Despite climbing wages and increased job openings, unemployment in the U.S. remains high, leaving many business searching for ways to fill the gap.

More companies are turning to technology to try and meet productivity demands from a reduced workforce, reports the Wall Street Journal.

A Top-down, By the Numbers Look at the Current Job Market

The WSJ reports that payroll has increased by 1.6 million in the last 3 months and is up 1.7% year-to-date, numbers that in typical times would have been indicative of positive growth.

However, while the US is experiencing a productivity boom, employers are currently hiring less, thanks in large part to the pandemic.

Historically, the typical pattern for recessions saw decreasing productivity, but in three of the last four quarters over the course of the pandemic, business output per hour has actually increased. From January to March of this year, output was up 4.1% from the year prior, the most rapid growth in a decade.

Meanwhile, job openings rose 1 million in April to 9.3 million, the highest number since record-taking began in 2000, indicating continued labor shortages. The factors here are multi-fold, including pandemic-related deaths and disability disproportionately impacting certain industries; continued reluctance by workers to re-enter the workforce due to pandemic-related fears and lack of sufficient wages; and shifting work/life expectations.

Technology as a Solution for Employee Shortages

To meet demand, a great number of companies have turned to technology.

“This recession took on a life of its own by leading to greater remote work, greater reliance on technology,” said Jason Thomas, head of global research at private-equity manager Carlyle Group.

With much of the workforce working remotely, software investment was up 10.5% first quarter over the same time a year ago. Companies have invested heavily into sectors such as collaborative communication, cloud computing, and e-commerce since the beginning of the pandemic.

“The longer shortages persist, putting upward pressure on wages, the greater the incentive for companies to turn to technology to economize on labor—and the longer the jobs recovery will take,” said the WSJ.

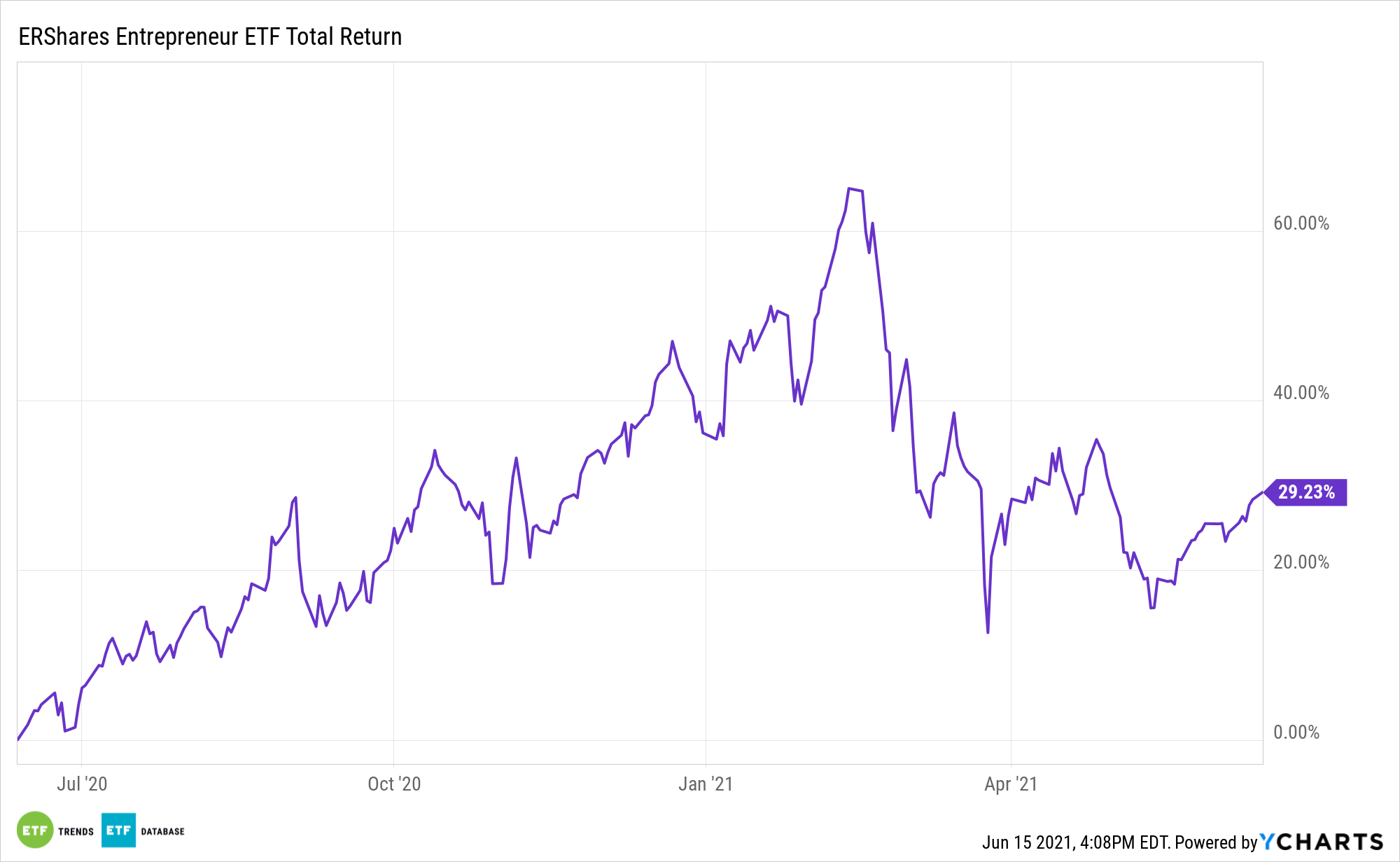

Investing in Technology with ENTR

The ERShares Entrepreneur ETF (ENTR) invests in primarily U.S. large cap, entrepreneurial companies using the Entrepreneurial Factor©, an approach that utilizes research, AI, and thematic investing to identify high growth opportunities.

ENTR follows entrepreneurial disruption in sectors such as cloud computing, 5G and next gen communications, e-commerce, and more, all of which are aligned to continue their growth opportunities as companies continue investing in technology to meet productivity demands.

The ETF has a 36.07% allocation in information technology stocks, a 17.46% allocation in communication services firms, and 12.21% in consumer discretionary companies.

ENTR has a gross expense ratio of 0.49%.

For more news, information, and strategy, visit the Entrepreneur ETF Channel.