As summer hits a midpoint heading into August, it’s important for investors to know the historical significance that the month brings, particularly when it comes to the S&P 500. As such, it’s important to watch ETFs that track the index, such as the SPDR S&P 500 ETF (NYSEArca: SPY), iShares Core S&P 500 ETF (NYSEArca: IVV) and Vanguard S&P 500 ETF (NYSEArca: VOO).

Sam Stovall, Chief Investment Strategist at CFRA Research, warns investors that August is a time to keep the S&P 500 under their investment radars with respect to volatility. A deep rise or deep decline could be in store, but should not necessarily deter investors from heavy market oscillations.

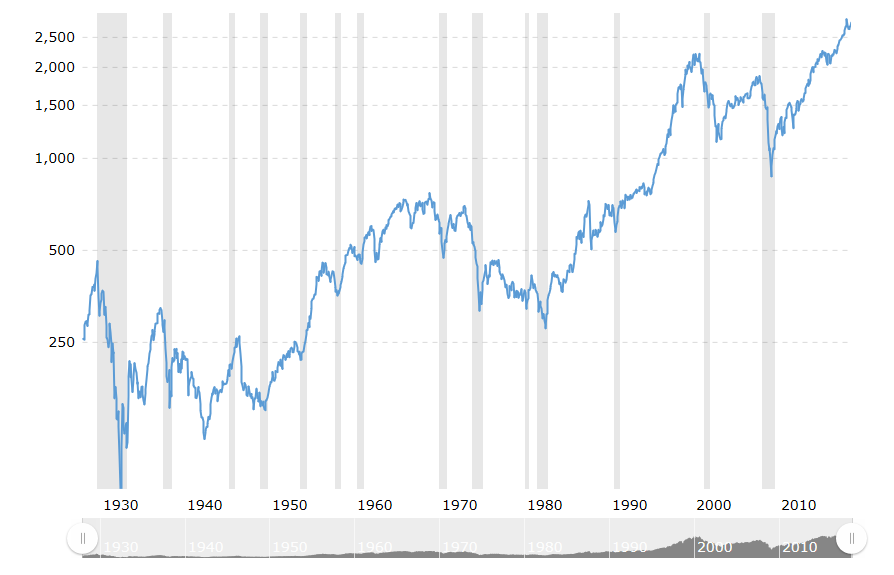

“Since WWII, the S&P 500 gained about 1%, on average, in July of midterm election years, but then stumbled in August, ranking it among the three worst months,” said Stovall. “The deepest August slump was in 1998, when the S&P 500 tumbled 14.6% in response to the losses endured by the hedge fund Long Term Capital Management. August also witnessed the second-highest rise of any month at 11.6%, in 1982, as the market began its 1982-87 bull run. Today, history says that investors should prepare for, but not necessarily run from, an increase in volatility.”

![]()

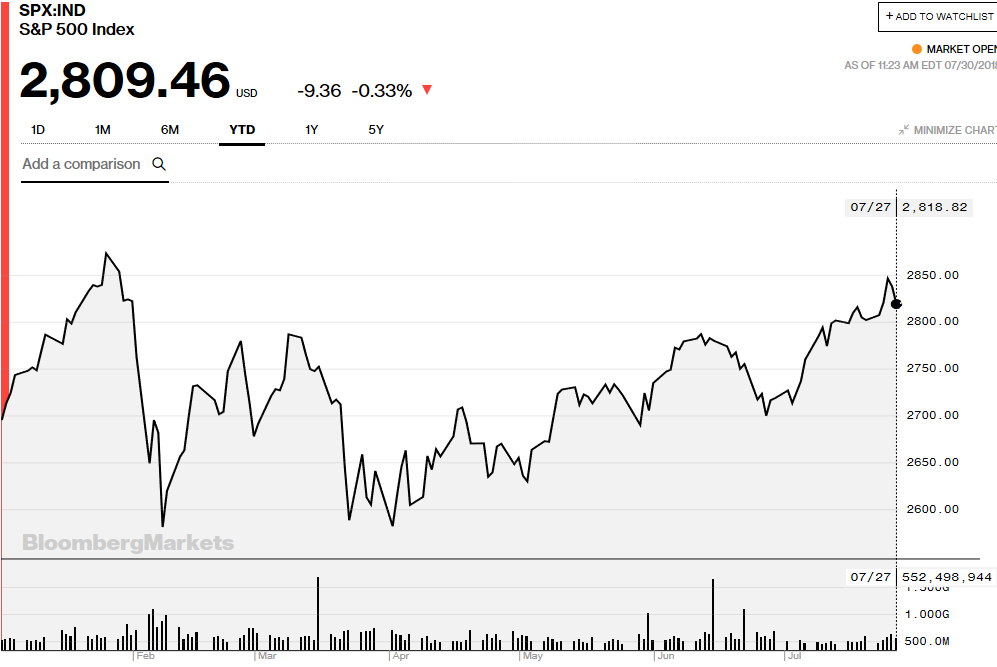

Looking at the year-to-date chart, the S&P 500 peaked at 2,872.87 on January 26 before taking a dive to 2,581 on February 8. Since then, it has slogged its way back to 2,846.07 on July 25 and will be re-testing its January 26 ceiling, which August could reveal.

![]()

In terms of how investors can approach the month of August, Stovall recommends using momentum indicators to gauge the strength of the S&P 500. The past week saw earnings report like Facebook deal blows to the S&P 500, but Stovall says a mix of top 10 S&P 500 stocks in a portfolio could help make volatility work for investors.

In terms of how investors can approach the month of August, Stovall recommends using momentum indicators to gauge the strength of the S&P 500. The past week saw earnings report like Facebook deal blows to the S&P 500, but Stovall says a mix of top 10 S&P 500 stocks in a portfolio could help make volatility work for investors.