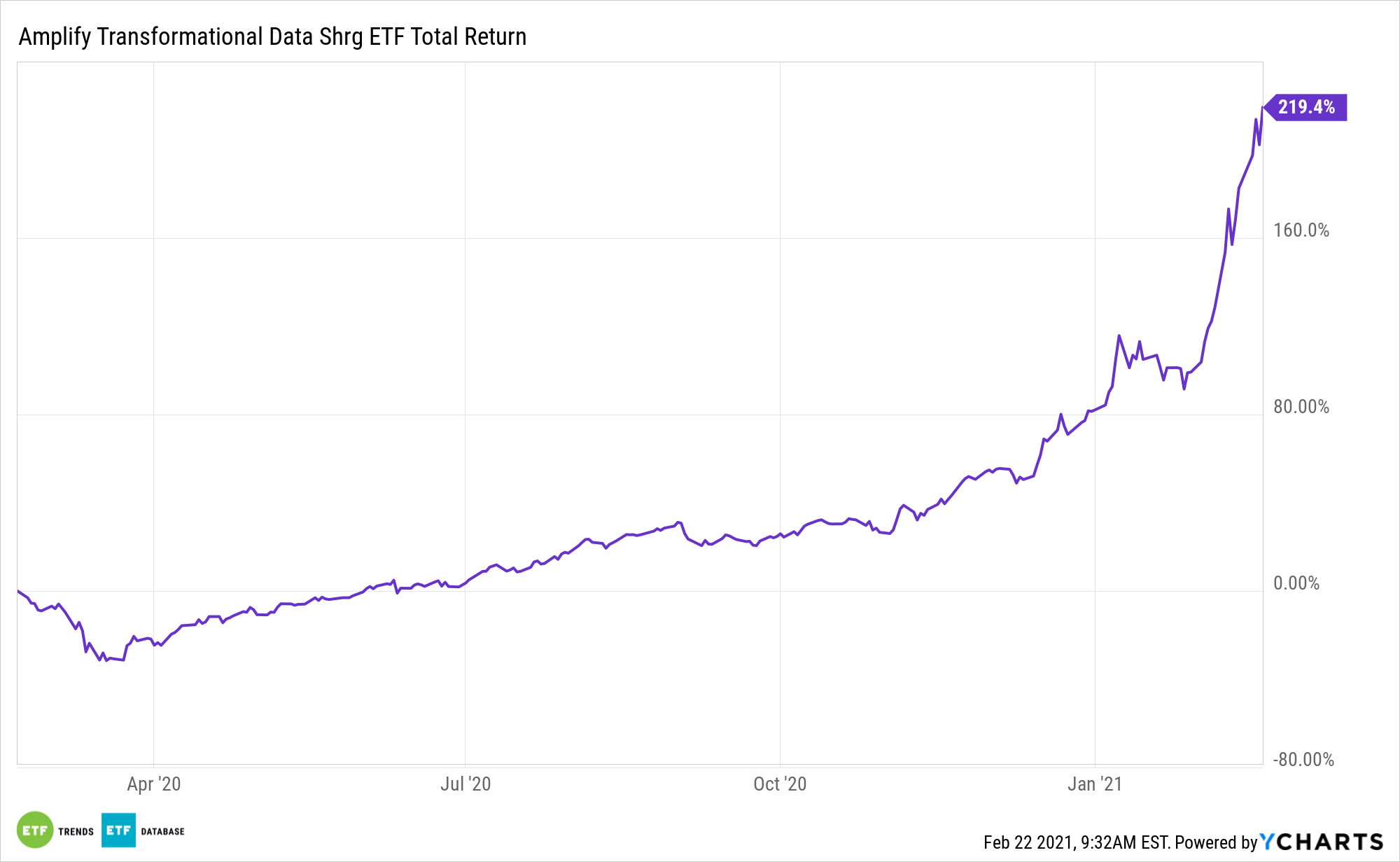

Bitcoin’s seemingly indomitable rise – it’s been hitting new highs on almost daily basis recently – is providing a spark for blockchain equities. Up 219%, the Amplify Transformational Data Sharing ETF (BLOK) proves as much.

According to Amplify, “BLOK is an actively managed ETF that seeks to provide total return by investing at least 80% of its net assets in equity securities of companies actively involved in the development and utilization of blockchain technologies.” Amplify classifies each company included in the index as either ‘core’ or ‘secondary’ based on how closely-tied the company’s business is to blockchain development.

Investors are displaying ample enthusiasm for BLOK, as the actively managed fund recently topped $1 billion in assets under management.

“Just over three years ago we launched the first actively-managed ETF focused on the dynamic market segment of blockchain-related stocks,” said Amplify CEO Christian Magoon. “BLOK has provided investors with additional portfolio diversification through its unique portfolio makeup that includes the Bitcoin Investment Trust. Blockchain technology is primarily known for one application today: cryptocurrency. However, there is a fast-growing universe of applications for blockchain technology. We believe the growth of crypto is a case study on the values blockchain technology delivers when it comes to trust, data sharing, efficiency and transparency.”

Banking on BLOK: Where Does Blockchain Go from Here?

Blockchain, the underlying technology that forms the basis for cryptocurrencies, has plenty of other real-world uses. Blockchain itself has been a hot topic, with companies like investment firm UBS looking to implement the transactional technology in the financial sector. Other industries, including healthcare and retail, are expected to be major adopters of blockchain.

The rapid rise of Bitcoin has generated fierce debate concerning the long-term viability of investing in cryptocurrencies. While rapidly evolving blockchain technology can provide a discrete digital ledger to track transactions, many advisors remain concerned with the regulation and volatility of cryptocurrency products, indicating that BLOK can be an ideal replacement strategy for clients looking to avoid some of the crypto volatility.

For now, there are dichotomies surrounding the blockchain thesis, though for investors willing to take on some risk, the story remains compelling.

The technology continues to capture investor interest as the technology gathers mainstream attention. According to the World Economic Forum, “10% of the global GDP is predicted to be stored on blockchain platforms by 2027.”

For more on active strategies, visit our Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.