As stocks tumbled on Oct. 10 and Oct. 11, gold exchange traded funds, such as the SPDR Gold Shares (NYSEArca: GLD), gained ground and trimmed what had been notable year-to-date losses. However, some market observers believe the yellow metal’s safe-haven status has yet to be renewed in earnest.

Investors have turned to GLD as a quick and easy way to gain exposure to gold price movements as they hedge against market risks, help protect their purchasing power in times of inflationary pressures or capitalize on increasing demand from the emerging markets with a growing middle-income class.

While the world’s largest gold ETF gained more than 2% last week, trimming its year-to-date loss to just over 6%, it and rival gold funds still have some work to do.

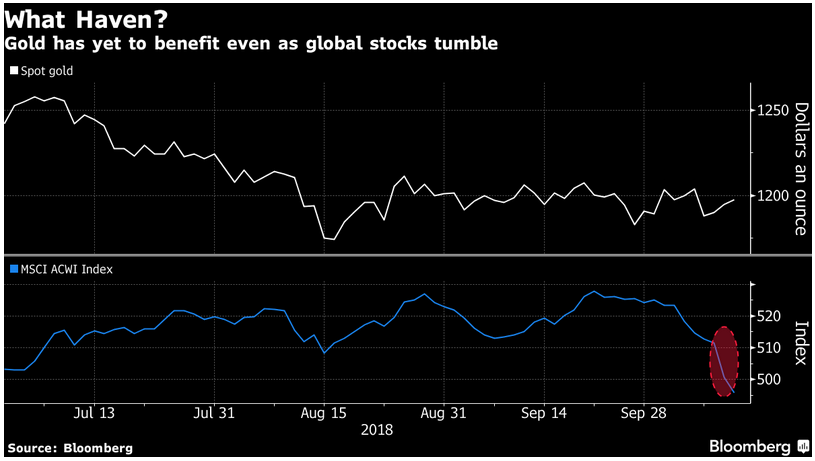

“The biggest selloff in equities since February rolled through Asia and into Europe on Thursday, triggering steep losses in benchmark share indexes, but gold has barely stirred, while other havens from U.S. Treasuries to the Japanese yen and the Swiss franc showed only limited fluctuations,” reports Bloomberg.

![]()

What Needs to Happen

September market the sixth consecutive month of losses for gold and some technical analysts believe the yellow metal needs to steady above the $1,200 to $1,210 per ounce area to encourage short covering, which stoke a swift rally.