Actively managed exchange traded funds are bringing in assets at a prodigious pace, but the group remains a small slice of the overall ETF industry.

An obvious area in which active ETF issuers can gain market share is fixed income. That’s particularly true this year with previously soaring 10-year Treasury yields, rising inflation, and still depressed interest rates combining to form a toxic brew for bond assets. Making matters worse for some investors is that many passive bond funds don’t adapt quickly enough to Treasury yield fluctuations.

Some advancements on the regulatory front could also facilitate increasing adoption of active fixed income ETFs.

“Actively managed bond ETFs got the green light to use custom baskets from the SEC in September 2019, when it issued the ETF Rule,” says Morningstar analyst Neal Kosciulek. “This gave the funds’ portfolio managers the ability to pick and choose which bonds to put in the baskets they deliver to authorized participants to meet redemption requests. Having this latitude will go a long way toward helping managers improve the tax efficiency of active bond ETFs and further bolster their appeal relative to active bond mutual funds.”

Opportunities Abound for Active Bond Managers

The aforementioned spike in Treasury yields was an opportunity for active bond ETF managers to strut their interest rate risk mitigation stuff. However, even with that rise in 10-year yields, interest rates are still low.

That indicates there are credit opportunities for active managers to exploit, particularly with corporate bonds, both investment-grade and junk, and international bonds – an asset class many passive aggregate bond funds barely touch.

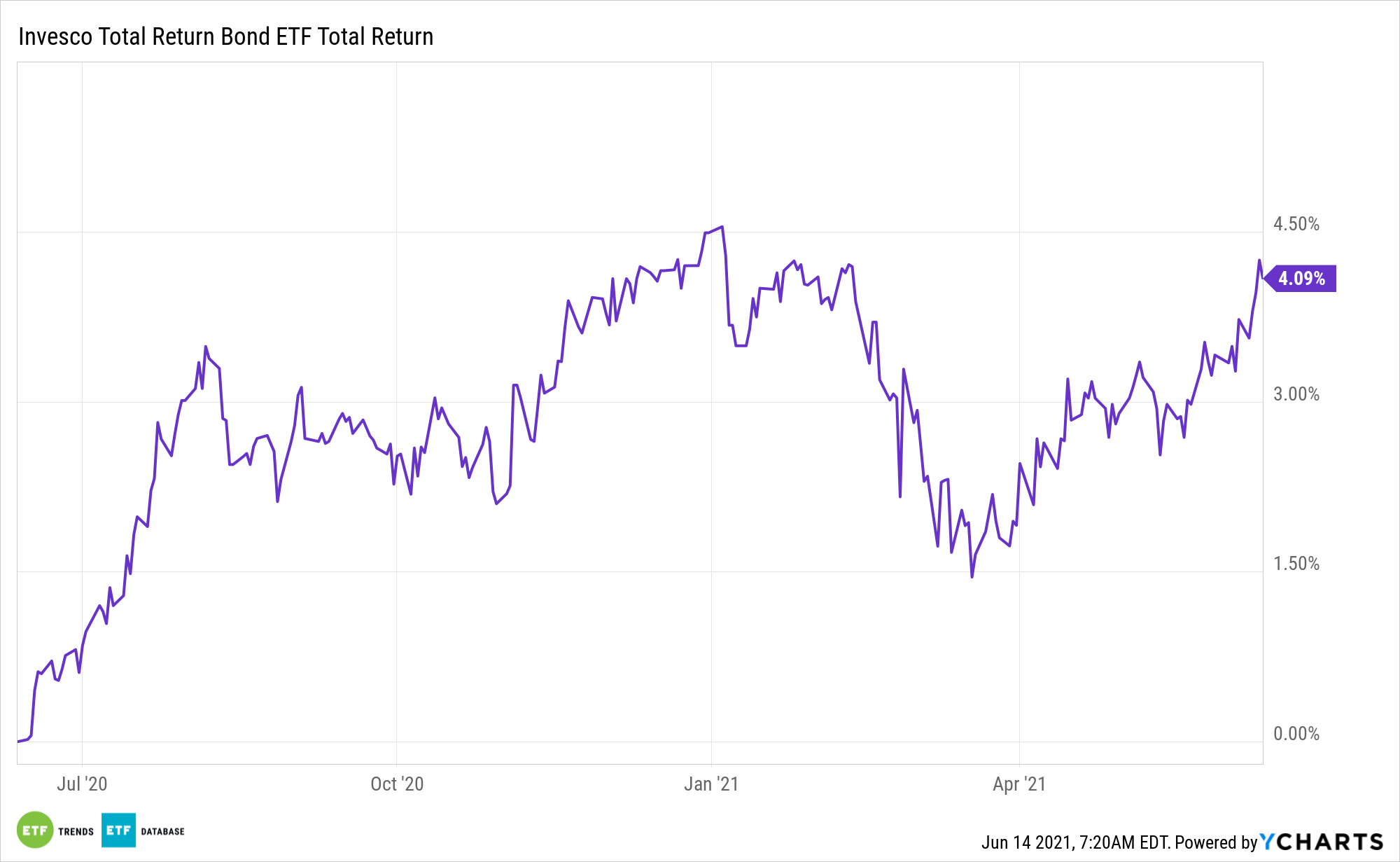

Some active bond ETFs are overweight credit, including the Invesco Total Return Bond ETF (GTO), which is the ETF answer to the Invesco Core Plus Bond (ACPSX). GTO’s positions in corporate debt is well above those found in passive total bond funds, but it holds enough government debt to provide some buffer in turbulent markets.

“As of May 2021, GTO held 37% of its assets in corporate bonds, 35% in government bonds, and 24% in securitized bonds,” adds Kosciulek. “GTO’s heavy bend toward government-issued debt has caused its performance to deviate from the mutual fund. For instance, during the coronavirus-driven sell-off, the ETF fell 7.51% while the mutual fund dropped 8.88%.”

Another way active bond ETF managers can lure investors in is by offering funds that directly tap into previously existing fixed income expertise. Some have already done that, and more are on the way. For example, T. Rowe Price recently filed plans for the T. Rowe Price Total Return ETF, T. Rowe Price QM U.S. Bond ETF, and T. Rowe Price Ultra-Short Term Bond ETF.

For more news, information, and strategy, visit the Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.