He goes on to describe the opportunity further:

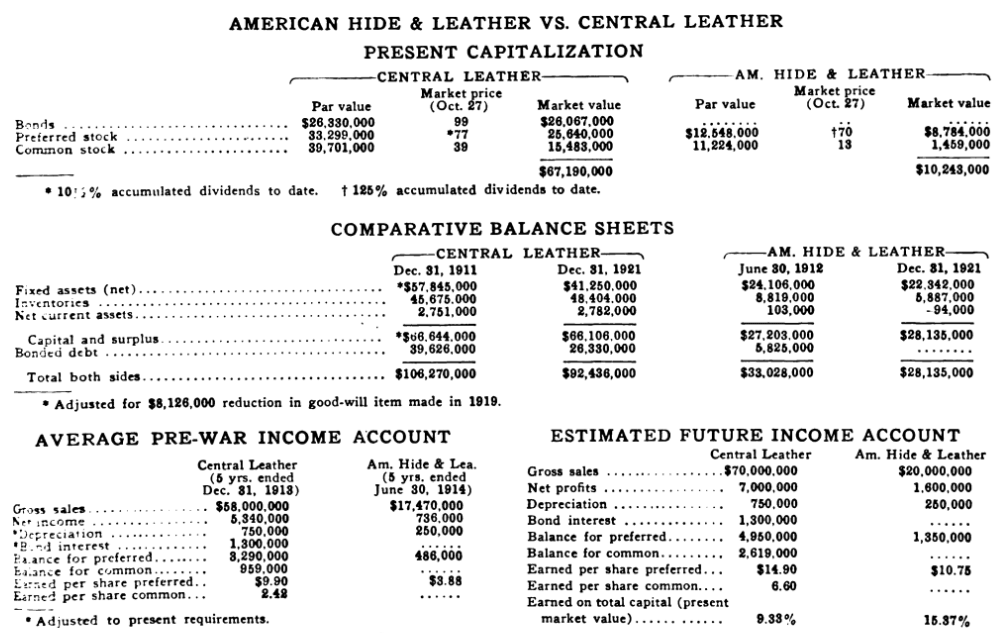

“Am. Hide & Leather preferred, representing thus the entire capitalization of the company, has a current market value of only about half the average pre-war sales. Central Leather’s three classes of securities aggregate $67,000,000 in market price, or somewhat in excess of its annual turnover. Otherwise stated, Central Leather is capitalized twice as heavily in comparison with its volume of business. This should be an important advantage in favor of the American company, for with the same margin of profit on its sales it should earn double as much on its capital. The actual results, however, have been just the opposite, because its ratio of net to gross has always been abnormally low. The average pre-war figures, given in our table, show a profit margin of only 4.74% on its total business, as against over 9% for Central Leather. After allowing for depreciation, American Hide & Leather’s net works out as only 5.40% on its capitalization, while Central Leather has earned 6.85%. On the latter’s stock capitalization alone the available balance averages over 8%.”

These two companies had enjoyed a brief period of success throughout WWI thanks to rising prices, which allowed them to sell inventory at better than average prices. However, when the war ended, prices returned to normal, and the two companies returned to their pre-war state.

“There is presented in the table showing Comparative Balance Sheets a skeleton balance-sheet of Central Leather at the end of 1921 and 1911. No one could guess from these figures the colossal vicissitudes of the intervening years. The inventory, the working capital, the surplus, are all nearly identical in both exhibits. The only significant change is a substantial reduction in fixed assets on one side, and in funded debt on the other. This represents chiefly the steady depletion of the company’s timber holdings, with a corresponding amortization of the bond issue. With American Hide & Leather, the case is very similar. But here the retirement of the funded debt, first effected out of surplus cash, seems now to have necessitated the reduction of inventories to an abnormally low figure.”

Re-basing the businesses to the different environment was proving to be a challenge, but Am Hide was achieving restructuring, while Central struggled. Graham noted:

“American Hide is now enjoying a higher earning power than its rival. The unofficial figures of $325,000 net after taxes for this period would be at the annual rate of over $10 per share of preferred-nearly 15% on the present market price of 70. Central Leather’s statement showed profits equivalent to about $9 on the preferred and $1.75 on the common. On its preferred and common combined, the results work out as 7.72% of market value-only half as attractive as the Am. Hide & Leather showing.”

That being said, Central had a hidden advantage on its balance sheet, in the form of unsold inventory, which could be sold into a rising market to strengthen its balance sheet:

“The financial condition of both companies at the close of 1921 was sound. The notes payable were relatively small and are said to have since been reduced. American Hide has undoubtedly a distinct advantage in the absence of funded debt, as contrasted with the maturity of $26,000,000 of 5% bonds which Central Leather will have to meet in 1925. These bonds, however, have enabled Central Leather to carry a larger relative inventory, which may now prove fortunate through the recent advance in hide prices. The slower rise in finished leather is threatening to cut into the tanners’ margin of profit, but this discrepancy should be corrected in the natural course of events.”

So which company did Graham favor? After crunching the numbers, he concluded that based on the company’s earnings potential Am Hide & Leather could pay out $7 per share on its preferred stock. Meanwhile, Central could afford $4 on its common. In both cases, the yield was about “10% on the present price,” although “the absence of senior securities should entitle the former issue to sell on a lower basis of yield.”

The dividend potential of Am Hide swayed the author. Even though he cautioned that the outlook for both companies was far from certain, Graham went on to state “Central Leather common is much further removed from dividends, and the heavy prior claims of the bonds and preferred stock make its position essentially more speculative than that of American Hide & Leather preferred.”

This originally appeared at ValueWalkPremium.com.