Two recent studies suggest that active management will continue to thrive in the current, uncertain environment and outperform passive management.

Prior to the onset of a global pandemic, the conventional wisdom was that active management struggled to meet its benchmarks and that bloated expense ratios made active funds too costly. But active managers have proven more adept at navigating the topsy-turvy pandemic markets, and as uncertainty around COVID-19 continues to abound, they might have an edge for years to come — particularly in emerging markets.

“We are seeing an upward trend of positive net flows into actively managed mutual funds and ETFs post-March 2020, which may indicate that investors are moving more assets toward active,” said PGIM Investments CEO Stuart Parker in an email in Financial Advisor.

Activate T. Rowe’s Active Experience for Exceptional Times

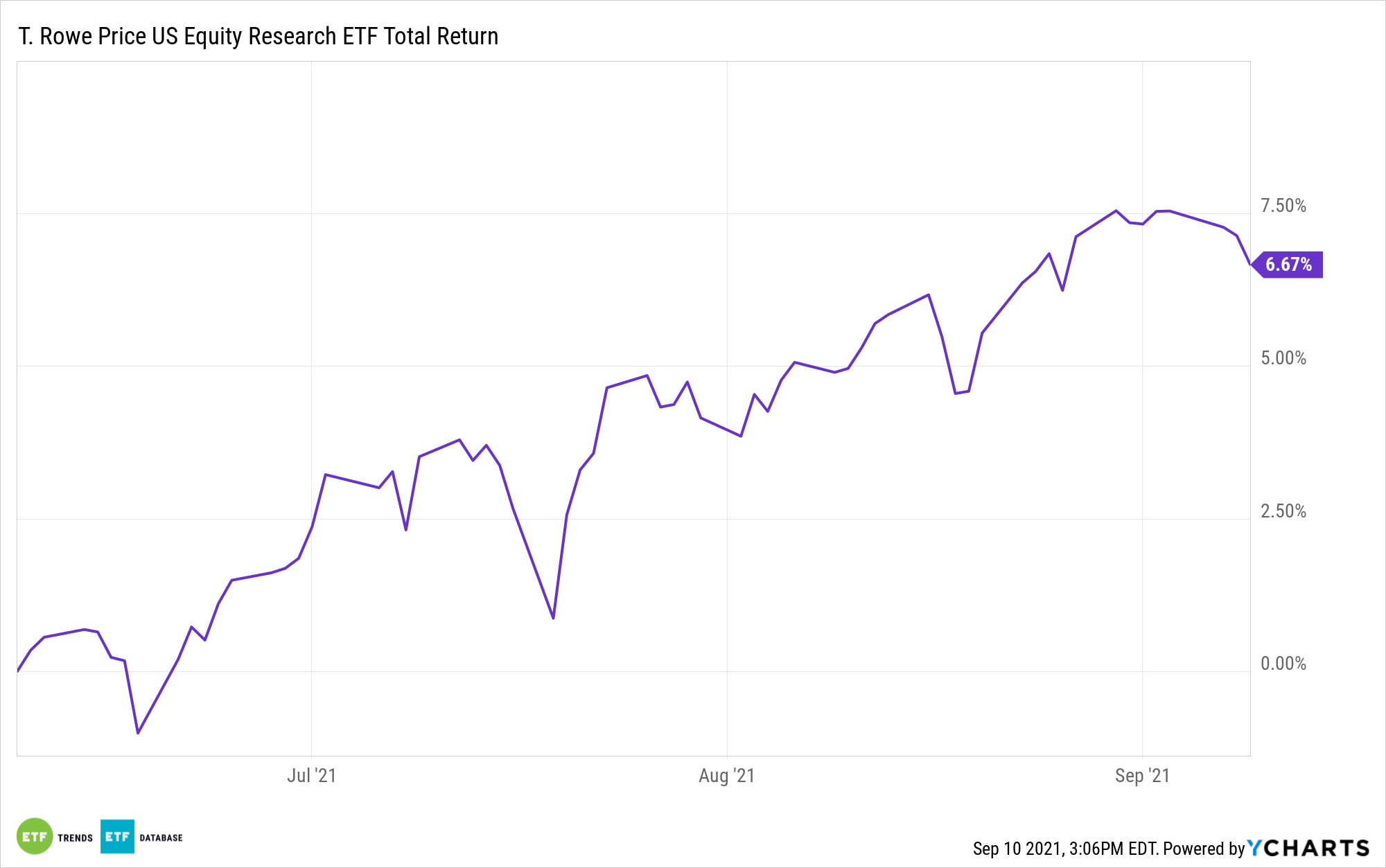

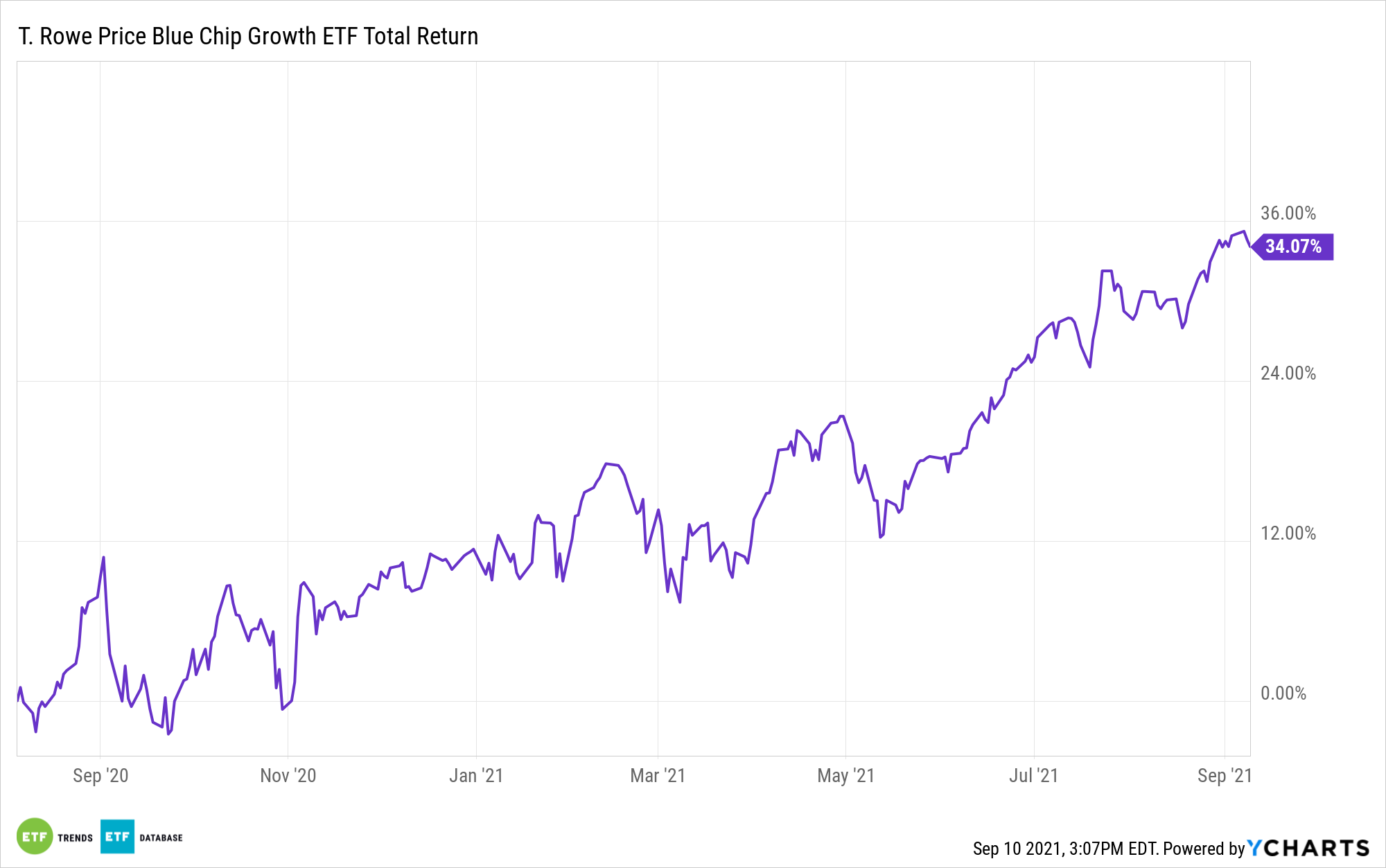

T. Rowe Price manages five active funds that are well-positioned to navigate the miasma of global uncertainty that has afflicted the world since March of 2020. Their expense ratios are modest, ranging from 0.34% for the recently launched T. Rowe Price US Equity Research ETF (TSPA) to 0.57% for the T. Rowe Price Blue Chip Growth ETF (TCHP). TSPA just celebrated its third month on the market and is up 6.3%, outperforming its category average of 0.85%.

Though passive management has its place, active managers can make a world of difference in climates of uncertainty, and can even transform situations of volatility into opportunities to thrive. Volatility remains the number one concern for many advisors, but a rogue’s gallery of possible woes are on everyone’s mind; inflation, stagflation, economic slowdowns, further COVID variances, political unrest, climate-related disasters, supply shortages, rising commodities prices, supply chain breakdowns, and more have many feeling like a deer caught in multiple sets of headlights all at once.

T. Rowe Price’s portfolio managers bring with them an average of 20 years of investing experience each. These are the kinds of steady hands on the tiller that investors will want in these unprecedented times.

For more news, information, and strategy, visit the Active ETF Channel.