Artificial intelligence (AI) isn’t just a standalone investment theme; it’s a technology that could potentially “expedite the automation and cost-saving of every industry” through a deep learning revolution, according to ERShares.

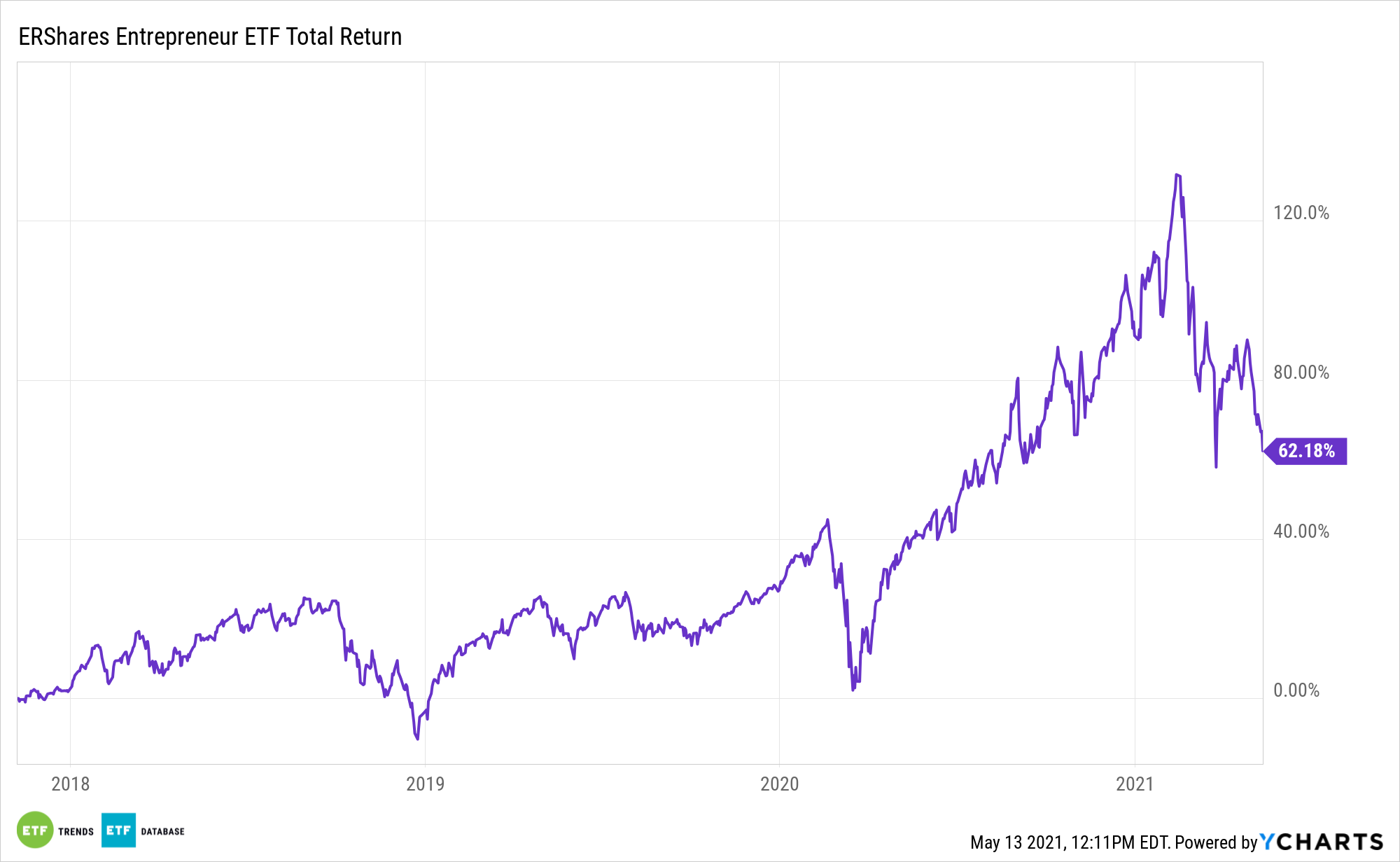

ERShares’s flagship fund, the ERShares Entrepreneurs ETF (ENTR), offers exposure to a range of disruptive technology sectors—including robotics and AI.

With its emphasis on high growth companies driven by strong leaders, ENTR offers access to several AI-driven stocks with an entrepreneurial twist.

Alphabet

For example, Alphabet (Nasdaq: GOOGL), has robust robotics and AI divisions working to integrate both technologies into everyday life.

Via TensorFlow, an open source end-to-end machine learning platform, Google has endeavored to make its own machine learning platforms accessible to both beginners and experts, as well as an extensive library and models for experimenting with, per the TensorFlow website.

In addition, Google’s Gradient Ventures, a venture fund that is AI-focused, targets early-stage tech start-ups. It utilizes Google’s experience as tech founders and entrepreneurs to help tech start-ups launch successfully. To date, Gradient Ventures has funded over 67 start-ups ranging across industries from fintech and insurtech, to healthcare and life sciences, per the Gradient Ventures website.

Though Alphabet is a massive company, it remains entrepreneurial in spirit, through consistent leadership by co-founders Larry Page and Sergey Brin, who remain board members and controlling shareholders, and by its commitment to support tech start-ups. Currently ENTR holds 7.09% of its portfolio in Alphabet.

NVIDIA

Another robotics and AI mainstay is computing hardware manufacturer NVIDIA (Nasdaq: NVDA), which was co-founded by current President and CEO Jen-Hsun “Jensen” Huang.

NVIDIA’s graphics cards power the machinery of everyday life, from computers to cell phones; the company makes powerful graphics processing unites (GPUs) dedicated to artificial intelligence and deep learning applications. The company has also developed a massive cloud-based software suite to bring artificial intelligence applications into enterprise settings.

ENTR holds 3.57% of its portfolio in NVIDIA.

FedEx

Finally…Fedex?

Yes, FedEx (NYSE: FDX), the delivery company, has integrated AI and robotics into every step of its delivery and sorting models.

Founded by current chairman and CEO Frederick Smith, FedEx has also partnered with several other companies to stay on the cutting edge of technology in its industry.

One such partnership is with Mercedes-Benz Vans to develop Coros, an AI package delivery tracking system. Coros, or Cargo Recognition and Organization System, is installed into the cargo space of the delivery vehicles and utilizes automatic barcode scanning and cameras to track packages in the cargo hold, giving real-time updates on their whereabouts. It also helps optimize sorting by using an LED system that indicates prime package placement.

FedEx Express has also partnered with Plus One and Yaskawa to install four robotic arms for sorting small packages and letters in its Memphis hub, per the FedEx website. This technology is among the first in its industry and is working to increasingly automate and enhance performance.

ENTR holds 3.8% of its portfolio in FedEx.

For more news, information, and strategy, visit the Entrepreneur ETF Channel.