Summary

2020 has already featured a number of short-term leadership shifts. I expect that trend to continue in 2021.

I believe that a vaccine-fueled global economic recovery will be the primary narrative in the coming year and asset price action will react accordingly.

More than just a matter of which stocks or sectors are likely to outperform, I think we’ll also see some broader changes in how people invest in 2021.

These are five thematic and asset class rotations I suspect we’ll see play out in the new year.

Investment Theme

Trying to put aside every that’s happened in 2020 with the COVID pandemic, it was a year of several broad pivots in the financial markets. We’ve already seen multiple leadership changes just this year from growth to defensives, back to growth and then finally to cyclicals.

With investors firmly in the camp that the COVID vaccine, with support from the government and the Fed, will lead to a global economic recovery, it’s easy to make the argument that cyclical leadership could continue in 2021 (and I’m in that camp as well).

I’m also foreseeing another year which could see investors making broad pivots in their collective portfolios outside of just the 30,000 foot view of defensive vs. cyclicals. These are my top 5 theme changes I expect to see in 2021.

Overview

By almost any measure, 2020 was a wild year. We’ve seen the coronavirus rock the financial markets and our very way of life with no firm end to the pandemic clearly in sight. We do know, however, that COVID shifted investor sentiment multiple times this year.

Investors entered the year fairly bullish but cautious about the prospects that weakness in European financials and negative interest rates globally could pull the global economy into recession. By the second quarter, we were undoubtedly there and investors pivoted out of risk assets and into more defensive areas, including Treasuries, consumer staples and gold. Once the Fed stepped in with its multi-trillion dollar stimulus packages, growth was back out in front led by the mega-cap tech names. As news of the success of Pfizer’s (PFE) COVID vaccine hit the street, sentiment shifted over to the areas of the market that usually do well coming out of an economic bottom, namely, cyclicals and value stocks.

I believe 2021 could be another year of shifts. And not just a matter of which stocks or sectors are likely to outperform in the coming year and will result in investors chasing returns. I’m also talking about broader themes that are already starting to play out this year and could pick up steam in the coming year.

With that being said, here are five changing themes and asset class rotations that I expect to see in 2021.

U.S. Stocks to Emerging Markets

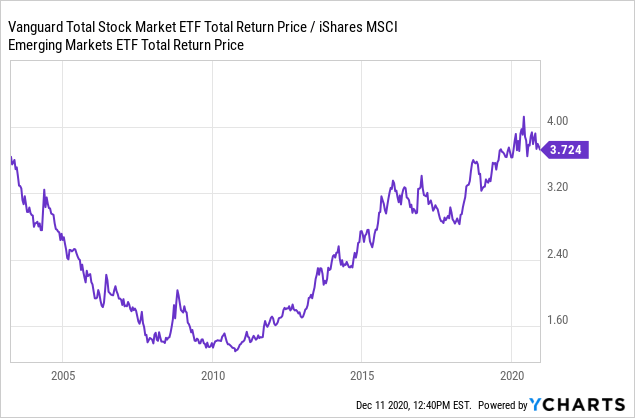

Most of us are probably already aware of the long-term narrative surrounding emerging markets, especially in relation to the U.S. stock market. With the exception of a short stretch around 2017, emerging markets spent the entire decade of the 2010s trailing U.S. stocks after leading for most of the 2000s.

Coming out the financial crisis, investors parked their portfolio mainly in large-cap tech growth stocks and never looked back. In reality, they never had to. With investors earnings 10% and 20% returns by simply investing in market beta, there was no need to take on excess risk in order to achieve above average returns.

Market watchers have been predicting a comeback for emerging markets for some time only to be disappointed every time. At the risk of saying “this time is different”, well, this time MIGHT be different.

Emerging markets have a few things going for it this time around. The higher growth & cheaper valuation story has been in play for a while now, but the relative valuation discount compared to the S&P 500 is even wider than normal. Emerging markets currently trade at around a 35% discount to U.S. stocks, a level which, historically, has suggested that emerging markets are poised for significant outperformance over the next several years.

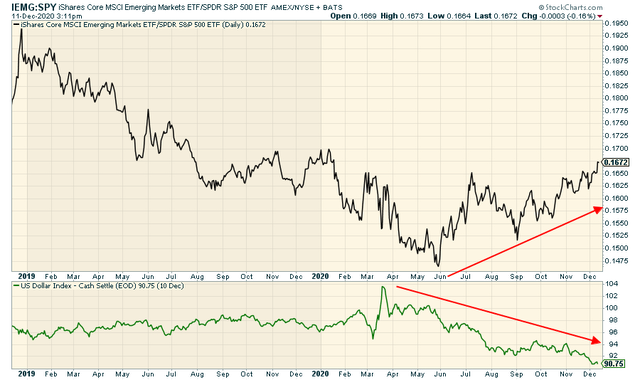

The fading dollar also acts as a tailwind. The outperformance of emerging markets relative to the S&P started right at the beginning of June, exactly the point where the dollar index had made its move from just over 100 down to its current level of 90-91.

I expect that the dollar will continue to fall in 2021 as spiraling federal debt levels and more government stimulus likely on the way eventually will continue to dilute the value of the dollar.

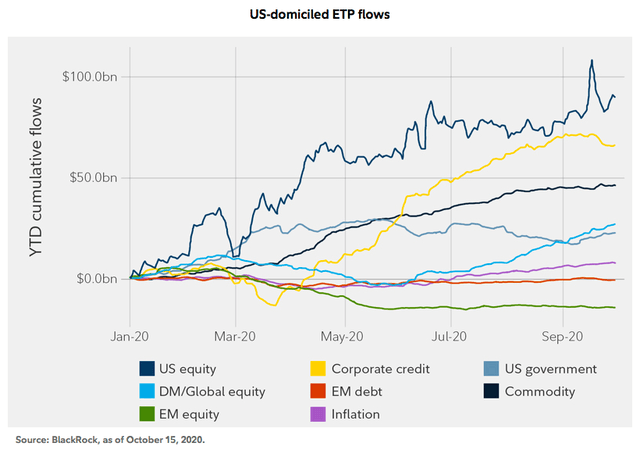

While the narrative certainly makes sense, investors have yet to really react.

Net ETF flows are higher across the board in 2020 with the exception of emerging markets, which continues to see net outflows. Two of the biggest funds in the space, the iShares Core MSCI Emerging Markets ETF (IEMG) and the iShares MSCI Emerging Markets ETF (EEM), have lost a combined $8 billion in outflows year-to-date.

If emerging markets are able to extend their current run of outperformance, I believe investors will eventually notice, as they have lately with small-caps. Growth forecasts are solid, valuations are attractive and the economic rebound story all play into this group’s favor.

Market Beta to ESG

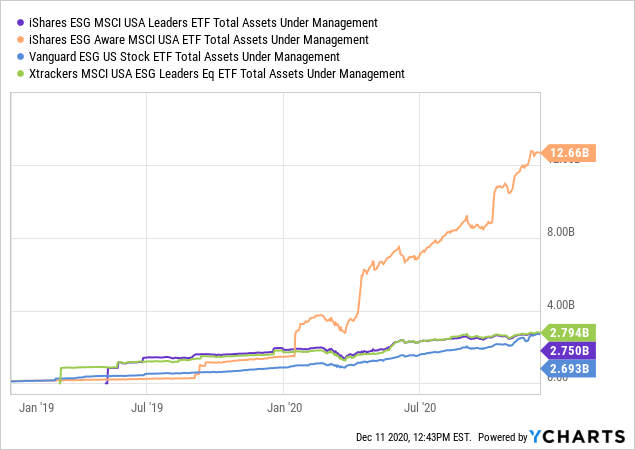

This isn’t necessarily a pivot from one asset class to another as much as it’s a growing theme that I believe will continue to get bigger in 2021.

The idea of socially responsible or socially conscious investing has been around for years, but it took a big step forward in 2020. With climate change, social justice and other platforms gaining more and more attention, the desire of some investors to support their causes through their portfolios is growing.

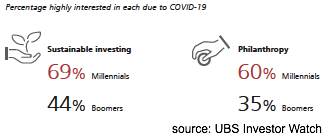

Part of the reason is the eager adoption of ESG investing by the younger generation.

source: UBS Investor Watch

source: UBS Investor Watch

Say what you will about the millennial generation, but they’ve generally been ahead of the curve when it comes to adapting to the new economy. When more than 2/3 of this population says they’re “highly interested” in ESG products for their portfolio, the big fund issuers listened and investors responded.

Four of the biggest ESG ETFs had just a few billion in assets at the beginning of the year, but that number has ballooned to more than $20 billion today.

Over time, I expect to see more investors swapping core ETF positions out of their portfolios for their ESG counterparts. For example, investors using the SPDR S&P 500 ETF (SPY) can replace it with the SPDR S&P 500 ESG ETF (EFIV). EFIV removes tobacco and weapons stocks from their portfolios as well as companies that score especially lowly in several ESG-related metrics. The results narrows the 500 stock index down to about 300 names.

Better yet, these funds are becoming ultra-cheap like their non-ESG counterparts. According to ETF.com, there are seven funds within its principles-based equity fund category that come with expense ratios of 0.10% or less, making them cost-competitive as well.

This is a rapidly growing theme and will only continue to get bigger.

Growth to Energy

This is more of a pure play on the economic recovery that I expect to continue throughout 2021. The recovery is undoubtedly slowing at the moment, but as the COVID vaccine becomes more widely available throughout the first half of the coming year, I believe business restrictions will be lifted, hiring will resume, more people will finally re-enter the workforce and we will begin returning to life as normal.

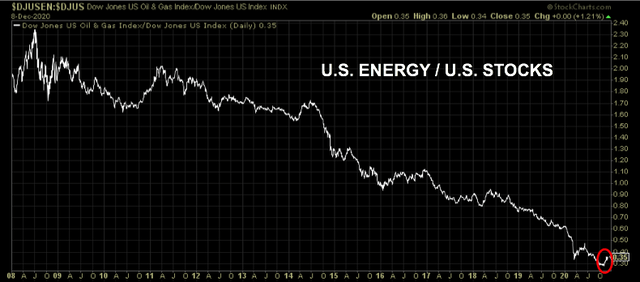

That’s an ideal environment for a rally in cyclical sectors, something that we’ve already been seeing play out since the beginning of November. Energy stocks, which have been getting hammered for years, both on an absolute basis and relative to the S&P 500, have staged an impressive rally.

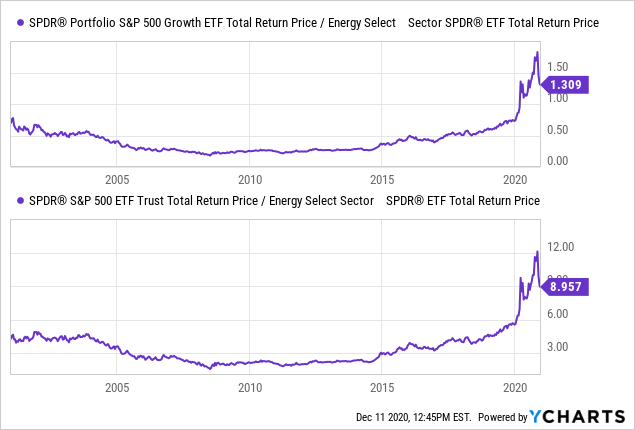

In case you believe the rally has gone too far, too fast, here’s the 12-year chart of energy stocks relative to the broader market.

There’s still a lot of catching up to do and I expect energy and other cyclical areas of the market, including financials and industrials, could be leaders if the economic recovery story plays out.

One of the ancillary outcomes of the COVID-inspired rally over the past several weeks is that tech and other growth areas of the market have relinquished leadership positions. Tech and consumer discretionary, in particular, two sectors which have been unquestioned leaders up until recently, have faded to the background. A lot of these stocks could probably use a pullback on valuation concerns alone, but as OPEC continues to limits on production increases and expectations for global energy demand rise, the energy sector looks like it could be in prime position for an extended rally.

Energy has trailed both the broad market and the tech sector by a wide margin over the past several years, but even after the recent rally, there’s plenty of room to run.

Like I mentioned above with respect to emerging markets, we know that investors are performance chasers and they’re already starting to push back in. Since the start of November, investors have added roughly $1.5 billion to the Energy Select Sector SPDR ETF (XLE) helping to lift the fund’s total net assets from $9 billion to nearly $14 billion today.

If the cyclical rally carries into 2021, I expect energy stocks to be a prime beneficiary.

Treasuries to Junk Bonds

I’ve been skeptical of the junk bond market for more than a year now. The case against the group seemed fairly easy to make. Balance sheet quality of high yield issuers was especially poor back in 2019 as global recessionary pressures were impacting cash flows and repayment risk. The COVID pandemic accelerated that trend and we saw numerous debt downgrades and defaults. Despite all this, yield spreads on high yield debt were at or near record low levels, so investors weren’t even being compensated for the risk they were taking.

But that didn’t stop investors from climbing on board. As long as the Fed pumped liquidity into the economy and investors were in a risk-on mood, junk bonds would have a steady stream of buyers lined up to support prices.

Treasuries, on the other hand, have just about maxed out their return potential. With yields on 10-year notes hovering around 0.9%, there’s little in the way of capital growth potential left and there’s almost no income to speak of. Unless the economy goes in the tank again and investors pile into safe haven trades, Treasury trades have a poor risk/reward outlook.

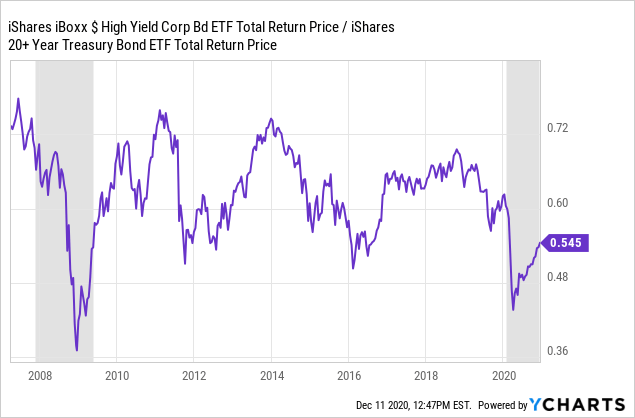

Junk bond prices relative to Treasuries have behaved about as you’d expect coming out of an economic trough, but history suggests there’s much more upside left.

The ratio of the iShares iBoxx $ High Yield Corporate Bond ETF (HYG) to the iShares 20+ Year Treasury Bond ETF (TLT) has touched the 0.75 range multiple times over the last dozen years. Today, that ratio is 0.545. If the ratio is able to return to its prior peak (no guarantees this will happen, of course), it would imply outperformance potential of more than 30%.

I expect investors to continue rotating out of relatively safe, low-yielding Treasuries and into higher risk junk bonds in 2021 for a few reasons.

First, I won’t make the case for a cyclical recovery again other than to say I believe that’s what we’ll see play out. The high yield space is littered with energy and financial names and those names should perform especially well in that environment.

Second, investors are showing a propensity to reach for higher yields if most of the Treasury curve remains below the 1% level. Granted, yields of just 4% for a portfolio of junk bonds isn’t attractive by historical standards, but it exceeds just about anything you’ll find elsewhere in the fixed income market right now. And that will be enough for investors to keep pushing into junk bonds.

Passive to Active

If you’ve read just about anything I’ve written over the past few years, you’ll know I’m a big fan of the low cost boom in the ETF space. I think the emergence of so many funds with expense ratios of less than 10 basis points has been one of the most important developments for the retail investors.

But I can’t ignore the fact that actively-managed funds are making a bit of a comeback here.

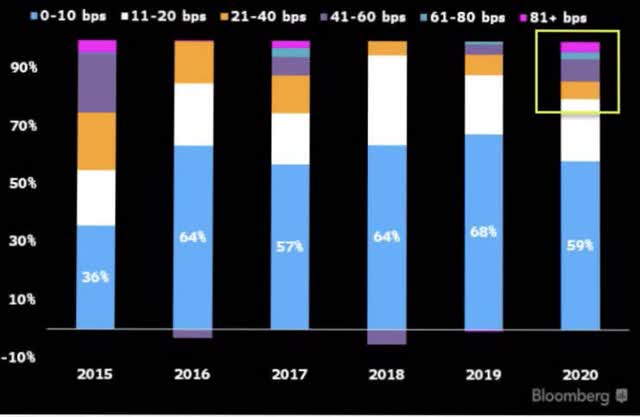

Over the past two years, almost all new investor money was going to products with expense ratios of 0.20% or less, with much of it moving into funds that charge single digit basis points. 2020, however, has seen a significant change.

Nearly 20% of ETF flows have gone into funds with expense ratios of more than 0.20% with an unusually high amount going to funds that charge 40 basis points and up. This group is comprised of a lot of niche and narrowly-focused products, but it’s also where almost all of the active funds reside.

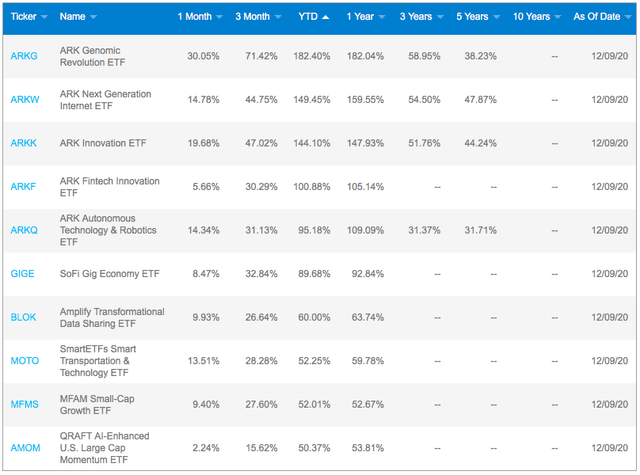

Why are investors pivoting back into higher fee funds? Well, look at some of the returns those funds have achieved.

This is a list of the top performing actively-managed equity funds for 2020. They’re all up at least 50% year-to-date, led by the ARK Funds, which command the top 5 spots on this list. The average expense ratio on these 10 funds? Around 0.75%. The total assets under management of this group? More than $28 billion, most of that belonging to the ARK funds.

The takeaway here? Investors are willing to pay higher fees if it comes with higher performance. If investors see these types of returns in active funds (and the ARK funds are becoming huge thanks to those huge returns) along with a number of issues debuting active non-transparent offerings, I expect investors will begin increasingly focusing on overall performance over simply looking at fees.

Originally published by Seeking Alpha, 12/14/20

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.