BlackRock, the world’s largest asset manager, is dropping the famous iShares brand from three of the firm’s actively managed fixed income ETFs.

Those funds are as follows: the BlackRock Short Maturity Bond ETF (NEAR), BlackRock Short Maturity Municipal Bond ETF (MEAR), and BlackRock Ultra Short-Term Bond ETF (ICSH).

Those ETFs “now carry the BlackRock brand to reflect the firm’s premier active management investment platform. There will be no impact to the funds’ investment objectives, tickers, CUSIPs, total expense ratios or share prices,” according to a statement.

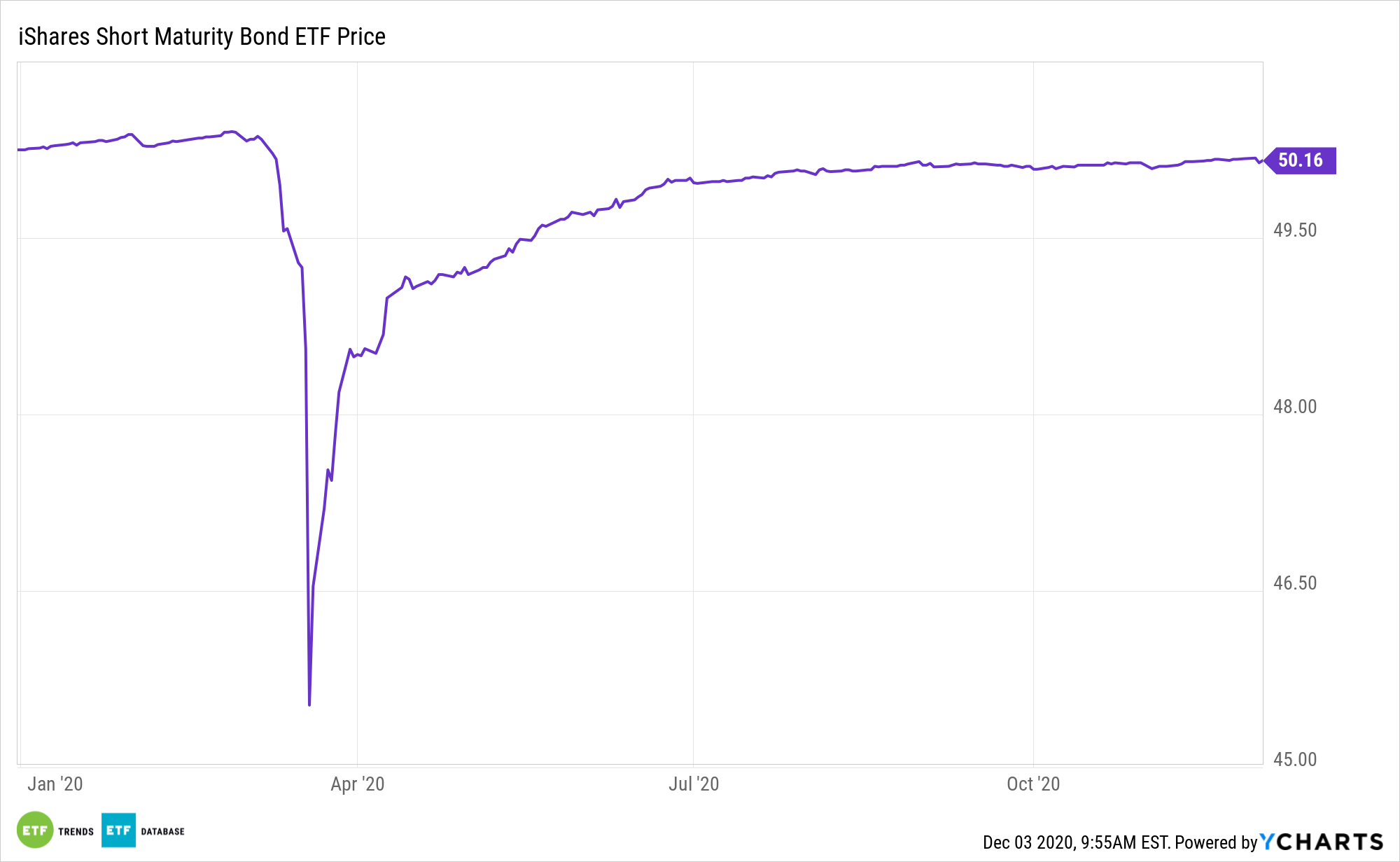

NEAR is a short duration strategy. The fund has an effective duration of less than a year, meaning its sensitivity to rising rates is minimal.

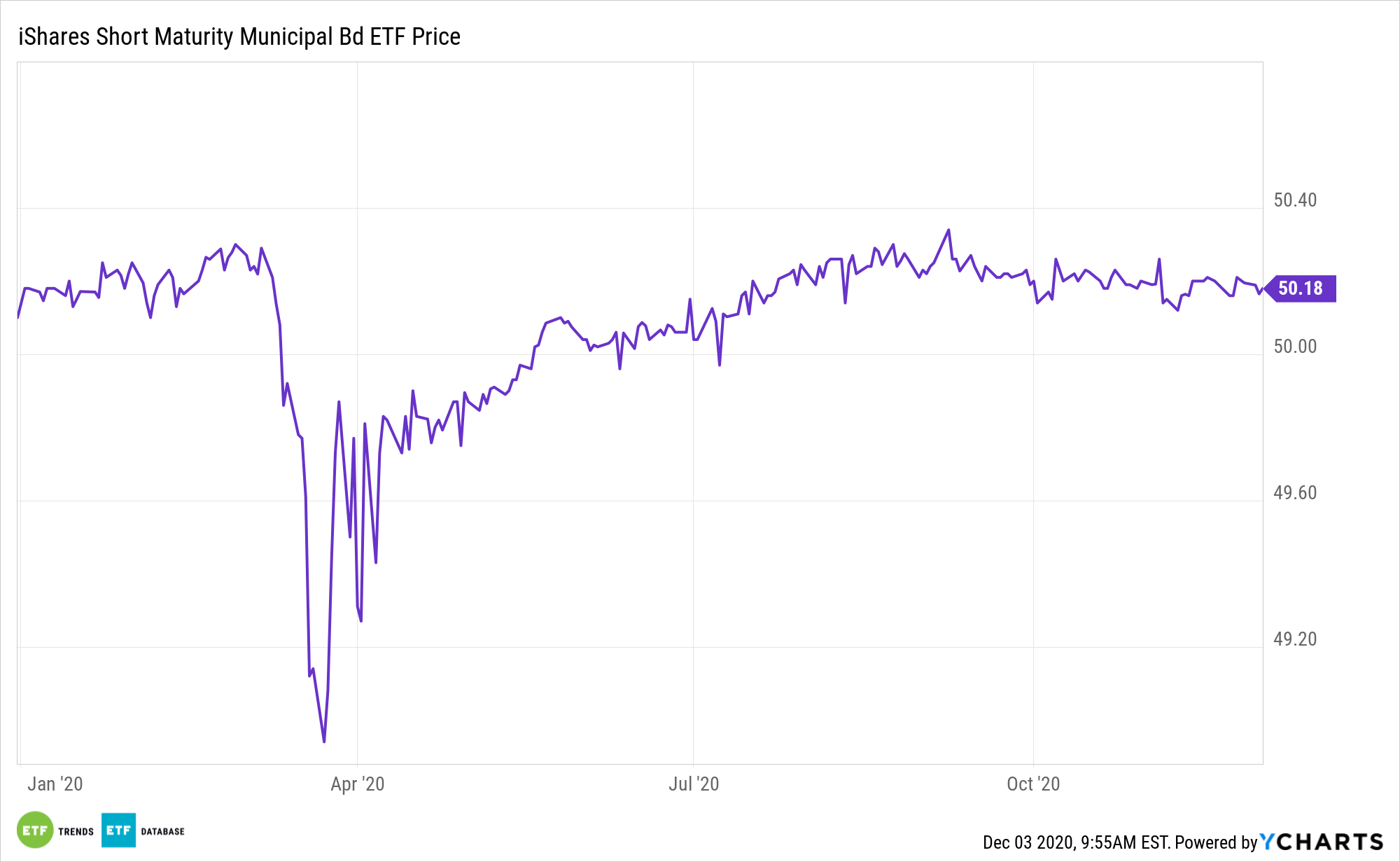

MEAR seeks to maximize tax-free current income. The fund normally invests at least 80% of its net assets in municipal securities such that the interest on each bond is exempt from U.S. federal income taxes and the federal alternative minimum tax.

MEAR primarily invests in U.S. dollar-denominated investment-grade short-term fixed- and floating-rate municipal securities with remaining maturities of five years or less, such as municipal bonds, municipal notes and variable rate demand obligations, as well as money market instruments and registered investment companies.

BlackRock and iShares Leading the Pack

“Alongside BlackRock’s proud tradition of active management, iShares has served as the beacon of index investing innovation and revolutionized exchanged traded products for over two decades,” said Armando Senra, Head of iShares Americas, BlackRock. “With more than 900 ETPs globally, differentiating our alpha-seeking and index-based offerings with clearly delineated branding is an important step in delivering transparency to our clients. We are committed to launching new active strategies when we believe the exposures will add value for clients and have clear alpha potential.”

In the future, BlackRock’s active ETFs will carry that brand while passively managed ETFs will sport the iShares brand.

“In October 2020, BlackRock expanded its Megatrends suite by introducing three alpha-seeking ETFs actively managed by experienced portfolio managers from BlackRock’s Fundamental Active Equity franchise. The funds are designed to provide unique exposure to the structural shifts influencing the future of the global economy,” according to the statement.

For more on active strategies, visit our Active ETFs Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.