On Wednesday, U.S. capital markets were shuttered to honor former President George H.W. Bush, who passed away last Friday evening at the age of 94. During his four-year term, Bush faced a plethora of challenges in the economy as any U.S. president would during his time in office.

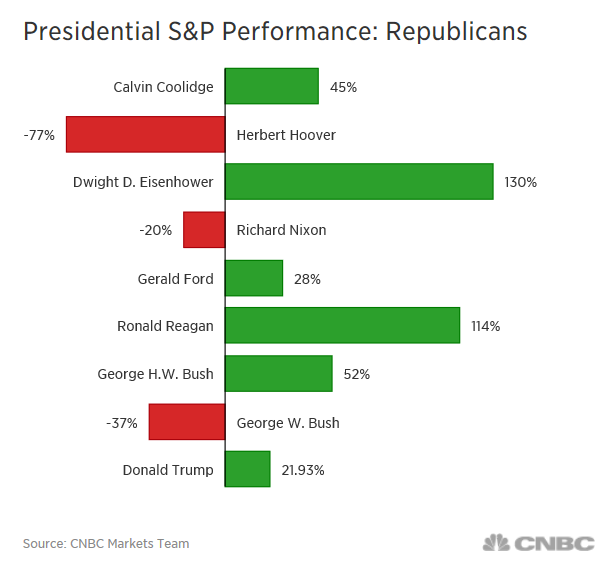

Bush’s 94 years of life included a stint as a World War II fighter pilot and of course, a trip to the Oval Office where he would preside over the third best stock market performance by a GOP president based on the S&P 500 index. The term Bush served, from January 1989 to January 1993, produced a 52% gain in the S&P 500, which was bested by only Dwight D. Eisenhower and Ronald Reagan.

Despite serving just one term, Bush had to overcome his fair share of economic challenges.

Despite serving just one term, Bush had to overcome his fair share of economic challenges.

Stock Market Crash of 1987 Fallout

The stock market crash in 1987 started with “Black Monday”–perhaps the name came about as it left investors’ portfolios battered black and blue as October 19, 1987 became notorious for being the largest single-day decline in the Dow Jones Industrial Average–shedding a whopping 22.6%. Prior to the crash, markets were in a heated frenzy as they were fueled by a spate of corporate takeovers that made stars out of names like Carl Icahn.

However, with the advent of portfolio insurance, investor sentiment was tantamount to being in a risk-on mode with an injection of steroids. As the story goes, a tsunami of sell-offs that Monday caused a market capitalization loss of over $500 billion, requiring the Federal Reserve to intervene after the crash by lowering interest rates in order to help bring the financial markets back to life.

When Bush came into office, he basically inherited a lot of the fallout from the crash of 1987. However, within his first year in office, the S&P 500 pulled itself from the depths of its previous declines to the surprise of market prognosticators, reaching all-time highs once again.

Savings and Loan Bailout

Savings and loan institutions (S&Ls) were initially intended to provide mortgage loans, which would eventually help prop up the housing market following World War II. With war chests of capital in their possession, S&Ls would make risky investments and combined with lax government oversight, this made for a disastrous combination.

Rising interest rates at the time meant that S&Ls had to may more in interest versus the income they made from mortgage loans–as a result, more than 1,600 S&Ls failed between the years 1986 to 1995. The federal government had to step in and help fund Federal Deposit Insurance Corporation (FDIC) claims.