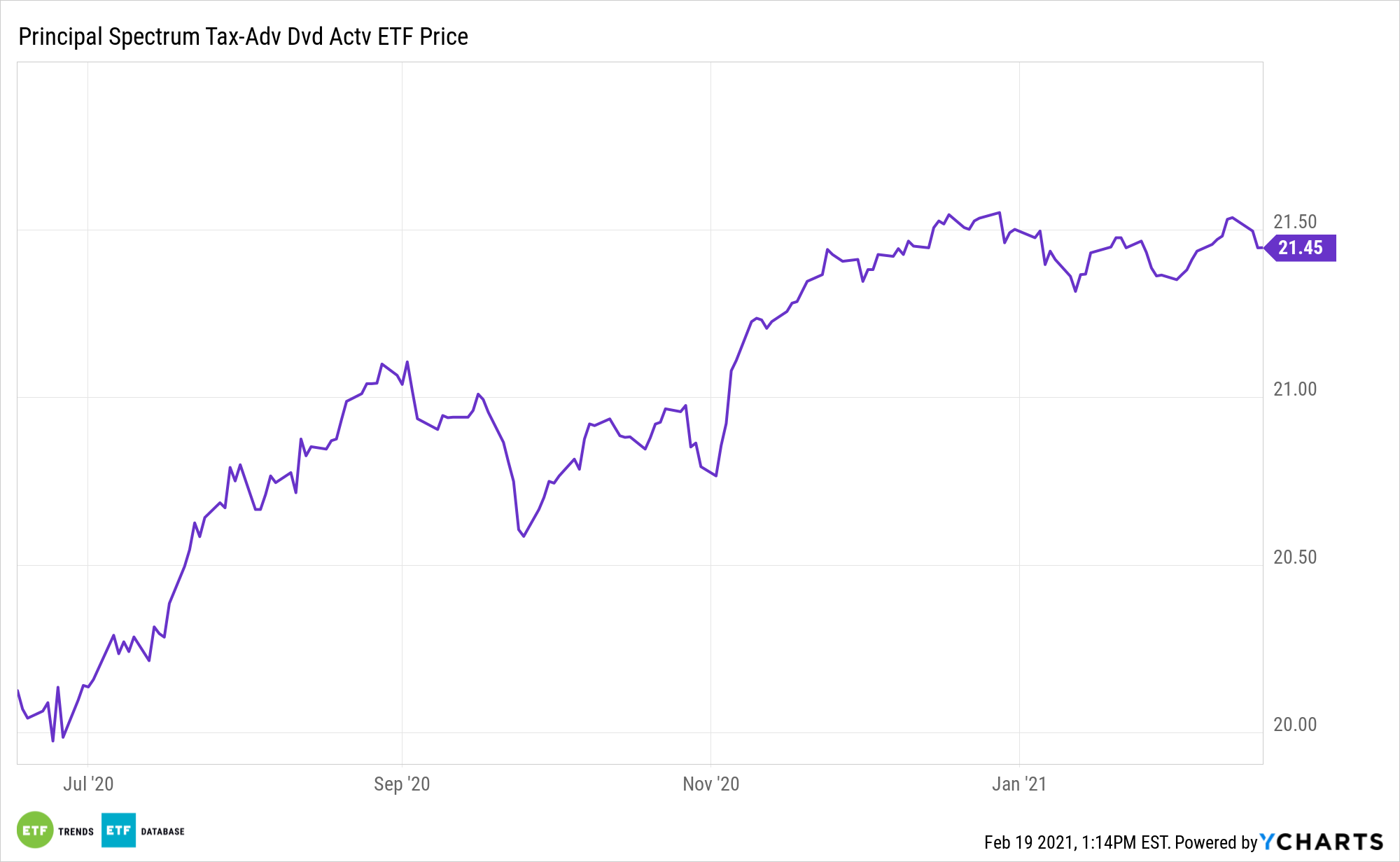

Convertible bonds remain one of the hotter corners of the fixed income market. Investors can grab sector upside without totally diving in with the Principal Spectrum Tax-Advantaged Dividend Active ETF (PQDI).

PQDI, which debuted in June, offers exposure to multiple income assets, including convertibles. The Principal ETF “seeks to provide current income. Under normal circumstances, the fund invests at least 80% of its net assets, plus any borrowings for investment purposes, in dividend-paying securities at the time of purchase,” according to Principal. “Such securities include, without limitation, preferred securities and capital securities of U.S. and non-U.S. issuers. The fund invests significantly in securities that, at the time of issuance, are eligible to pay dividends that qualify for favorable U.S. federal income tax treatment.”

PQDI offers a higher level of income because it combines convertibles exposure with preferred stocks and REITs, among other income-generating assets. PQDI’s convertibles allocation is proving potent this year.

“The hot convertible securities market remains underappreciated on Wall Street—only a tiny fraction of institutional investors participate in the hybrid sector,” reports Andrew Bary for Barron’s. “That’s the view of Tracy Maitland, the president and chief investment officer of Advent Capital Management, which runs about $11 billion, mostly in convertibles.”

Call on Convertibles with PQDI

Convertible bonds are a type of hybrid fixed-coupon security that allows the holder the option to swap the bond security for common or preferred stock at a specified strike price. Due to the bond’s equity option, convertible bonds typically pay less interest than traditional corporate bonds. The fund, though, does not convert its holdings into shares. Investors are exposed to the equity premium due to the way the bonds are priced.

“Convertible bonds now carry low interest rates—many new issues have had yields of zero recently—and can be exchanged into the issuing company’s stock if the shares rise. This gives convertibles equity-like characteristics and enabled the market to return about 45% in 2020 on the back of gains in stocks like Tesla (TSLA), making it one of premier U.S. asset classes,” adds Barron’s.

Convertible bonds are seen as a middle ground between stocks and bonds. The securities pay lower coupons than regular unsecured debt securities, but they can also make up the difference if the company’s shares continue to appreciate.

For more on active strategies, visit our Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.