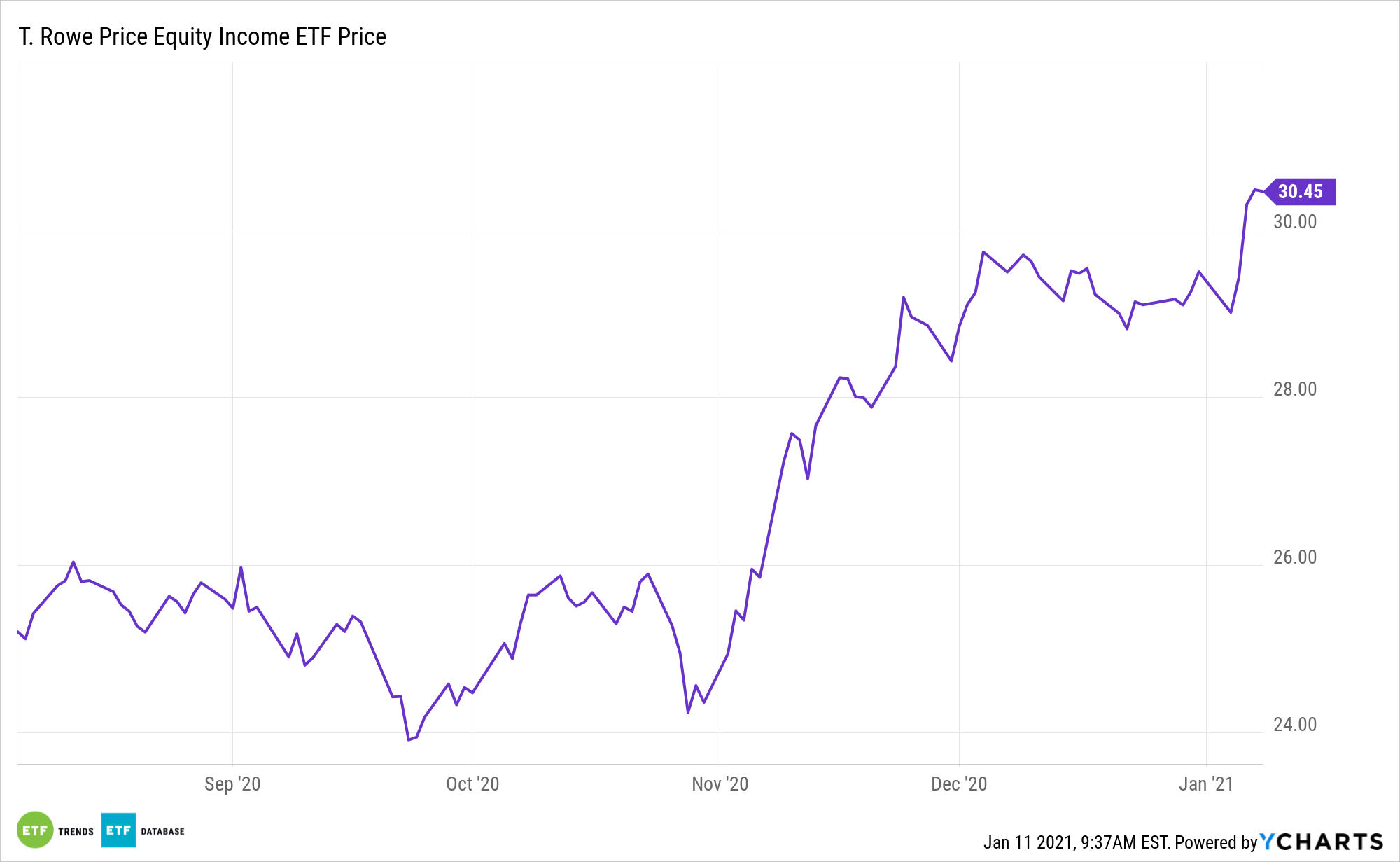

Bond yields are still depressed, but dividend stocks are on the mend. Investors can capitalize on those scenarios by adding active management to the mix with the T. Rowe Price Equity Income ETF (TEQI).

The T. Rowe Price Equity Income ETF seeks a high level of dividend income and long-term capital growth by investing most of its assets in common stocks, with an emphasis on large-capitalization stocks that have a strong track record of paying dividends or that are believed to be undervalued.

Constructed similarly to flagship investment strategies that have served T. Rowe Price clients well for decades, the active ETFs use the same portfolio managers as their corresponding mutual funds and employ the firm’s long-standing strategic investing approach, characterized by rigorous research, risk awareness, and independent decision making.

T. Rowe Price active ETFs complement the firm’s traditional mutual fund offerings and deliver the key features associated with existing ETFs that many investors prefer, including continuous daily trading, real-time market determined pricing, and tax efficiency.

Domestic dividends perked up in the fourth quarter, indicating this model portfolio could be poised for a strong showing this year.

TEQI Can Bolster Returns in a Low Rate Environment

As income-minded investors look for ways to bolster returns in a low rate environment, various exchange traded funds can rise to the challenge.

Exposure to the value factor could be in play following rotation away from high growth that has outperformed this year to cheaper cyclical sectors. Value stocks tend to trade at a lower price relative to their fundamentals (including dividends, earnings, and sales).

“Indicated dividend net changes (increases less decreases) for U.S. domestic common stocks increased $9.5 billion during Q4 2020, compared to a decline of $2.3 billion in Q3 2020, and a gain of $10.6 billion in Q4 2019,” according to S&P Dow Jones Indices. “For Q4 2020, aggregate increases amounted to $13.9 billion, up 64.2% from the $8.4 billion increase of Q3 2020 and up 15.7%, from Q4 2019’s $12.0 billion. Aggregate dividend cuts decreased 59.8% to $4.3 billion from Q3 2020s $10.8 billion in cuts, and was up 221% from the $1.3 billion in cuts for Q4 2019.”

Dividends are in demand as fixed income investors face a lower-for-longer interest rate environment. The Federal Reserve is expected to maintain its near-zero interest rate policy to help push inflation up, bolster the economy, and lower the unemployment rate. The Fed has already stated it is willing to let inflation run higher to offset years inflation fell below its 2% target.

For more on active strategies, visit our Active ETFs Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.