Growth and value are perhaps the most obvious rivals in the factor universe. The two are the most paired in factor conversations, so it stands to reason that if one is performing well, market participants are likely to take unfavorable views of the other.

However, not all growth funds are cut of the same cloth, meaning investors holding those products this year are encountering varying outcomes this year as growth stocks trail value rivals.

As Morningstar analyst Benjamin Slupecki notes, diverging fortunes of value and growth stocks in 2021 is creating some flipping and flopping among actively managed strategies addressing these factors.

“The tides changed starting in October. From October 2020 through April 2021, the Morningstar US Morningstar US Large Value Index returned 35.6% and the Morningstar US Large Growth Index returned 22.4%,” writes Slupecki. “In this context, we found six large-growth funds that carry Morningstar Analyst Ratings of Bronze, Silver, or Gold that moved up four quintiles in terms of their category rankings and four analyst-covered funds that moved down four quintiles.”

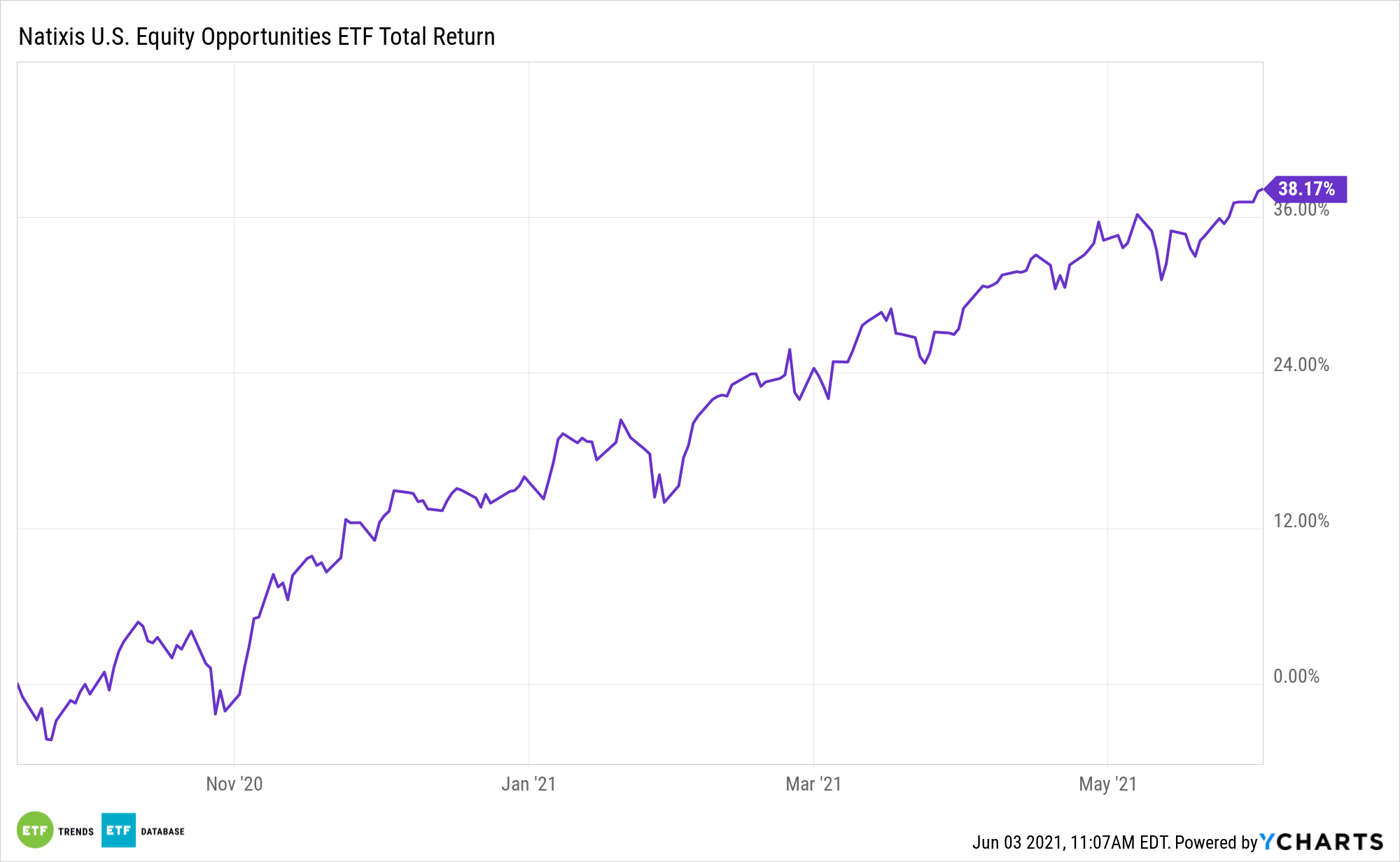

One example of an active mutual fund that flipped for the better is the Natixis U.S. Equity Opportunities (NEFSX).

That fund, which has both growth and value exposures, “was languishing at the 90th percentile for its 12-month returns. But since then, the fund’s performance has catapulted it to the number-two spot among all large-growth funds in the top 1 percentile,” according to the Morningstar analyst.

For exchange traded fund investors, it’s a point worth noting because there’s an ETF equivalent of NEFSX, the Natixis US Equity Opportunities ETF (EQOP). EQOP, which debuted last September, is a semi-transparent ETF, meaning its holdings aren’t disclosed on a daily basis.

The objective is to have growth and value each account for 50% of the portfolio, so when factor’s weight drifts above 60% or declines below 40% for three months, Natixis recommends to the managers bring the portfolio back in line with desired allocations.

At the end of the first quarter, six of EQOP’s top 10 holdings fit the bill as value stocks. However, three of the top five holdings – Facebook (NASDAQ: FB), Google parent Alphabet (NASDAQ: GOOG), and Amazon (NASDAQ: AMZN) – hail from the famous FAANG quintet.

For more news, information, and strategy, visit the Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.