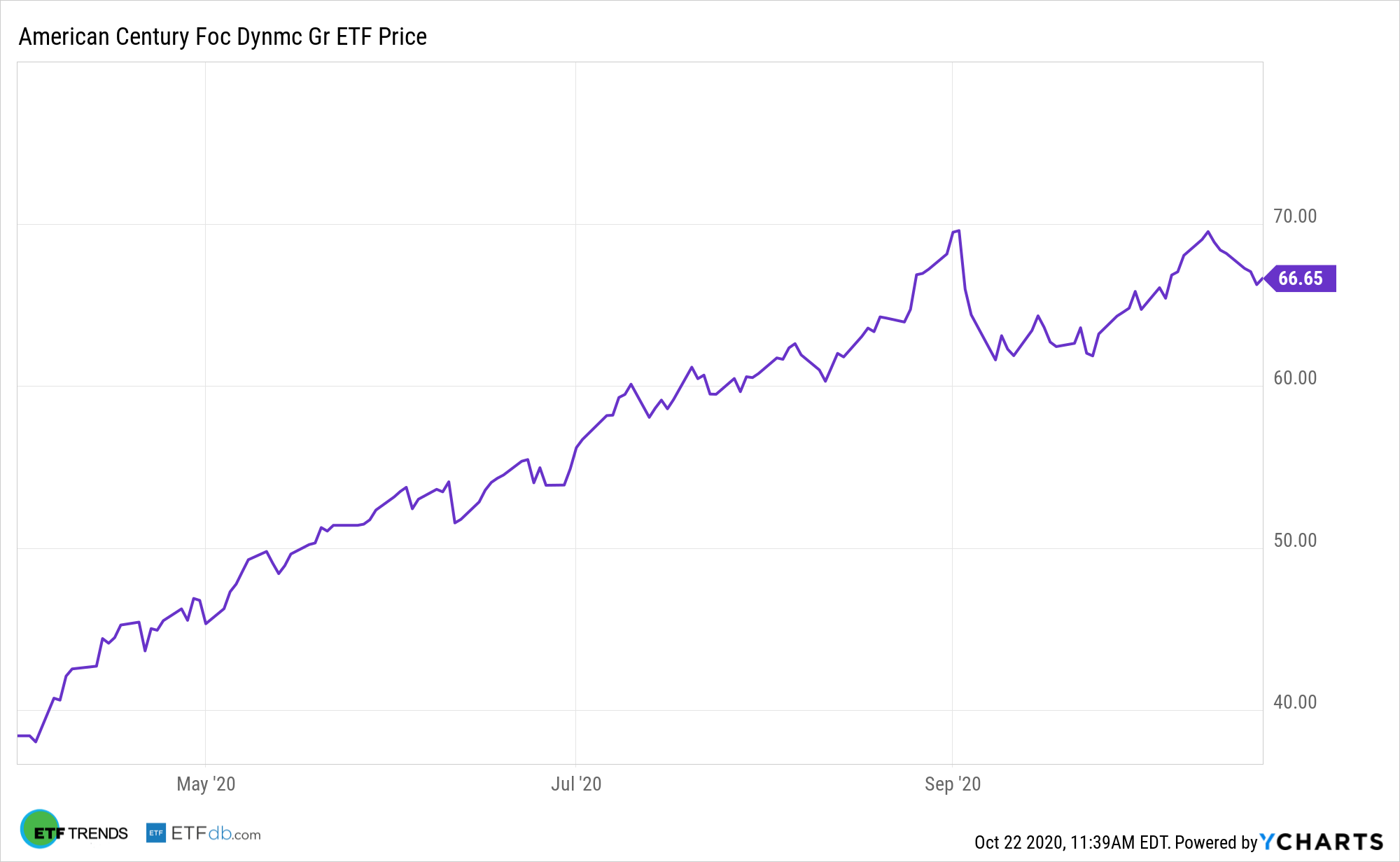

As growth stocks continue extending their dominance over value rivals, new, active approaches to growth are worth considering. Enter the Focused Dynamic Growth ETF (FDG), which is designed to invest in early-stage, high growth companies.

Under a new fund structure, FDG delivers American Century’s time-tested investment strategies in these ETF vehicles without the daily holdings disclosure requirement of fully transparent ETFs.

At the end of third quarter, “FDX has 37 holdings. A total of 98% of the companies are U.S.-based, while the rest come from Belgium. The top 10 firms make up more than 50% of net assets, which stand at $207.7 million. Amazon.com (NASDAQ:AMZN), Tesla (NASDAQ:TSLA), Salesforce.com (NYSE:CRM), Square (NYSE:SQ), and Visa (NYSE:V) lead the list of companies in the ETF,” according to Investing.com.

A Fantastic Time for FDG

FDG is a “high-conviction strategy designed to invest in early stage, rapid growth companies with a competitive advantage, high profitability, growth, and scalability to sustain their leading position,” according to American Century.

FDG offers the best of both traditional active equity and ETF worlds, highlighting value add through the alpha potential of active management, access to a growing array of active equity strategies, the advantages of the more efficient ETF structure and the additional choice of structures that meet investor needs.

Growth stocks are often associated with high-quality, prosperous companies whose earnings are expected to continue increasing at an above-average rate relative to the market. Growth stocks generally have high price-to-earnings (P/E) ratios and high price-to-book ratios. Still, data suggest the growth/value premium isn’t overly elevated relative to historical norms.

Growth stocks may be seen as exorbitant and overvalued, causing some investors to favor value stocks, which are considered undervalued by the market. Value stocks tend to trade at a lower price relative to their fundamentals (including dividends, earnings, and sales). While they generally have solid fundamentals, value stocks may have lost popularity in the market and are considered bargain priced compared with their competitors.

“In terms of sector allocation, information technology (36.31%) has the highest weighting, followed by consumer discretionaries (27.73%) and health care (11.68%). The fund’s trailing P/E and P/B ratios stand at 56.69 and 9.55,” notes Investing.com.

For more on active strategies, visit our Active ETFs Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.