An industry first is looming. Mutual fund issuer Guinness Atkinson is slated to convert two of its mutual funds to exchange traded funds on March 26.

The Guinness Atkinson Dividend Builder Fund (GAINX) and Guinness Atkinson Asia Pacific Dividend Builder Fund (GAADX) mutual funds will become ETFs on March 26.

“The shares of the two mutual funds are slated to become shares of the SmartETFs Dividend Builder (DIVS) and SmartETFs Asia Pacific Dividend Builder (ADIV), respectively,” according to a statement issued by the company.

In 2021, Dimensional Fund Advisors also plans to convert six tax-managed mutual funds with $20 billion in assets under management into ETFs. Meanwhile, the Nottingham Company has received board approval to transform its $99 million Adaptive Growth Opportunities Fund into an ETF too.

Jennifer Hoopes, senior managing director and general counsel at Foreside, explained that before turning a mutual fund into an ETF, compliance teams need to make sure they understand the differences between the two vehicles. The ETF infrastructure might not even exist in some cases, but before a company launches any such products, they should understand the operational process, according to a 2019 analysis by Ropes & Gray. For instance, Hoopes noted that teams need to understand what authorized participants do, how the creation and redemption process works, and how baskets are created.

“This move represents the culmination of a dialogue we’ve had with our shareholder base, who like many are increasingly attracted to the benefits of ETFs, including their lower costs and greater flexibility,” said Jim Atkinson, CEO of Guinness Atkinson Asset Management.

The New Funds Join the Firm’s ETF Lineup

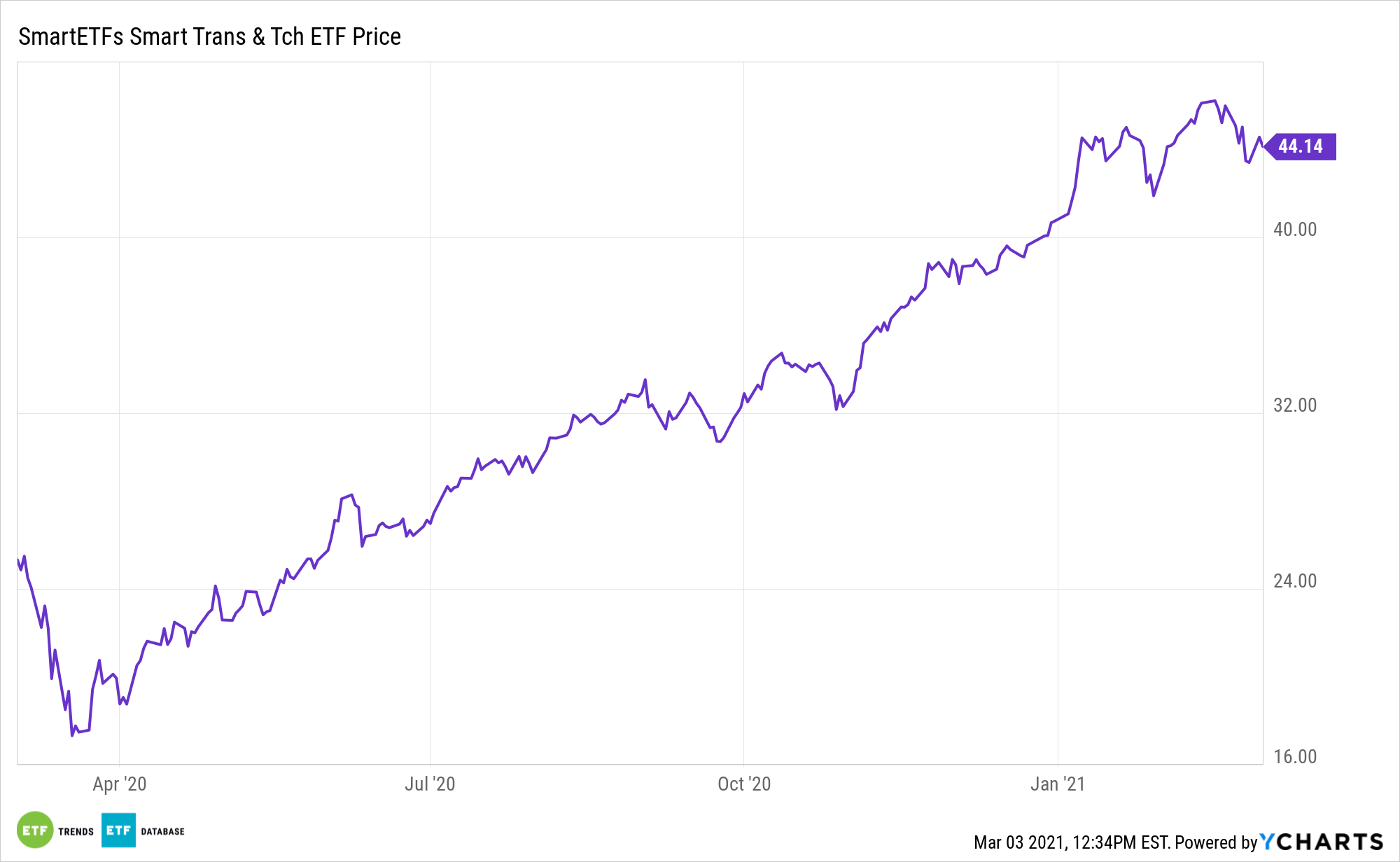

Guiness Atkinson already issues ETFs, including SmartETFs Advertising & Marketing Technology ETF (NYSE: MRAD), SmartETFs Smart Transportation & Technology ETF (MOTO), and SmartETFs Sustainable Energy II (SULR).

MOTO seeks long-term capital appreciation from investments involved in the manufacture, development, distribution, and servicing of autonomous or electric vehicles and companies involved in related developments or technologies to support autonomous or electric vehicles including infrastructure, roadways, or other pathways.

The ETF is actively managed, as well as fully transparent, investing in approximately 35 equally weighted positions on a global basis. This includes companies that manufacture, distribute, service, offer, support, or enable the following: electric vehicles, autonomous vehicles, transportation as a service, flying autonomous vehicles, autonomous or electric public transportation, and hyperloop-based transportation, for passengers or goods.

For more on active strategies, visit our Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.