Looking to build up income in a sustainable way? Consider dividend growth ETFs.

Unlike high-yield ETFs, which provide a sizable income boost right away, dividend growth ETFs focus on stocks that steadily grow the size of their dividends over time.

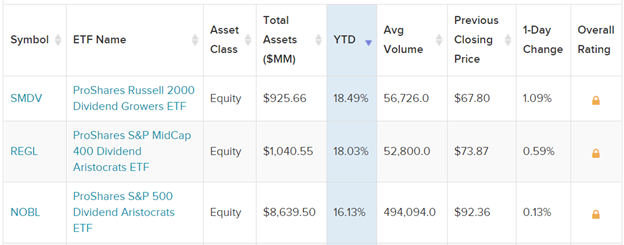

Year-to-date, the top performing dividend growth ETFs are all from ProShares, with small-, mid-, and large-cap focuses respectively.

Source: ETF Database. Data as of June 2nd, 2021.

Dividend Grower Shows Small Cap Growth Power

High-yield ETFs often focus on established companies that can make sizable payouts to shareholders relative to their stock prices. That skews them toward large cap stocks.

In contrast, dividend growth ETFs tend to focus on the small- or mid-cap spaces.

The ProShares Russell 2000 Dividend Growers ETF (SMDV) is just such an ETF. SMDV focuses only on the highest quality dividend growers in the Russell 2000 Index, meaning the companies have raised their dividends consistently over at least the past ten years. The fund’s 75 holdings, which are equally weighted, generally exhibit strong financial fundamentals, including stable earnings and steady growth.

25% of the portfolio is in financial stocks, while another 23% is in utilities and 20% in industrials. SMDV’s largest holding is in Aaron’s Company (AAN), at 1.92% of its total portfolio.

REGL Offers Regal Payouts

Up 18.03% on the year, the ProShares S&P MidCap 400 Dividend Aristocrats ETF (REGL) invests exclusively in mid cap companies that have posted at least fifteen consecutive years of dividend growth.

Like SMDV, REGL’s portfolio is heavily weighted toward industrials (29%), financials (28%), and utilities (18%).

At 2.03%, REGL’s top holding is Nu Skin Enterprises (NUS).

NOBL: Large Caps Still Have Room to Grow

With a robust 16.13% growth on the year, the ProShares S&P 500 Dividend Aristocrats ETF (NOBL) is also a great option for dividend growth.

This ETF chooses investments based on S&P 500 stocks that have hit at least 25 years of consecutive dividend growth, looking for consistent high payouts as well as growth. Most of NOBL’s holdings have grown their dividends for 40 years or more.

Unlike the other two ETFs, NOBL has a significant allocation to consumer staples stocks (18%). Another 25% are in industrials. 11% resides in financials.

NOBL’s biggest holding is Nucor Corp (NUE), at 2.13% of the portfolio.

For more news, information, and strategy, visit the Dividend Channel.