Value stocks were on fire in the first half of 2021, and while plenty of market observers expect that scenario to persist in the second half, changes in the economic recovery cycle could favor higher quality stocks, perhaps even growth names.

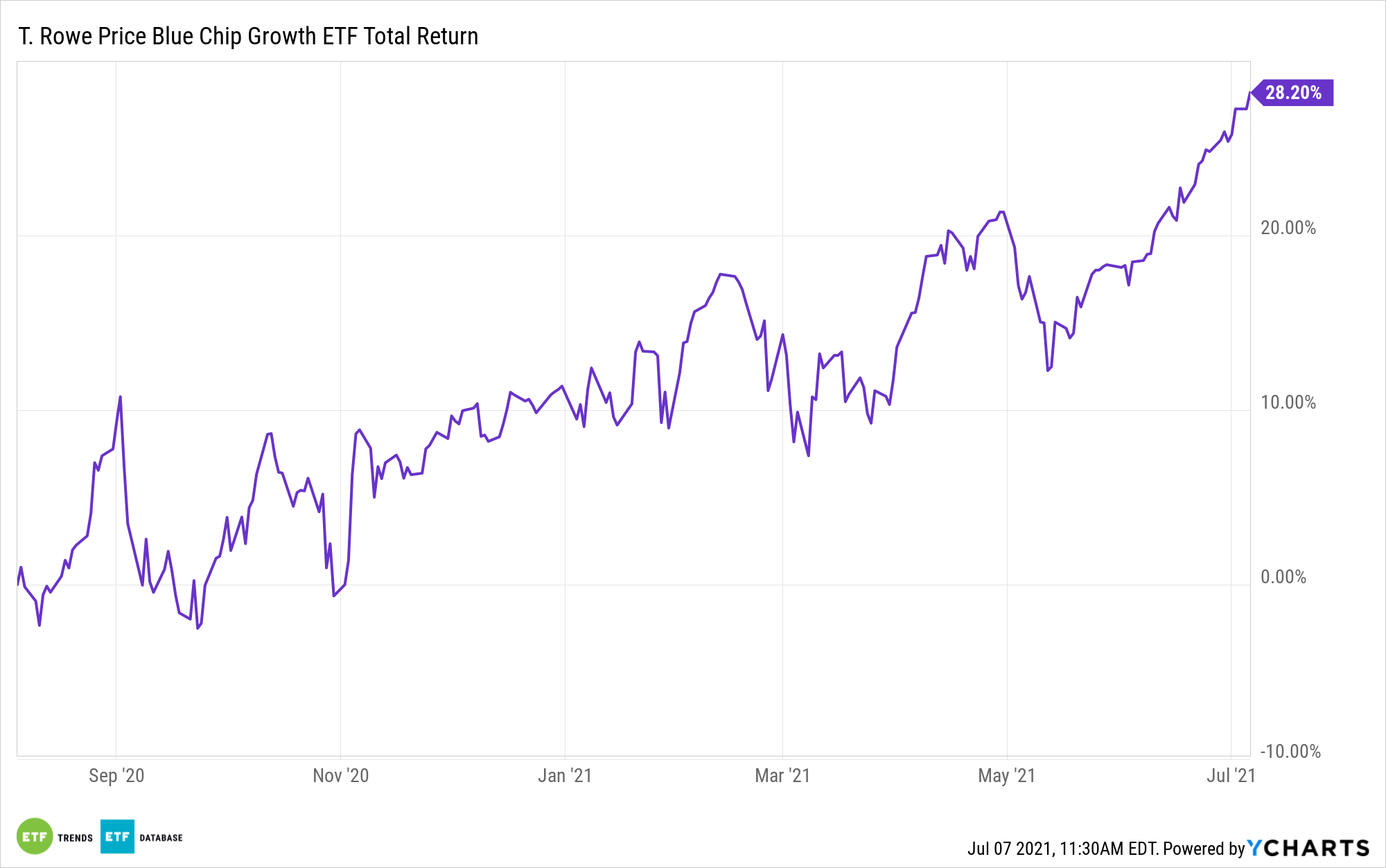

The T. Rowe Price Blue Chip Growth ETF (TCHP) is an example of an exchange traded fund that marries both concepts. Moreover, the actively managed TCHP offers investors exposure to disruptive trends, including e-commerce and the digitalization of the economy. A credible idea for long-term investors, TCHP’s structure indicates the fund is also a worthy near-term consideration.

“We see the potential for the rally in cyclical stocks to continue, although prevailing valuations and the pattern of past recoveries suggest to us that the next leg of any upcycle may favor names with higher quality business models,” writes T. Rowe Price portfolio manager Mark Finn.

TCHP is managed by Larry Puglia, who has been with T. Rowe Price for more than three decades.

TCHP’s Quality Flair, Growth Potential

TCHP is an actively managed semi-transparent ETF, meaning its holdings aren’t disclosed on a daily basis. However, the fund’s roster at the end of the first quarter, the period for which data are most readily available, confirms a roster positioned to benefit from a rebound in growth stocks as the communication services, consumer cyclical, and technology sectors are well-represented in the TCHP portfolio.

Additionally, TCHP offers an overt layer of quality. For example, TCHP top 10 holdings include Alphabet (NASDAQ: GOOG), Apple (NASDAQ: AAPL), and Microsoft (NASDAQ: MSFT) – three of the most cash-rich companies in the U.S.

TCHP’s quality positioning is important for multiple reasons, not the least of which are the fact that quality, broadly speaking, is currently inexpensive. The factor also tends to perform well when the Federal Reserve scales back asset purchases.

Online retail is yet another catalyst for the fund.

“Consider the rise of e commerce, a theme that is usually the province of growth investors because of elevated valuations that often price in a great deal of future earnings potential. We believe this trend has more room to run as consumers become more comfortable purchasing a growing array of products online, including groceries,” notes Finn.

TCHP’s top 10 holdings feature several names with deep e-commerce exposure, including Amazon (NASDAQ: AMZN), PayPal (NASDAQ: PYPL), and Alibaba (NYSE: BABA).

For more news, information, and strategy, visit the Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.