China’s real growth rate has weakened, raising fears among investors that one of world’s largest economies may be on the cusp of a dramatic slowdown.

But, China is headed for something worse than a recession: a prolonged and fractious period with the United States, according to a new report by Bank of America, U.S. Trust.

It’s hardly a stretch to say that the U.S. and China have entered an economic cold war, a turn of events that have chilled the global capital markets and contributed, to the recent market swoon in equities, says Joe Quinlan, Head of CIO Market Strategy. The era of engagement is over. The two largest economies in the world are now rivals—a seismic shift the capital markets are only now beginning to discount.

China’s cyclical slowdown is less about trade frictions with the United States and more about policy-induced tightening measures. The latter includes the phasing out of preferential tax treatment for automobiles, undermining vehicle sales this year, and tighter credit conditions in China’s vast shadow banking system, subsuming fixed capital investment and related activities. The one-two punch slowed real growth to 6.5% in the third quarter—one of the weakest rates since the global financial crisis—and has raised fears among investors that one of world’s largest economies may be on the cusp of a dramatic slowdown in growth.

China, in our opinion, is not headed for recession but something perhaps worse: a prolonged and fractious period with the one country in the world that not only has the economic and military firepower to block or forestall the rise of the Middle Kingdom but also is determined, at least on the surface, to do just that: the United States.

Any doubts that the U.S. views China as a strategic rival, and is not in the “business as usual” mode, appears blown away by a recent speech by Vice President Mike Pence. The October 4 address was critiqued as “broader and deeper in its criticism of China than any other U.S. government statement of the past several decades.”1 A sampling: speaking to China’s military and economic objectives, the vice president proclaimed that the United States “will not be intimidated and will not stand down.”2 Another shot across the bow: “previous administrations all but ignored China’s actions. And in some cases, they abetted them. But those days are over.”3

Combative words, for sure—but not against a foe itching to go to war with the U.S. go to war with the U.S. but against a country which happens to be America’s top creditor (China owns nearly $1.2 trillion in U.S. Treasuries), key export market for U.S. companies (China accounted for 8.4% of U.S. goods exports last year, double the levels of Germany and France) and most profitable market for corporate America (last year, U.S. foreign affiliates earned $13.4 billion in China, more than in Germany and France combined).

The seemingly harsh words from the vice president preceded relatively harsh actions. Unnerving the markets, the administration has slapped tariffs on nearly half of all Chinese imports to the United States this year, and is threatening even broader restrictions. Against this backdrop, escalating U.S.-China trade tensions remains a dark cloud over the global capital markets, with little signs of dissipating anytime soon.

Across the Pacific, meanwhile, Vice President Pence’s adversarial speech left the Chinese people “upset and angry,” and was viewed as “unacceptable” by the government.4 The upshot: a full-scale boycott of American goods has yet to materialize but remains a risk the longer trade tensions simmer. Many Chinese producers have seen their costs rise and orders decline due to the U.S. tariffs, while the national government has been caught flat-footed by Washington’s tougher-than-expected hard line on trade with China.

The Clash of the Economic Titans

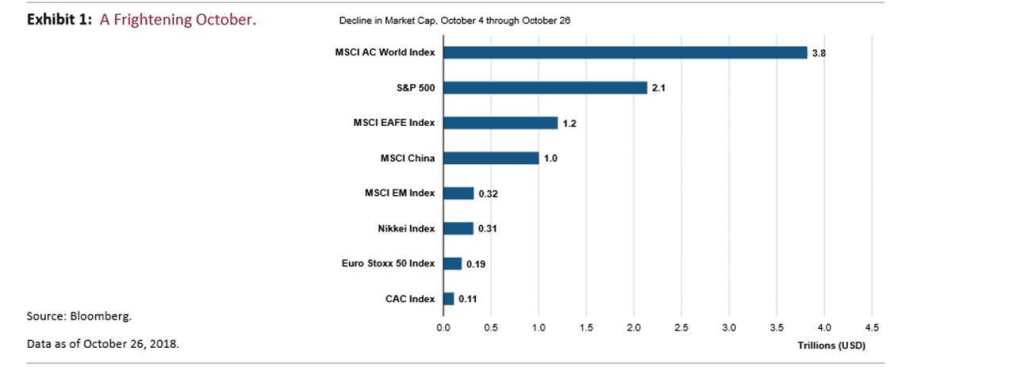

It’s hardly a stretch to say that the U.S. and China have entered an economic cold war, a turn of events that have chilled the global capital markets and contributed, in our opinion, to the October market swoon in U.S. and global equities. To wit, since the vice president’s adversarial speech on October 4, global equities have shed some $3.8 trillion in value, with the S&P 500 losing some $2.1 trillion. Other major indexes have also been hammered (Exhibit 1, which depicts the carnage of October).