Despite some price tumbles over the past week, investors remain bullish on gold. Inflation remains a concern for many and gold is particularly well-positioned to thrive in the current economic conditions. The mining sector is benefiting from gold’s ongoing surge, which has made mining ETFs a popular destination for investor capital.

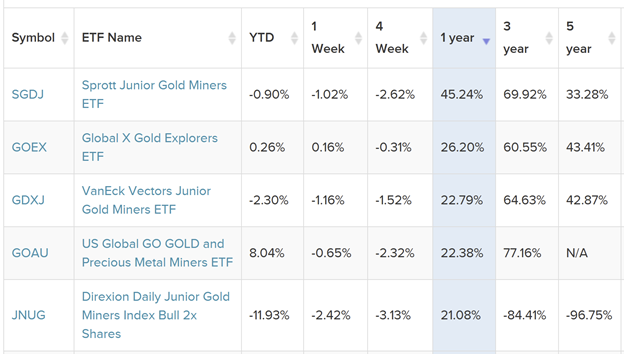

Over the past twelve months, the mining ETF with the highest returns is the Sprott Junior Gold Miners ETF (SGDJ). It is up 45.24%, easily best in the field:

Source: Etfdb.com

SGDJ tracks small cap gold mining companies, focusing on small companies with strong revenue growth and price momentum, two factors that have historically predicted long-term stock performance.

The portfolio, which holds roughly 30 to 40 stocks at any given time, tracks the Solactive Junior Gold Miners Custom Factors Index. It is rebalanced semi-annually, ensuring that it reacts to seize opportunities in a timely fashion and keeps its holdings optimized.

Although small cap stocks tend to have more volatility, they also boast larger upside.

With the possibility of high-value discoveries, gold mining is an industry that can change in a moment. Small- and mid-sized companies are often gobbled up by the larger players, creating plenty of opportunities for investors to reap huge rewards.

Under SGDJ’s Hood: The Top 3 Holdings

The biggest current holding for the Sprott Junior Gold Miners ETF is Great Bear Resources. Great Bear Resources made a huge discovery two years ago, which continues to bring in significant revenue for the firm.

At 4.82%, the next-largest holding in SGDJ is Skeena Resources Limited, a Canadian company which completed a share consolidation last week. Skeena has multiple sites in Canada’s famous “Golden Triangle” region. The company’s stock price has risen considerably over the past 12 months, trading at $5.40 a year ago and at $14.38 today.

Centamin PLC is the third-biggest holding in SGDJ, with a stake of 4.38%. The company had a rough initial go of the pandemic, with its biggest site proving unsafe just as the COVID crisis worsened.

However, the gold mining organization seem to be poised to surge as its mines come back online and the vaccine rollout continues.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.