When the Fed announced it was hiring Blackrock to run its Secondary Market Corporate Credit Facility program 29 years ago, I wrote a letter to the CEO, Larry Fink. In it, I implored Blackrock to be broad and deep in its buying of ETFs. And honestly, I think they’ve delivered.

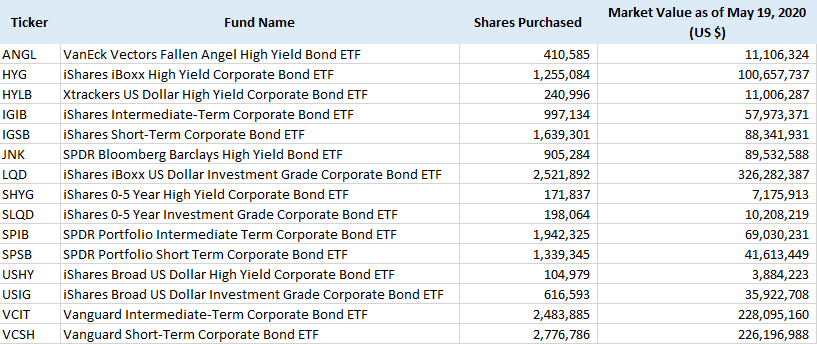

The Fed finally published what ETFs they owned as of May 19, 2020. So this isn’t representative of everything they currently own, or what they may eventually own:

This is a good list. It’s a broad list. It features good funds from great companies. But I was curious if there was any particular logic behind it, so I ran one more little bit of check on it:

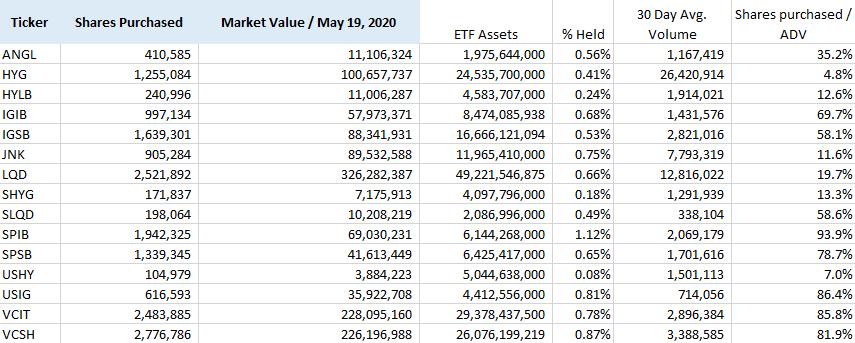

From this, there are a few obvious observations.

1. This really is spread pretty broadly. Yes, LQD might be the biggest single holding, but the % of the fund now owned by the Fed is completely in line with the other funds. If anything, the only fund with outside Fed ownership isn’t a Blackrock fund; it’s the SPIB, an intermediate corporate fund from State Street.

2. At the same time, this is only one week of activity, and the Fed already owns between half and one percent of these 15 ETFs. As the kids say, “that escalated quickly.”

3. It’s worth noting that Blackrock went out on a bit of a trading limb to include some of thee funds. In the case of the two Vanguard Corporate ETFs (VCIT and VCSH) and SPIB, they had to be a whole day’s volume in one week. Now, they’re not allowed to buy at big premia, so it’s hard to argue this is a problem, but it does show they’re willing to do the work on the desk in the name of being inclusive and broad.

4. It would have been very, very easy for them to have skipped out on the funds from Van Eck and DWS (the VanEck Vectors Fallen Angel High Yield Bond ETF – ANGL, and Xtrackers US Dollar High Yield Corporate Bond ETF – HYLB). These are both great funds, but they’re hardly the name brand giants in the space compared to HYG or JNK.

So in short: Bravo Larry. I have doubts you ever read my note, but I’m glad the spirit of at least was in the decision making here.

For more market trends, visit ETF Trends.