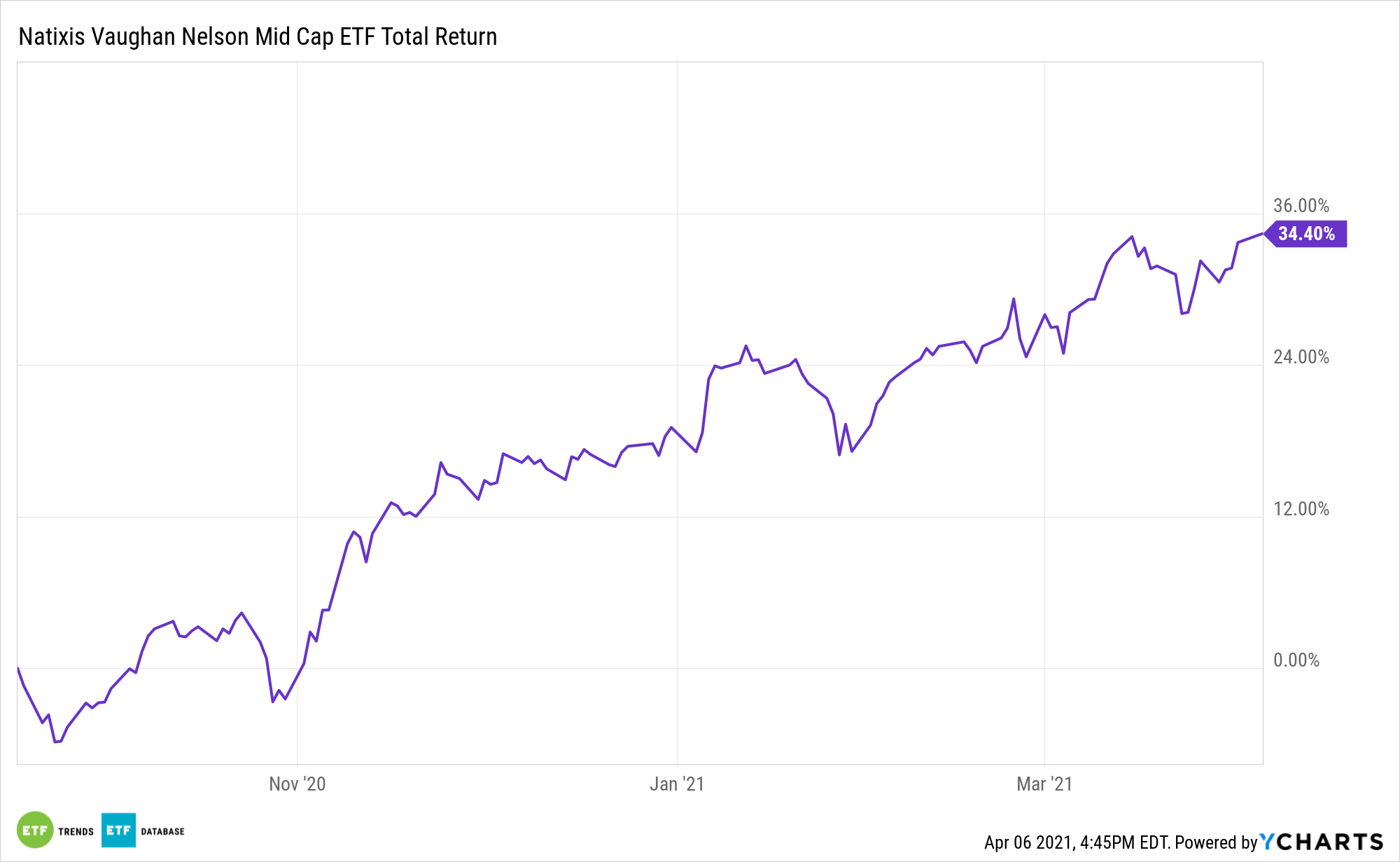

Smaller stocks and active management are often considered a particularly fruitful combination for investors. Market participants seeking mid cap exposure may find a friend in the Natixis Vaughan Nelson Mid Cap ETF (VNMC).

VNMC, which launched last year, takes advantage of temporary information and marketplace inefficiencies in the mid cap universe to find opportunities to invest in companies at valuations materially below their long-term intrinsic value. The fund invests in companies within the market capitalization range of the Russell Midcap® Value Index at the time of purchase. Chris Wallis (CEO & CIO), Dennis Alff, and Chad Fargason are the named portfolio managers.

Interestingly, VNMC is worth a hard look when small caps are performing well.

“In the months in which small-cap returns were positive, mid caps outperformed nearly 40% of the time,” according to Boston Partners research. “Overall, mid caps outpaced small caps 53% of the time. This demonstrates that a key element of mid caps’ strong historical relative performance has been their tendency to preserve capital in down markets.”

The Market’s Sweet Spot?

As investors look over their equity market exposure, investors may find that large cap stock positions are too big for rapid growth and small caps expose them to volatile short-term moves. Middle capitalization stocks, sometimes referred to as the market’s sweet spot, could help investors achieve improved risk-adjusted returns.

Leveraging the New York Stock Exchange’s Proxy Portfolio Methodology approach, Natixis’s semi-transparent active ETFs disclose proxy portfolios on a daily basis that closely track the actual portfolios’ intraday performance. This structure allows the portfolio managers to shield the identity of stocks on which they are actively trading, while still providing market makers enough information to offer competitive bids and asks on the ETFs. Natixis’s active semi-transparent ETFs give investors access to highly skilled active managers through a tax-efficient and lower cost vehicle.

For long-term investors, VNMC is a prime idea for mid cap exposure.

“Investors who put their money in a portfolio of mid-cap stocks that were inexpensive and high-quality, have enjoyed an advantage over a strategy that holds high-quality names regardless of valuation,” according to Heartland Advisors. “In fact, the combination meaningfully outpaces the returns of the mega-cap dominated S&P 500 and adds to the long history of mid-caps outperforming large-cap stocks as a group.”

For more on active strategies, visit our Active ETFs Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.