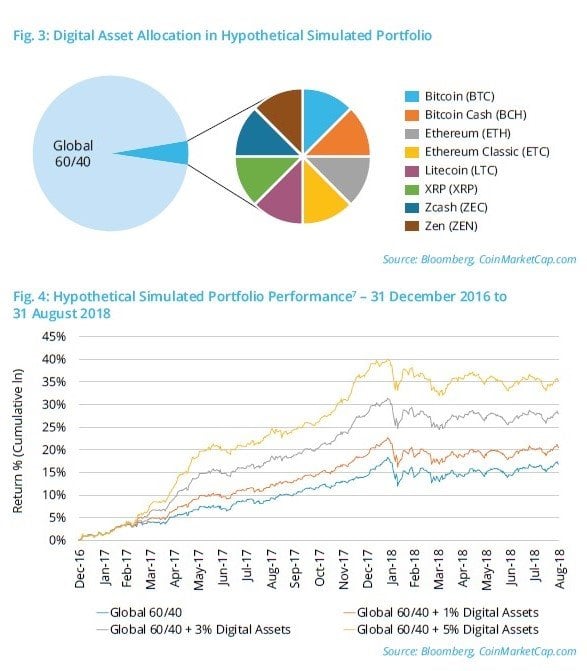

To gain a deeper understanding of these benefits, we conducted a series of portfolio simulations to assess how an allocation to an equal-weighted mix of select digital assets might have impacted the return/risk profile of a portfolio comprised of global equities and bonds (the “Global 60/40”).6 Looking at the results, it appears that portfolios containing an allocation to digital assets performed even better than the Global 60/40, on both an absolute and risk-adjusted basis. For example:

- Adding a 1% digital asset allocation increased the hypothetical simulated cumulative return by 447 bps, without materially increasing volatility to improve risk-adjusted returns by 23%.

- Adding a 3% digital asset allocation increased the hypothetical simulated cumulative return by 1,385 bps, without materially increasing volatility to improve risk-adjusted returns by 59%.

- Adding a 5% digital asset allocation increased the hypothetical simulated cumulative return by 2,387 bps, without materially increasing volatility to improve risk-adjusted returns by 127%.

Given what we know about Modern Portfolio Theory, this is not all that surprising. Since digital assets are uncorrelated with traditional assets and imperfectly correlated with one another, they can be combined to build portfolios with higher risk-adjusted returns.

Conclusion

At Grayscale, we were early investors in digital assets because we have long believed in their potential to capture a share of some of the largest markets in the world (e.g. store-of-value), improve the efficiency of our global financial system, and create business models that democratize information and value in incredible new ways. We also recognize that because of their highly unique set of properties, they offer a distinct return stream, allowing them to play a diversifying role in investor portfolios. It is still early in the lifecycle of digital assets, but we believe there is a compelling case for investors to allocate some portion of their portfolio to this new asset class. A lot can happen over the next few years, but remember: diversification is a “free lunch” and asset allocation is all about the long game. We invite you to join us on the journey to a new frontier.

Industry News

In this month’s Industry News, we examine recent hedge fund performance, event driven hedge fund launches since the start of 2018 and endowment plans that are currently seeking new investments in the asset class.

Hedge Fund Performance

In 2018 YTD (as at August), hedge funds have returned 1.32%. Among the funds that have achieved positive returns is Foxhill Opportunity Fund; managed by Princeton-headquartered Foxhill Capital Partners, the vehicle has been a key driver of the performance of the Preqin All-Event Driven Strategies Hedge Fund in 2018 YTD. The fund generated 1.87% in July 2018, and its 2018 YTD return is 29.86%. The vehicle employs an event driven strategy with expertise in stressed, distressed and special situations investments focused on North America.

Kondor Equities Institutional FIA, which is managed by Brazil-headquartered Kondor Invest, generated 7.99% in July 2018, bringing its 2018 YTD return to 18.30%. The fund employs a long bias strategy and uses equities, debt, foreign exchange and derivatives as methods of investment, with a sole focus on Brazil.

Dichotomy Partners, managed by New York-based Dichotomy Capital, generated a return of 2.00% in July 2018, bringing its 2018 YTD return to 19.44%. The fund primarily employs a value-oriented strategy, but also targets fixed income and long-only equity opportunities focused on North America and Europe.

Event-driven Hedge Fund Launches

Since the start of 2018, 98 event driven strategies hedge funds have launched securing an estimated aggregate $8.5bn so far. One such fund is Islet Master Fund which is managed by New York-based Islet Capital. The globally focused fund aims to deliver non-correlated results within defined risk parameters, primarily through investments in equities, equity-linked securities and related derivatives.

Kyma Capital Fund, launched in September 2018 and managed by Kyma Capital, is a discretionary distressed fund that will take long and short positions in European leveraged companies and will hold a concentrated portfolio of no more than 10 positions at a time in medium-sized companies. The fund will hold high-yield bonds, loans and credit default swaps and shares, and will seek to take an active role in invested companies.

Launched in July 2018, European Special Opportunities Fund, managed by Indar Capital, will implement an opportunistic deep value plus catalyst strategy focused on liquid European equities and distressed situations.

Endowment Plans Seeking New Investments

Endowment plans seek to diversify their portfolios by targeting a variety of hedge fund strategies around the world. There are currently 607 active endowment plans on Preqin’s online platform looking to invest in hedge funds. One such investor is Dartmouth College Endowment, which seeks to invest in long/short equity or risk/ merger arbitrage funds. The Boston-based Ivy League institution is looking to allocate $1.3bn to hedge funds in the next 12 months and will invest on a global scale, but would also consider investing in a fund solely focused on the Asia-Pacific region.

Carnegie Mellon University is seeking to opportunistically invest in new hedge funds over the next 12 months and will target direct single-manager hedge funds. It seeks global exposure and invests in a wide variety of strategies such as currency, distressed, macro and value-oriented. The Pittsburgh-based national research university typically invests $3-10mn per fund.

New York-based Juilliard School Endowment seeks to invest in a mix of both new and existing managers over the next 12 months. The performing arts conservatory is targeting commingled hedge funds and invests in both single-manager and funds of hedge funds.

Performance Benchmarks

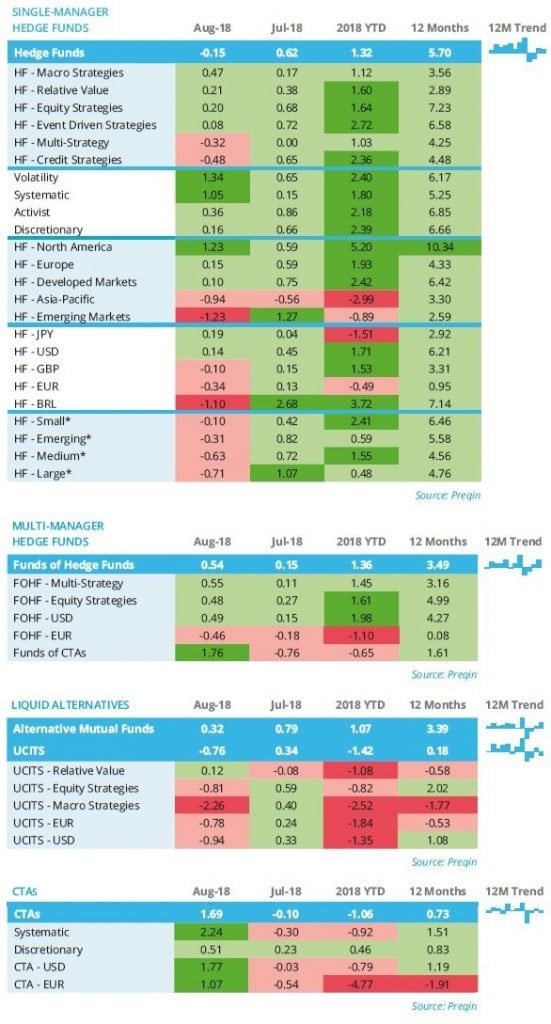

- The Preqin All-Strategies benchmark recorded -0.15% in August after posting positive returns in July (+0.62%). This takes the year-to-date and 12-month returns to 1.32% and 5.70% respectively.

- Macro strategies outperformed all other top-level strategies with gains of 0.47%. Multi-strategy vehicles (-0.32%) and credit strategies (-0.48%) were the only top-level strategies to suffer losses in August.

- Volatility-driven hedge funds enjoyed strong performance in August generating returns of 1.34%. By contrast, discretionary hedge funds had the weakest performance of all top-level trading methodologies, making incremental gains of 0.16%.

- CTAs overcame three months of consecutive negative returns to achieve a return of 1.69% in August, pushing 12-month returns to 0.73%.

Fund Searches and Mandates

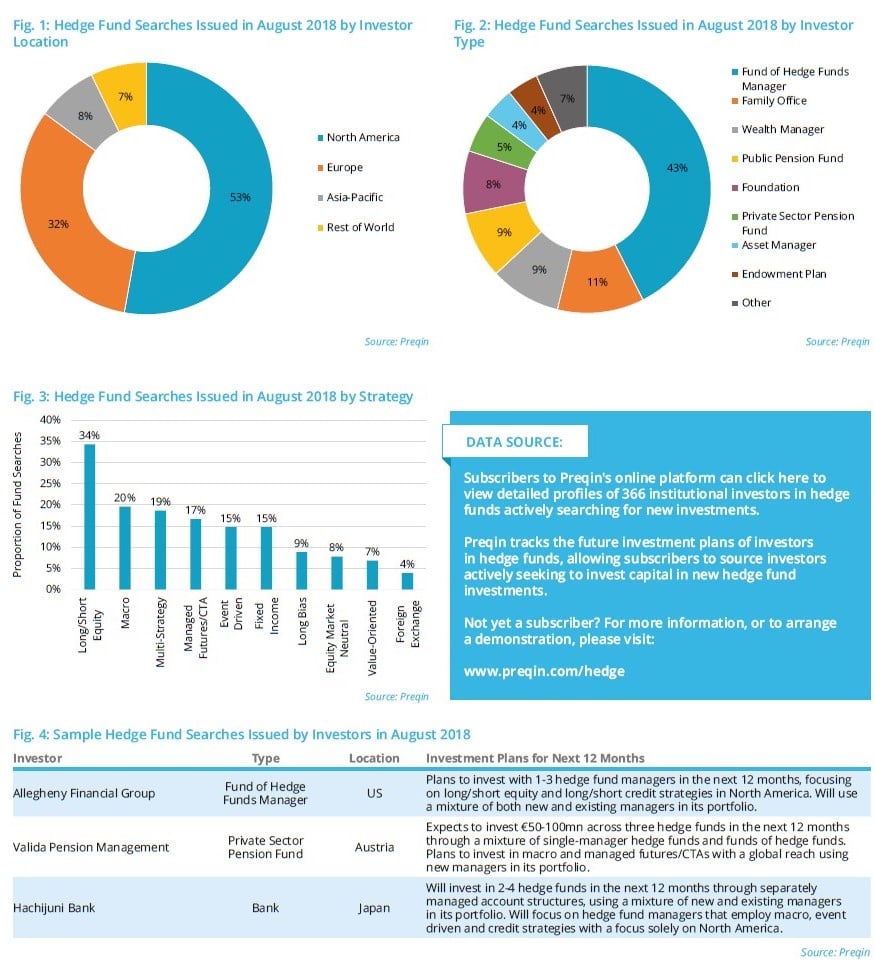

We take a look at the fund searches and mandates issued by active hedge fund investors over August 2018.

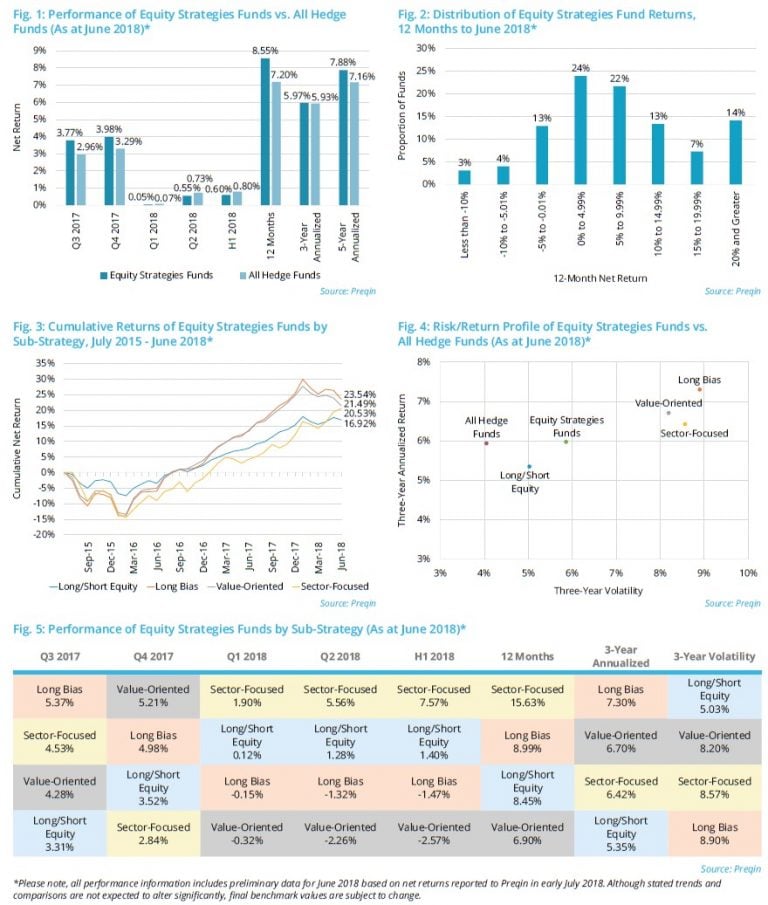

Equity Strategies Hedge Funds

In this excerpt from the 2018 Preqin Alternative Assets Performance Monitor, we break down the historical performance statistics of equity strategies hedge funds.

Article by Preqin

For more trends in fixed income, visit the Advisor Solutions Channel.