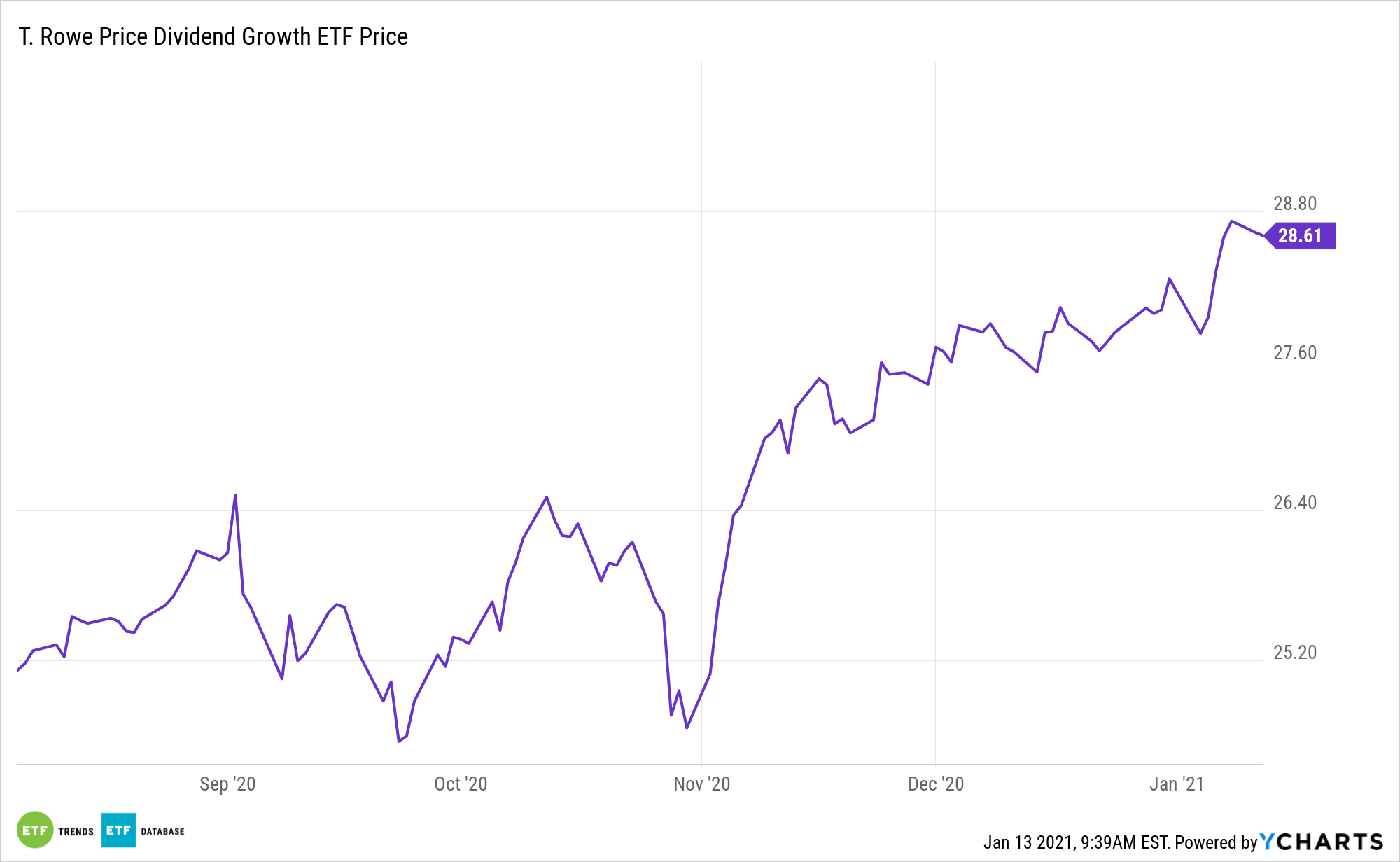

With dividend stocks experiencing a renaissance and poised for payout growth this year, investors may want to consider active strategies such as the T. Rowe Price Dividend Growth ETF (TDVG).

This actively managed ETF seeks to provide clients with a growing stream of dividend income and superior risk adjusted returns. It’s a philosophy that has not changed since the inception of its mutual fund counterpart, the T. Rowe Price Dividend Growth Fund, which launched in 1992.

TDVG invests at least 65% of its total assets in dividend-paying stocks, emphasizing companies that are expected to increase their dividends over time. More specifically, the portfolio typically invests in between 100 and 125 dividend paying companies, including holdings like Microsoft (MSFT), Apple (APPL), and Visa (V).

For dividend growth investors, the good news with TDVG is that it avoids many of the trouble spots that crimped the dividend space in 2020.

“Dividend stocks suffered in early 2020 partly because scores of companies (including major firms like Disney (DIS), Royal Dutch Shell (RDS.A), and General Motors (GM)) either reduced or suspended their dividends as the sudden economic decline from the coronavirus dented profitability and cash flow,” writes Morningstar analyst Amy Arnott. “Sector exposure was another factor that weighed down returns, as dividend stock benchmarks are light on the technology issues that have led the market. Investment style is a closely related reason for dividend stocks’ underperformance, as they lean heavily toward value instead of the high-growth, momentum-oriented stocks that led the market during most of 2020.”

Let’s Talk TDVG

Investors should consider quality dividend growth stocks that typically exhibit stable earnings, solid fundamentals, strong histories of profit and growth, commitment to shareholders, and management team conviction.

When selecting the portfolio’s holdings, the durability of the company’s business model is tested by assessing the management team quality, the potential for excess cash flow generation, and both the current state and potential trajectory of the company’s financial condition. T. Rowe Price is mindful of broad industry diversification and manages position sizes to control its risk profile. Additionally, their patient, long term approach seeks to minimize portfolio turnover.

TDVG is appropriate for investors seeking a stock portfolio with the potential for a mix of income and capital appreciation from a tenured strategy and experienced manager. Tom Huber, an experienced fund manager with a long history of managing dividend growth equities, is the ETF’s leader. Huber has been managing dividend growth portfolios since 2000 and previously served as an analyst for T. Rowe Price, specializing in leisure, food and drug retail, and specialty retail.

For more on active strategies, visit our Active ETFs Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.