In another sign of advisors’ and investors’ growing affinity for actively managed exchange traded funds, the Swan Hedged Equity U.S. Large-Cap ETF (HEGD) recently topped $75 million in assets under management.

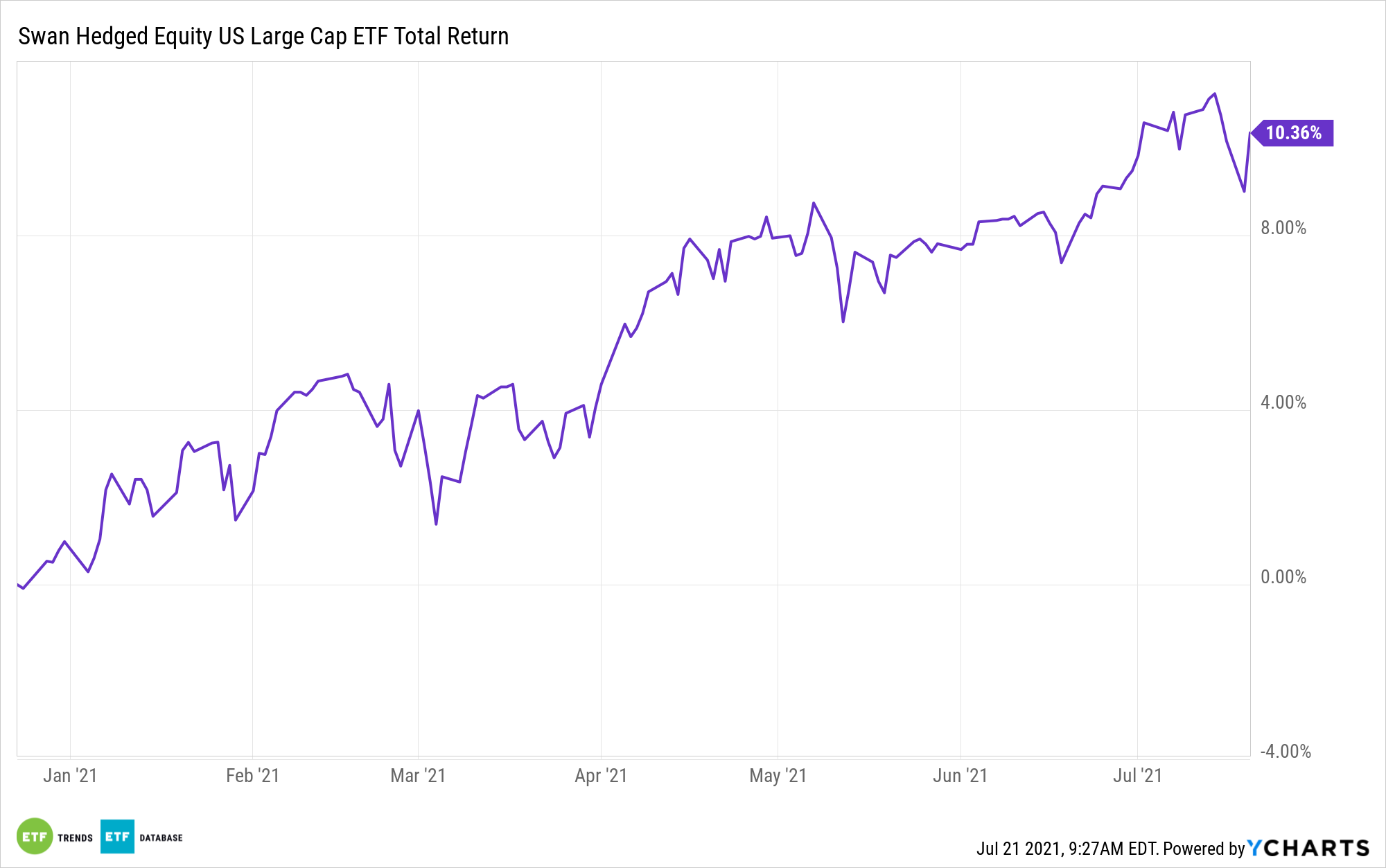

To be precise, HEGD has $78.75 million in assets as of July 21. The milestone for the fund issued by Colorado-based Swan Global Investments comes just over six months after it came to market. That’s an impressive pace of asset-gathering for a new active ETF, particularly one offered by an independent issuer.

“HEGD was created to help long-term investors participate in the equity markets for capital appreciation while hedging against the risks associated with today’s often volatile markets. HEGD’s asset level will allow more investors and advisors to gain accessibility to the fund,” according to a statement issued by the asset manager.

The HEGD strategy is appealing because it provides long equity market exposure by holding a basket of low-cost broad market ETFs. Downside protection is provided by way of active management of long-term equity anticipation contracts – longer-dated options contracts.

The fund is based on Swan Global’s defined risk strategy (DRS), which is more than two decades old.

HEGD “focuses on mitigating market risks. HEGD pairs the benefits of passive investing 1 in equity index ETFs with actively managed options strategies, potentially resulting in a less turbulent investment experience and more consistent returns,” according to the statement.

The fund’s long equity exposure is currently comprised of the SPDR S&P 500 ETF Trust (SPY) and the iShares Core S&P 500 ETF (IVV).

The audience for HEGD is wide because the fund addresses two primary, historically accurate facts about investing. First, stocks do go up over time. Second, large drawdowns are detrimental to investors’ outcomes. HEGD addresses the latter point via its actively managed options strategies and that could be supportive of better long-term returns by mitigating drawdowns.

For more news, information, and strategy, visit the Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.