As today’s low yields are likely to persist, there is a significant review taking place for bonds traditionally played in a balanced 60/40 portfolio of equities and bonds. Looking at a recent article from T. Rowe Price, “Role of Bonds in a 60/40 Portfolio,” there’s a question of how to redesign a traditional balanced portfolio with practical solutions.

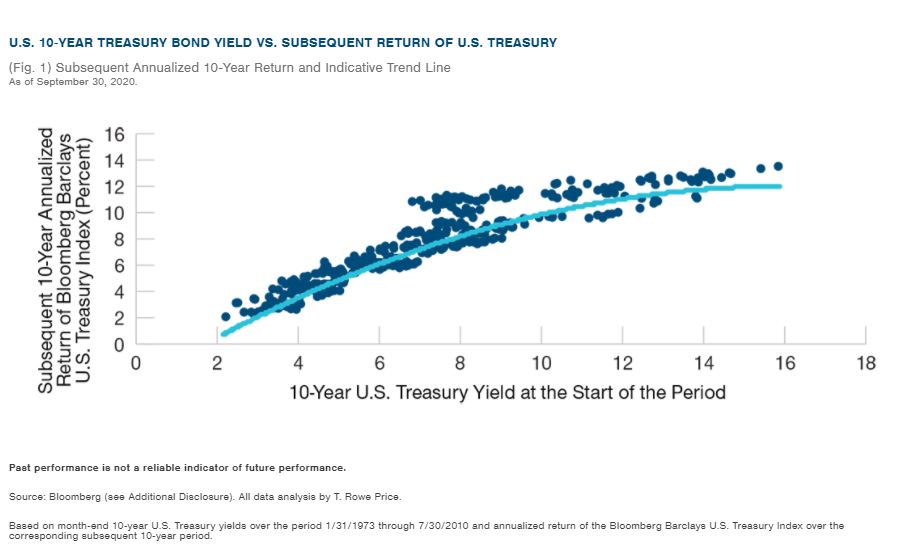

As stated in the article, there are multiple impacts to consider when responding to the new challenges coming out of this reevaluation. Looking at subsequent return expectations, it seems a 10-year yield level can be used as a valuation gauge for the U.S. Treasury market return over the next 10 years.

With that in mind, putting aside the relationship between equities and bonds, the more expensive the investor’s starting level, the lower the subsequent return expectation. This doesn’t bode well for a traditional 60/40 balanced portfolio if the expectation is for relatively poor performance for bonds over the next decade, even harder if equities deliver lower returns as well.

The easiest solution is to reset expectations on what a traditional balanced portfolio might deliver. It won’t solve today’s investors’ financial needs, but it’s a start in accomplishing some significant change. And to reach a specific nominal target means to consider changing the composition of the portfolio.

The conclusion reached by T. Rowe Price states, “Since future nominal bond returns are expected to be low given current low starting yields, investors need to make their equity allocation work harder (i.e., generate a higher return) or increase their equity risk exposure. It appears that the status quo of a 60/40 allocation is expected to lead to a lower nominal return outcome than has been achieved historically.”

Downside Risk Management

Looking at the impact on the diversification characteristics of bonds in a traditional equity/bond portfolio, it’s important to note sovereign bond yields are currently at record‑low levels across the world. That said, this has been normal for many investors all over the world for years.

As explained in the article, “While the diversification benefits are expected to be lower under a low‑yield environment (coupled with yield curve control policies or negative interest rate policies), the returns from bonds are still expected to be flat (like in Japan during the coronavirus crisis) or slightly positive during market stresses.”

As seen in the figure above, the negative correlation between local equity and local sovereign bonds remained in place in Germany and Japan even after their yields fell below 1%. So, while running at a slower speed, this form of diversification still works.

Government bonds are still playing a diversifier role in a 60/40 portfolio, even with low or negative yields. This means investors should reset expectations about the degree of the diversification benefit as opposed to its existence.

The 60/40 Portfolio Switch-Up

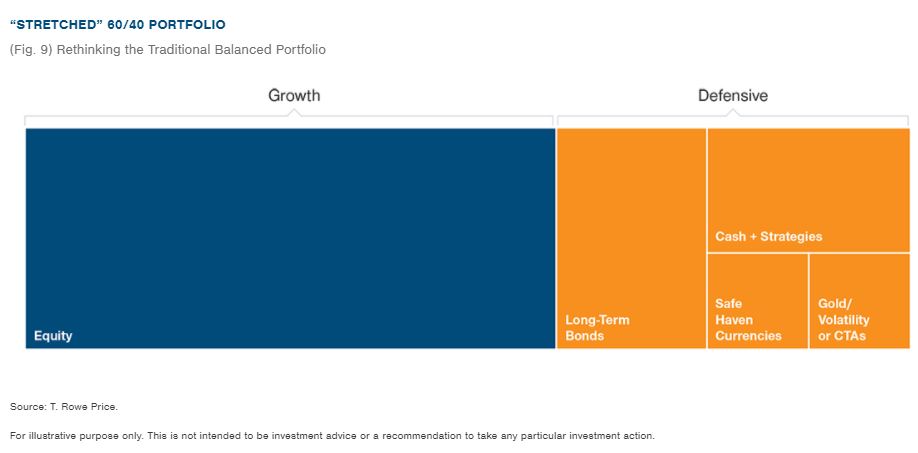

Based on what’s been established, the thought of moving forward with a 60/40 balanced investor is to “stretch” their portfolio. This would mean the equity allocation becomes even more paramount than before to meet the long‑term growth target. This ideally makes sense for investors, as active management’s importance is greater when beta returns are modest.

The traditional bond allocation can potentially be restructured as well. Investors can keep duration in their portfolio but invest further out in maturities. Investing in longer‑dated bonds frees up some cash, which will help as there will likely be a need for a lower amount of portfolio capital to achieve the same amount of duration. The remaining cash can be used to potentially invest in diversifying strategies.

The idea for this “stretched” 60/40 portfolio is to identify ways to build robust portfolios without increasing overall risk dramatically. Understandably, each investor may have different needs and objectives that may lead to different decisions. With that said, the low‑yield environment requires a rethinking of the 60/40 portfolio design. Practical solutions exist and should be evaluated in line with each investor’s risk tolerance and return objectives.

As T. Rowe Price concludes, “The impact of low bond yields on the design of the 60/40 balanced portfolio are expected to be with us for the foreseeable future. In addition to resetting expectations, we find that there are ways to build robust portfolios without increasing overall risk dramatically. While “flat” may be the new “up” for the role of bonds in a 60/40 portfolio, the concept of the traditional balanced portfolio has not been killed by the arrival of low yields. The traditional 60/40 portfolio may be dead; long live the extended 60/40 portfolio!”