With yields low and some states facing fiscal challenges, active management and municipal bonds could be an ideal match for many income investors.

State Street Global Advisors and Nuveen are tapping into that theme with the SPDR Nuveen Municipal Bond ETF (MBND), which debuted yesterday.

MBND “will mainly draw its holdings from the Bloomberg Barclays 3-15 Year Blend (2-17) Municipal Bond Index, which covers investment-grade debt with two to 17 years of maturity remaining. The portfolio can hold a wide variety of types of municipal debt from a variety of entities, from states and territories drilling down to counties and districts, according to a statement.

Why Create the MBND ETF Now?

Yields on munis have been steadily falling, with bond prices rising, even before the coronavirus pandemic. After the 2017 tax law changes, demand for tax-exempt munis became more attractive in response to caps in the federal deduction for state and local taxes, especially among higher-tax states. The tax law also diminished supply due to new limits on when governments can issue tax-exempt debt.

Due to the economic shutdown, which led to a spike in unemployment rates across the country, plenty of states are facing budget woes. Some of those with the worst shortfalls are among the largest issuers of municipal bonds, meaning they’re also among the biggest weights in this category’s ETFs. But the muni market is proving resilient.

The new MBND “can invest in holding of any credit quality but limits its junk bond exposure to no more than 20% of the portfolio. It aims for a weighted average duration of 4.5-7 years and a weighted average maturity between five and 12 years. The fund benchmark guides the portfolio exposure, with individual securities weighted within 5% of their weight in the index and sectors deviating by no more than 10%.”

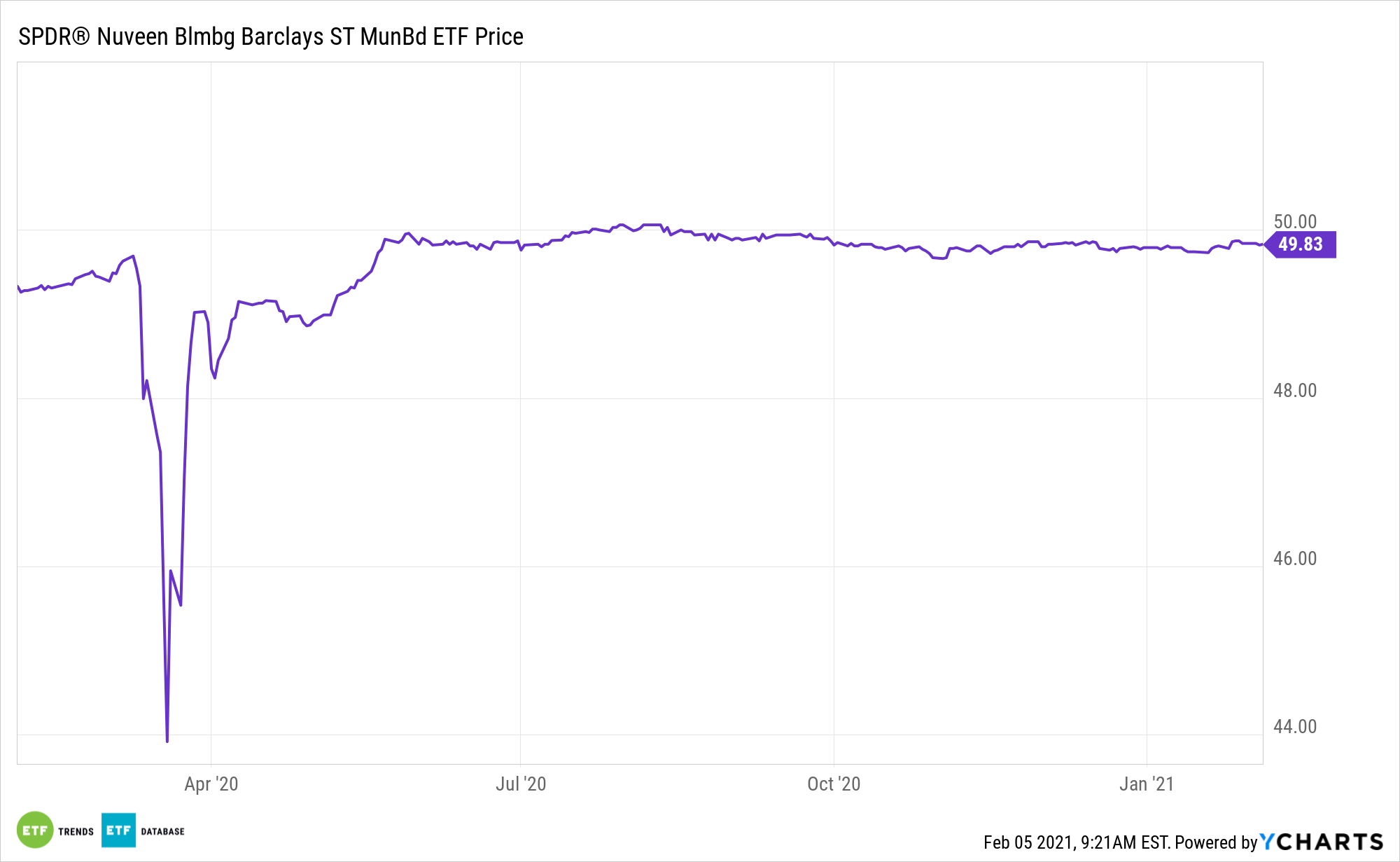

State Street and Nuveen partner on three other passive municipal bond ETFs, including the $4.5 billion SPDR Nuveen Bloomberg Barclays Short Term Municipal Bond ETF (NYSEArca: SHM).

The new MBND, which trades on Cboe, charges 0.40% per year, or $40 on a $10,000 investment.

For more on active strategies, visit our Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.