Regulated sports wagering is taking off in a big way in the U.S., and a second exchange traded fund could soon be available to investors to participate in that boom.

Last week, ETF Series Solutions (ESS) filed a prospectus with the Securities and Exchange Commission (SEC) for the iBet Sports Betting & Gaming ETF. The fund could be close to coming to market because the SEC filing reveals that the ETF will trade on the Nasdaq under the ticker “IBET,” and that it will carry an annual fee of 0.79%. Filings with tickers and expense ratios are often signs that a fund is close to launching.

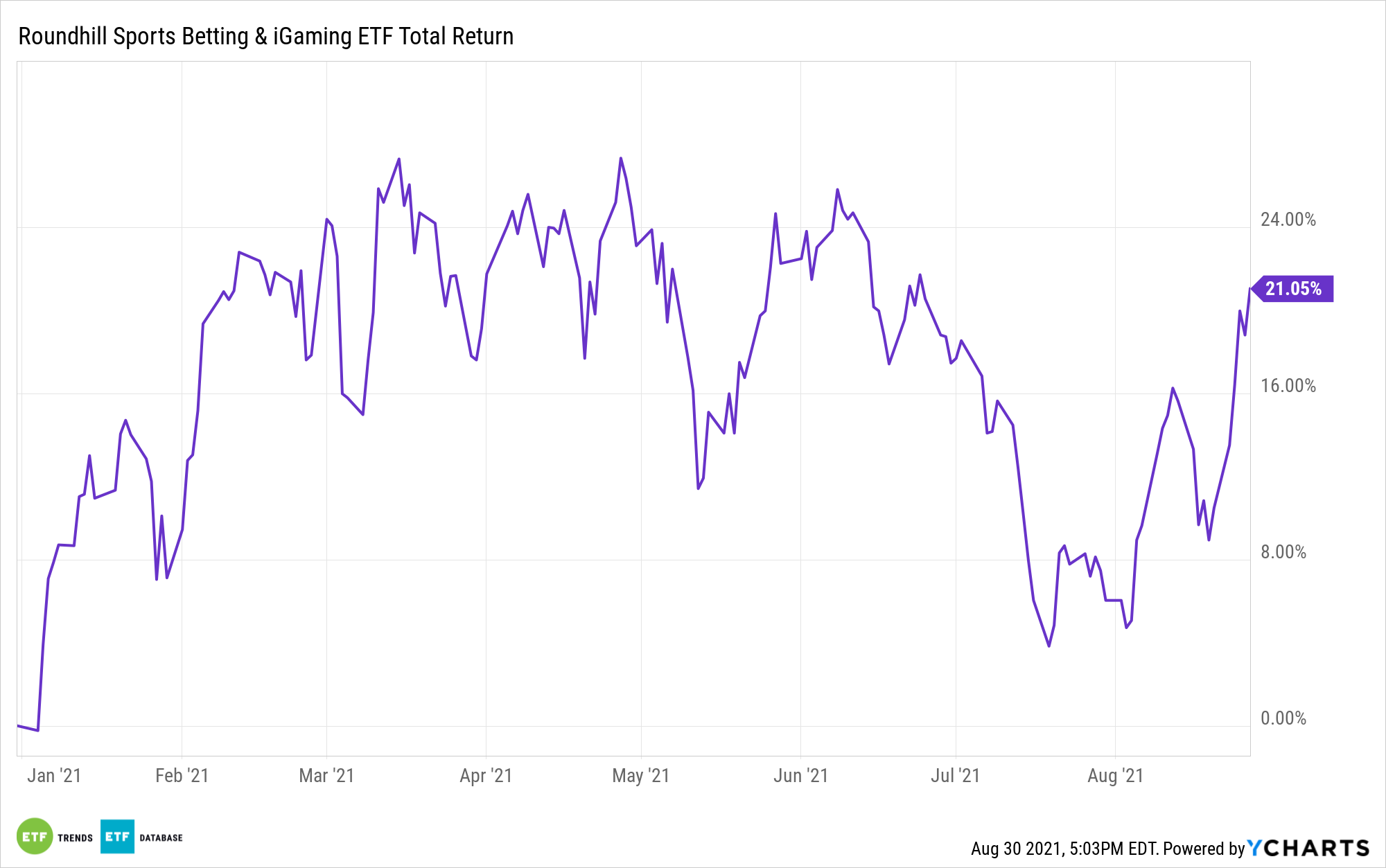

There is an existing fund in this segment: the Roundhill Sports Betting & iGaming ETF (BETZ). BETZ came to market in June 2020 and has $404 million in assets under management. An obvious difference between IBET and BETZ is that the former will be actively managed and the latter is a passive fund.

Going active could give IBET some latitude in terms of holdings, but the prospectus doesn’t feature specific names that could be on the fund’s roster.

“Operating casinos or racetracks; operating an online multiplayer video game competition platform; operating a mobile sports betting platform; owning real estate primarily used for gaming activities, operating online communities for gaming; and developing educational tools for online gaming,” according to the prospectus.

The regulatory document does identify some of the segments IBET could feature exposure to.

“Under normal circumstances, the Fund will invest at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in securities of companies in the Casinos & Gaming sub-industry or companies whose primary business consists of owning, developing, or operating sports betting or gaming (including iGaming and esports) venues, software, media content, or electronic platforms,” notes the prospectus.

If IBET can get to market soon, it could amount to good timing. Not only is the 2021 NFL season starting on Sept. 9 (football is the most wagered on sport in the U.S.), but Wall Street is increasingly bullish on the outlooks for online casinos and sports betting.

“We expect a combination of favorable legislation and consumer adoption to drive growth in US online sports betting and internet gambling (i-Gaming) from $900 million/$1.5 billion markets today to $39 billion/$14 billion in 2033, equating to 40 percent/27 percent CAGRs for over a decade,” said Goldman Sachs in a note out earlier this year.

For more news, information, and strategy, visit the Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.