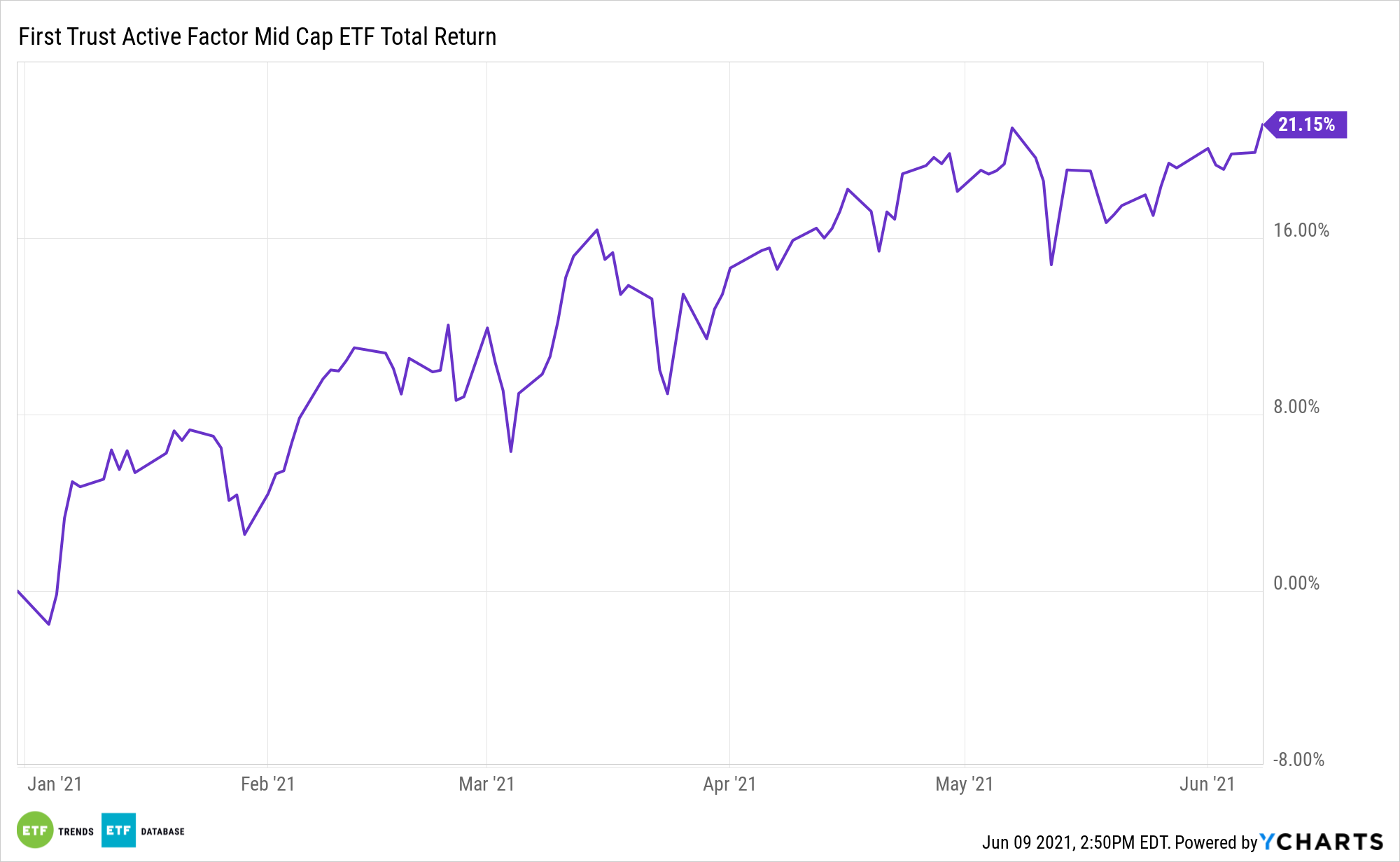

The S&P MidCap 400 Index is up a tidy 19.51% year-to-date as mid cap stocks stand among this year’s best-performing equity assets.

Still, stocks in the middle remain overlooked. That could mean there’s ample opportunity for active managers to make inroads with this capitalization segment. The First Trust Active Factor Mid Cap ETF (NYSE Arca: AFMC) may be on its way to garnering more attention.

The actively managed AFMC debuted in December 2019 and has led a relatively anonymous existence since then. The First Trust fund hit an all-time high on Tuesday.

As its name implies, AFMC is a factor-based strategy that maintains the goal of providing multi-factor exposure while limiting single stocks and sector risk. Factors that can be included in AFMC include low volatility, momentum, quality, and value.

“The flexibility to alter the investing factors allows them to gain exposure to the desired factors while attempting to control risks. The active risk management overlay seeks to reduce the tracking error of the portfolio by diversifying across the rewarded factors mentioned above, while limiting sector and industry concentrations, controlling market exposure and reducing single stock risk,” according to First Trust.

AFMC’s multi-factor approach could be appealing to investors because, as 2021 proves, factor leadership is fluid. Sure, value is winning this year, but that hasn’t been the case for more than a decade; growth and momentum were the stars over that period. Pinpointing when factor leadership will be necessary is difficult, underscoring the allure of AFMC’s methodology.

With value leading this year, AFMC is something of a find for mid-cap investors because the fund has more than adequate cyclical exposure, with consumer discretionary and financial services names combining for 31% of the fund. Real estate and materials names combine for 13%. The price-to-earnings ration on AFMC is 16.02x, which is relatively inexpensive when compared to a mid-cap growth strategy.

As an actively managed multi-factor fund, AFMC can more nimbly shift when factor leadership changes. In fact, it’s already embracing some growth elements, as over a quarter of its 274 holdings are healthcare and technology stocks.

AFMC is part of a broader suite of active multi-factor ETFs from First Trust. The lineup also includes the First Trust Active Factor Large Cap ETF (NYSE Arca: AFLG) and the First Trust Active Factor Small Cap ETF (NYSE Arca: AFSM).

For more news, information, and strategy, visit the Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.