“No risk, no reward” is an age-old adage thrown around in the investment community, explicitly stating that those who take on a high degree of risk will reap the benefits of their emboldened maneuvers. In the fixed-income space, it can refer to foregoing credit risk in order to obtain the highest of yields–a paragon of risk-on bond investing.

A Wall Street Journal article recently stated that bonds with less-than-investment-grade quality or junk bonds, have been outperforming their peers, particularly with respect to flattening yields of benchmark Treasury debt and even investment-grade corporate debt. Per the article, “Government bonds are wilting under signs of rising inflation and an accelerating economic expansion, and high-grade corporate bonds have fallen as changes to the tax code and softening global growth mean many longtime buyers don’t want or need the debt.”

Related: An ETF That Taps Into Closed-End Funds for High Yields

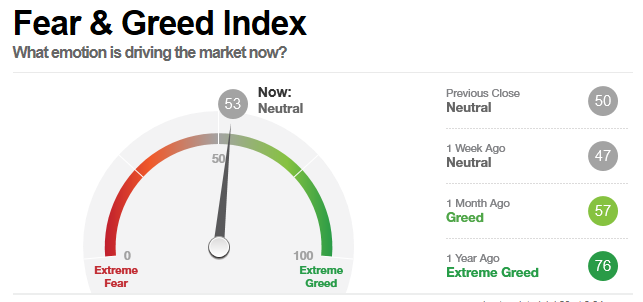

Furthermore, if trade wars begin to have less of an impact on investing and economic growth continues at its current pace, which could signal more rate hikes by the Federal Reserve, the sentiment to take on more risk could rise. CNN Money’s Fear & Greed Index, which measures the emotions driving the markets, is already showing a slight tilt to the right where a dip into greed could fuel more risk-taking.

![]()

As such, here are three fixed-income ETFs that will allow the most risk-tolerant investors to channel their inner Evel Knienvel.

1. iShares iBoxx $ High Yield Corp Bd ETF (NYSEArca: HYG)

HYG tracks the investment results of the Markit iBoxx® USD Liquid High Yield Index, which is comprised of high yield U.S. corporate bonds that have less than investment-grade quality. Investors who have been able to forego the credit risk have seen total returns of 3.95% the last three years and 1.22% the past year based on Yahoo! Finance performance figures.

2. SPDR Blmbg BarclaysST HY Bd ETF (NYSEArca: SJNK)

SJNK seeks to provide investment results that correspond generally to the price and yield performance of the Bloomberg Barclays US High Yield 350mn Cash Pay 0-5 Yr 2% Capped Index. SJNK invests its total assets in the securities comprising the index, which is designed to measure the performance of short-term publicly issued U.S. dollar-denominated high yield corporate bonds. The short-term maturities will help hedge some credit risk due to the lesser exposure, but holdings are still less than investment-grade. SJNK has returned 1.20% year-to-date, 2.94% the past year and 3.76% the last three years.

3. iShares 0-5 Year High Yield Corp Bd ETF (NYSEArca: SHYG)

SHYG seeks to track the investment results of the Markit iBoxx® USD Liquid High Yield 0-5 Index, which is primarily composed of U.S. dollar-denominated, high yield corporate bonds with remaining maturities of less than five years. Like SJNK, debt maturities are shorter, thereby helping to hedge some credit risk, but issues are still less than investment-grade. Nonetheless, SHYG has managed to return 1.13% year-to-date, 2.86% the past year and 4.14% the last three years.

For more trends in fixed income, visit the Fixed Income Channel.