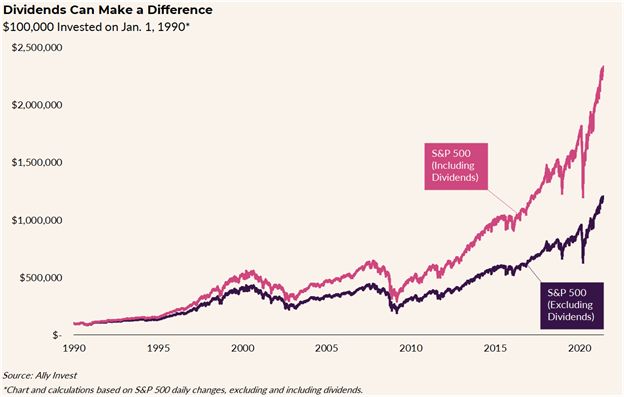

Dividends are an under-considered strategy to hedge against inflation, one that might work as well or even better than classic methods such as cyclical stocks, gold, or TIPS, writes Callie Cox, a senior investment strategist at Ally Invest, in a note to clients.

”No matter where you look, it’s important to prioritize cash flow over growth potential when inflation is surging. Short-term payouts may actually help you maximize long-term growth,” she said.

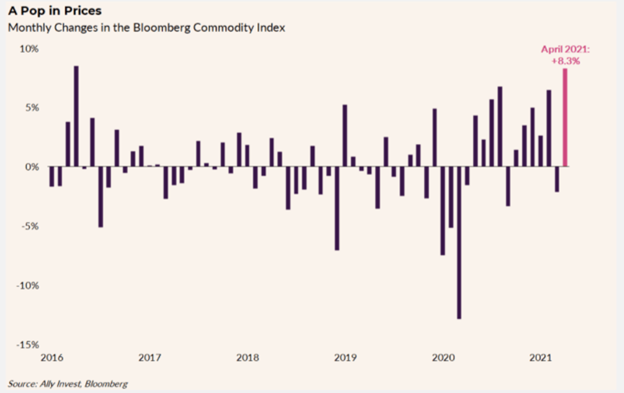

The Fed has previously expressed belief that the current elevated levels of inflation are temporary, but changed their tune after last Wednesday’s meeting. What’s more, the data keeps pointing to rising prices and an ongoing inflationary environment. For example, copper prices have seen record highs, and staples such as corn and coffee have increased 20% since April:

Dividend-paying stocks (and dividend ETFs) might appear counterintuitive in an inflationary environment, but if inflation erodes investment value over time, then the income received now reflects the value of the moment.

As Cox says: “While dividend payers usually aren’t the trendiest companies – toilet paper makers, food distributors and power companies – their payouts could help get cash back in your pocket sooner (at a presumably higher present value). And if you re-invest that dividend payment, you may be able to supercharge your portfolio’s growth over time.”

The Stock Market Maintains Value Even When the Dollar Doesn’t

Cox points out that “the value of a dollar may fall over time, but the stock market has historically done the opposite.”

The S&P 500 index has grown an average of 8% a year since 1990. In comparison, the core CPI has grown an average of 2% over the same period.

“Stock market growth has historically overwhelmed inflation, and that’s why investing is so critical for building wealth,” added Cox.

High yielding equity ETFs, such as the Columbia Research Enhanced Value ETF (REVS) or QRAFT AI-Enhanced U.S. Large Cap Momentum ETF (AMOM), can get income in pockets now, and that income can be reinvested back into the market, where its value will continue to grow even if the value of the dollar continues to shrink.

In fact, about 76% of the stocks in the S&P 500 Index paid a regular dividend, writes Cox, adding that many have grown their dividends substantially. Last quarter, S&P companies boosted their dividend by $20 billion, the biggest increase in nine years.

Whether inflation is temporary or not, dividends can benefit your portfolio, continues Cox.

“Let the math work in your favor: Think about how the time value of money can impact your investments, and be prepared to take advantage if the market slides on an inflation scare.”

For more news, information, and strategy, visit the Dividend Channel.