“This is the most expensive sentence in finance,” said my Professor. He went to the whiteboard and wrote out: “This time it’s different.” This was my very first class in business school, circa 1990: Remedial Math. My acceptance to Boston University had been contingent on me completing this summer course, as I went into B-school with a shiny undergraduate degree in Creative Writing from the prestigious basement hallways of UMASS, and had avoided having to take any math beyond Algebra to that point. “However,” he continued. “What statistics can tell us is whether that sentence is wrong, or right. What you do from there is up to you.” I have been a quant-tourist ever since: math isn’t my first language, but I bathe in it like an American Japanophile who watches samurai movies with the subtitles on.

It’s Always Different

Since then, I’ve come to realize that feeling like “this time it’s different” is almost the default state of investing. But sometimes, there are structural, legal, technological, and geopolitical differences that are, in fact, unique to a given era. And yet, our base models of academic finance — the efficient market hypothesis among them — assume a kind of run-rate status quo that lasts decades. Since that remedial math class ended (I got a B+), I would argue we’ve had enormous changes that should impact our understanding of markets, of which two stand out to me:

- Technology. The rise of both the internet and computing power means that the distinction between “real time data” and “usable information” is almost nil for someone with the will to build an algorithm. Technology has also made everything from trading to taxes easier and easier. In other words, it’s a lubricant, which only gets more slippery by the day.

- Regulation/Market Structure. In 2000, Reg FD effectively eliminated legal inside information, and in 2007 Reg NMS restructured the entire equity market in pursuit of frictionless execution.

This combo platter has created the medium in which all of our modern market trends have grown. The decline of active management can be directly traced to both. The rise of Robinhood day traders? Same. The massive increase in derivative trading? Same. And all of this has the effect of essentially compressing time. The market feels more volatile not because we now have bigger moves, but because the moves happen on much shorter time scales than in the past. This is hardly a new observation, but it remains true: life moves pretty fast (as Ferris Bueller would say).

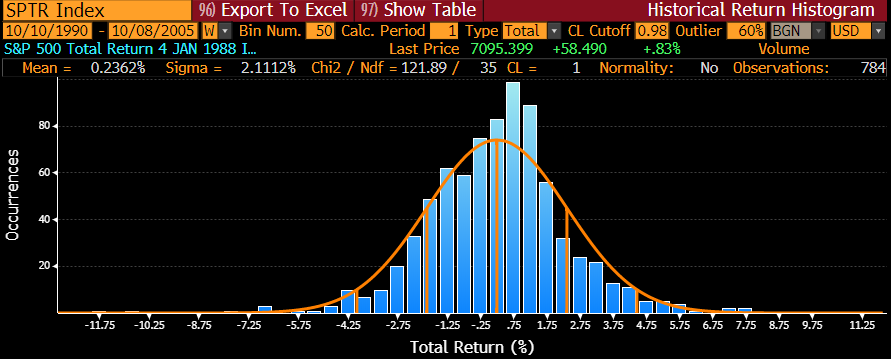

You can see this in various ways just in the patterns of returns available in the market place. For example, here’s a histogram of market returns for the first half of the 30 years since my math class:

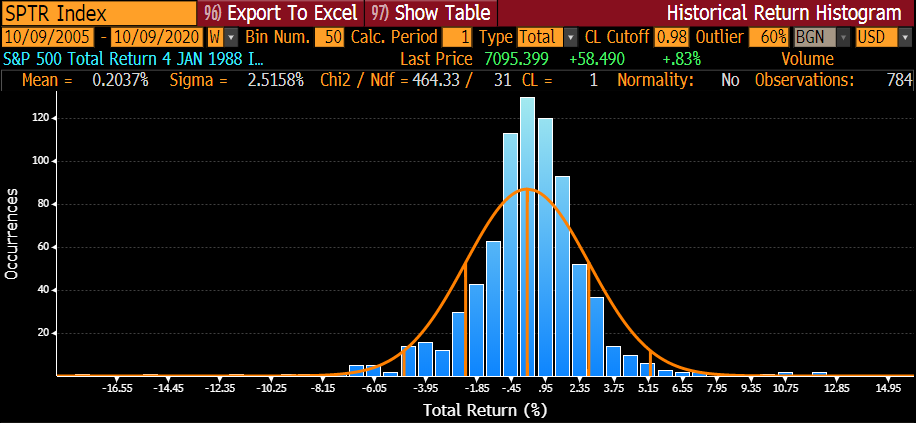

And here’s the more recent 15 years:

And here’s the more recent 15 years:

This isn’t a deep analysis — like I said, quant-tourist here. This is just weekly returns dumped into Bloomberg’s Histogram function, but there’s not a lot of question to me that these are different markets. Just visually, the more recent markets have both a higher number of central tendency observations, and at the same time, wider variation. (Born out by the higher Chi-square and higher Sigma).

Perhaps the best English-major way to say this is that investors are standing on jello right now, while investors 20 years ago were standing on sand. Neither is comfortable, but one was a bit more predictable. Investing right now can feel like you’re walking a ridgeline, and a fall to either side is going to be dramatic.

There are also deep, deep structural features of our markets right now, which actually make this even worse. Corey Hoffstein at Newfound Research published a criminally un-reported paper a few weeks titled “Liquidity Cascades: The Coordinated Risk of Uncoordinated Market Participants” that shows how the combination of monetary policy, basket trading, liquidity incentives, and leverage make the current market less one of standing on Jello but actively trying to surf waves of the stuff, with each perturbance being amplified by pro-cyclical forces. I implore you to read it. There’s no math in it.

What To Do?

The way all of the above shows up in most conversations I have with advisors and investors is just a simple question: How do I stay invested, but still manage what feels like too much risk? Traditional answers to this question have all centered on diversification. Simply buy a bunch of uncorrelated assets, and it’ll all work out, right? But mean-variance optimizers weren’t built to handle a risk-free rate of zero, massive economic stimulus, or any of the points above.

The answer for many investors has been to look for investments designed from the ground up to shape the pattern of returns available in the market into something more palatable. There have been a few notable approaches here.

- Defined Outcomes: Using options, it’s relatively simple (from a math perspective) to create guardrails around your potential returns. This is what options traders have done for decades. Want to own equities but want some income? Sell some covered calls. Want to cover your tuckus from downside panics? Buy puts. Products from Innovator and First Trust have filled this gap.

- Tail-Risk Strategies: There are many, many ways to hedge, and products like Cambria’s TAIL and Amplify’s SWAN, or even approaches like Pacer’s TrendPilot products have unique patterns of return that can be useful in solving this problem.

- Pattern Molding Strategies: I admit I just made that term up, but this is where I think the most interesting products are being launched. Nationwide’s surprise hit, NUSI, is certainly in this camp, using options to extract income and manage downside risk on the volatile Nasdaq 100 index. But perhaps the coolest newbie in the space is Simplify ETFs SPYC. SPYC seems designed to precisely mitigate the concerns Corey Hoffstein highlights, and which I’m calling “surfing Jello.” It takes basic S&P 500 exposure, and then uses options to potentially profit from falling off *either* side of the central tendency. Market melts up? You’re great. Market melts down? You’re great. Of course, nothing’s free, but the idea of sacrificing a percent or two if the market is really, really boring seems like a decent trade.

You Don’t Have To Bail

My takeaway here is pretty simple. You’re right to be nervous about the markets — many things are worrying. But that doesn’t mean you have to stick your head in the sand. There are ways to manage these risks. They may just not be the ones they taught in business school in 1990.

[Note: I am hosting a webinar with both Corey Hoffstein and the team from Simplify this afternoon to discuss all of this, and I called “dibs” on being the moderator as quick as I could. We’ll post a link to the replay here if you can’t make it, but come ask hard questions, it’s more fun that way. You can register here.]

For more market trends, visit ETF Trends.