The activist investor Engine No. 1, recently in the news for forcing out three Exxon board members earlier this year and replacing them with its own representatives, has announced a new strategy for assessing environmental, social, and governance (ESG) investing, reported Bloomberg.

In a report that they published on Monday, Engine No. 1 has said that it will tackle the lack of any sort of standardized measurement for ESG by creating its own framework. They will be combining ESG information along with financial analysis to analyze companies in an effort to predict the effect that ESG performance has on the value of these companies.

“ESG data is as core to the investment process as financially driven analysis,” said Chris James, founder of San Francisco-based Engine No. 1. “This framework, when applied to capital allocation, brings common sense back to capitalism itself.”

The ESG arena is burgeoning with investments and is expected to grow from $35 trillion last year to $50 trillion by 2025. Engine No. 1 believes that active managers must dig into the ESG data to ensure that they are investing in companies that are contributing to reducing emissions and bettering human rights practices, and that their investments are also encouraging continued growth in those arenas.

“For all the hype and hope in these extravagant numbers, however, the results have so far been disappointing,” Engine No. 1 said. “Far from changing corporate behavior and creating a better world, some ESG funds have served the narrower and more self-indulgent purpose of making investors feel better by excluding obviously ‘bad’ companies from their portfolios.”

Putnam Does the Research

Putnam believes in sustainability and holds ESG practices as a core aspect of its investment approach. Its ESG-focused active sustainability managers are a fundamental part of its work to align shareholder ESG values with investment practices by engaging directly with the companies invested in as to their ESG fundamentals and practices.

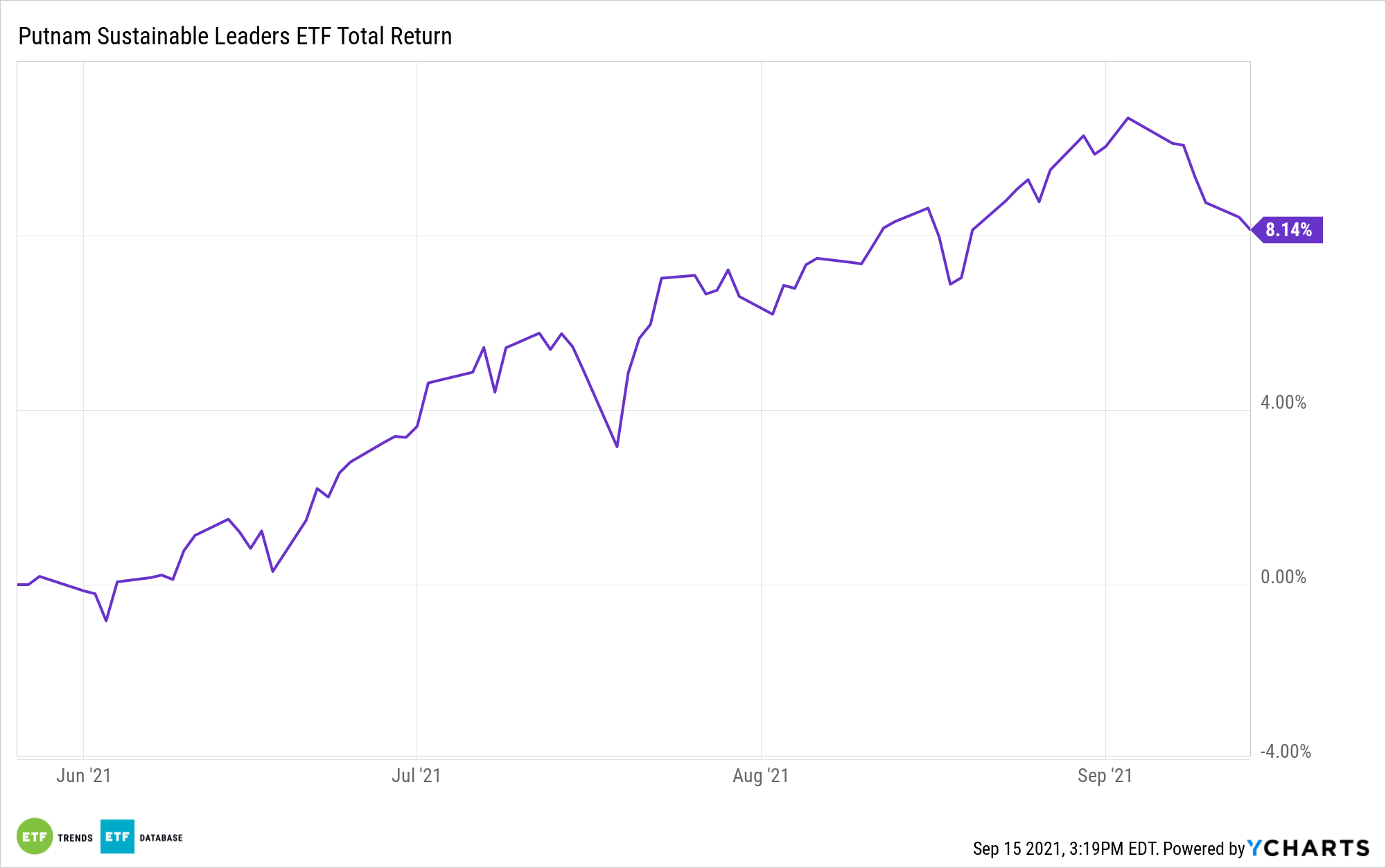

The Putnam Sustainable Leaders ETF (PLDR) invests in companies whose focus on ESG issues goes well beyond just basic compliance, but for whom ESG is an integral part of their long-term success. These companies have transparent goals and provide consistent, measurable progress updates.

As a semi-transparent fund using the Fidelity model, PLDR does not disclose its current holdings on a daily basis. Instead, it publishes a tracking basket of previously disclosed holdings, liquid ETFs that mirror the portfolio’s investment strategy, and cash and cash equivalents. The tracking portfolio is designed to closely track the actual fund portfolio’s overall performance, and actual portfolio reports are released monthly.

Holdings as of the end of July included Microsoft Corp. at 8.61%, Apple at 7.31%, and Amazon.com at 4.95%. The fund was heavily allocated to information technology stocks (32.67%), followed by healthcare at 15.92%, and consumer discretionary at 14.90%. PLDR has an expense ratio of 0.59%.

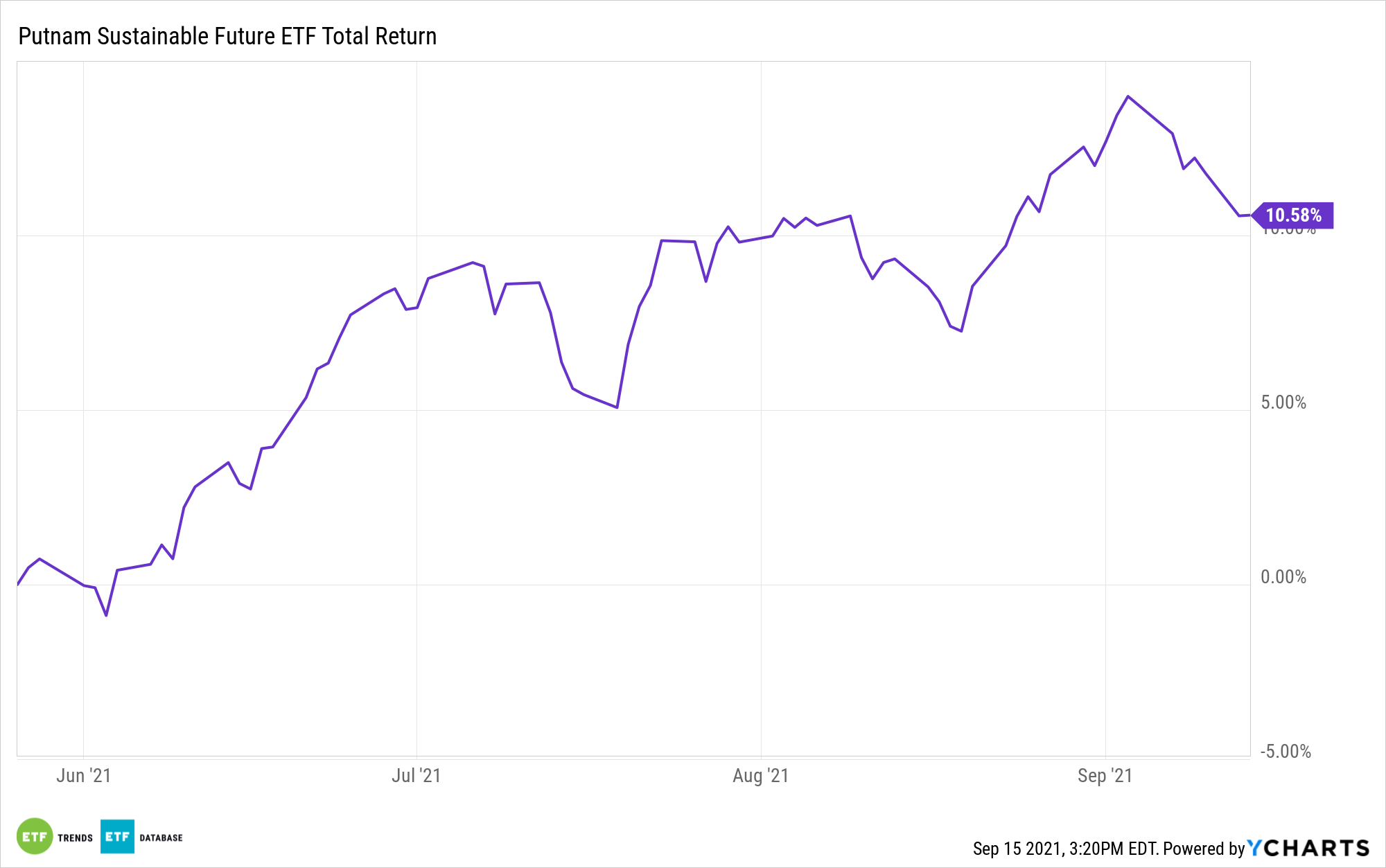

Meanwhile, the Putnam Sustainable Future ETF (PFUT) invests in companies seeking to provide solutions to future sustainability challenges. It is a forward-looking approach as these companies are helping to develop ESG and solve problems related to sustainability.

PFUT focuses on impact companies as identified in its sustainability rating system, investing in companies driving economic development, as Putnam believes that strong sustainability practices equate to strong financial growth.

Like PLDR, PFUT is a semi-transparent active ETF. Holdings are disclosed monthly, but as of the end of July, they included Danaher Corp (which designs and manufactures products for professional, medical, industrial, and commercial industries) at 3.82%, Adobe at 3.43%, and Chipotle Mexican Grill at 2.71%.

PFUT’s top sector allocations as of the same time period were 32.43% in healthcare stocks, 29.983% in information technology, and 9.71% in consumer discretionary. PFUT has an expense ratio of 0.64%.

For more news, information, and strategy, visit the Big Ideas Channel.