Municipal bonds remain a pivotal part of long-term, retirement-oriented portfolios, but with yields in the asset class low, investors may want to consider adding active management to the mix with the newly minted SPDR Nuveen Municipal Bond ETF (MBND).

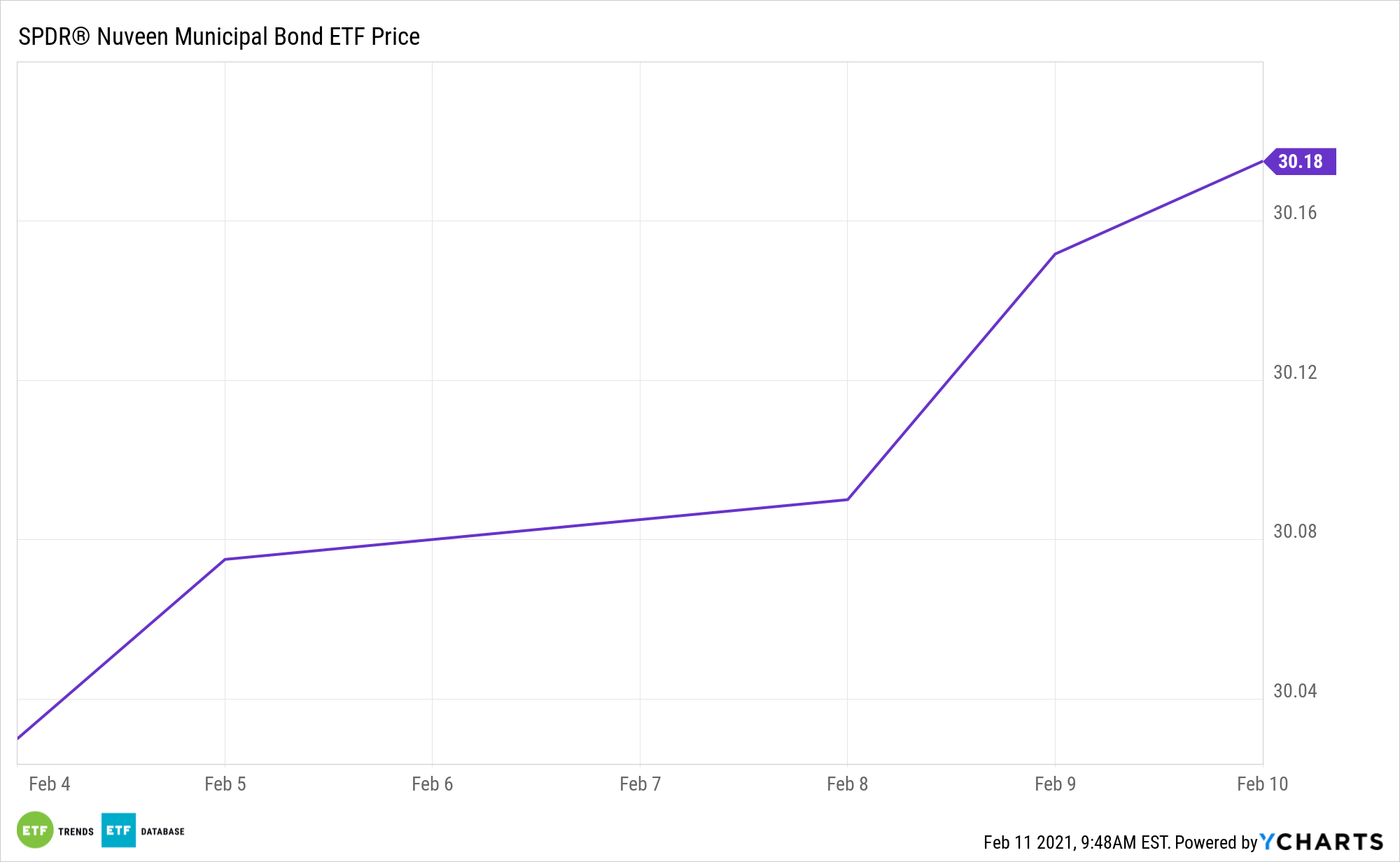

MBND is the latest municipal bond exchange traded fund produced by the Nuveen and State Street Global Advisors partnership. The ETF launched last week.

The fund “will mainly draw its holdings from the Bloomberg Barclays 3-15 Year Blend (2-17) Municipal Bond Index, which covers investment-grade debt with two to 17 years of maturity remaining. The portfolio can hold a wide variety of types of municipal debt from a variety of entities, from states and territories drilling down to counties and districts, according to a statement.

Although it’s a new ETF, MBND is worthy of consideration right out of the gate.

“Favorable supply-and-demand dynamics drove strong municipal bond performance in January despite a material move higher in interest rates driven by vaccine optimism and expectations for additional fiscal stimulus,” according to BlackRock research. “The S&P Municipal Bond Index returned 0.56% for the month. High yield munis posted the strongest gains, led by the more liquid tobacco and Puerto Rico bonds. The outperformance of munis versus Treasury bonds further stretched their rich valuations, pushing muni-to-Treasury ratios to all-time tights in the intermediate and long end of the yield curve.”

Why Buy a Municipal Bond ETF?

Municipal bonds have long been considered some of the most reliable fixed income options. Enter Covid-19 and a once untouchable space could now be in jeopardy with defaults. Nevertheless, MBND and friends are proving steady amid a spate of new issuance.

Yields on munis have been steadily falling with bond prices rising, even before the coronavirus. After the 2017 tax law changes, demand for tax-exempt munis became more attractive in response to caps in the federal deduction for state and local taxes, especially among higher-tax states. The tax law also diminished supply due to new limits on when governments can issue tax-exempt debt.

February is a historically good time to buy munis.

“The month of February has produced positive total returns in 8 of the past 10 years. While rich valuations will cause a drag, we expect strong demand to continue outpacing an elevated but manageable level of issuance,” adds BlackRock. “We believe fundamentals will likely benefit from additional fiscal aid, and vaccine distribution should support longer-term revenue normalization. As the new administration lays out its agenda and tax policy comes into focus, we anticipate heightened demand for tax-advantaged assets such as muni bonds.”

For more on active strategies, visit our Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.