This record was achieved on the eve of another milestone for the ETF industry: the 25th anniversary of the listing of the first ETF in the US, the venerable SPDR S&P 500 ETF (SPY US), on 22nd January 1993. At the end of January 2018, SPY on its own accounted for assets of $307 Bn.

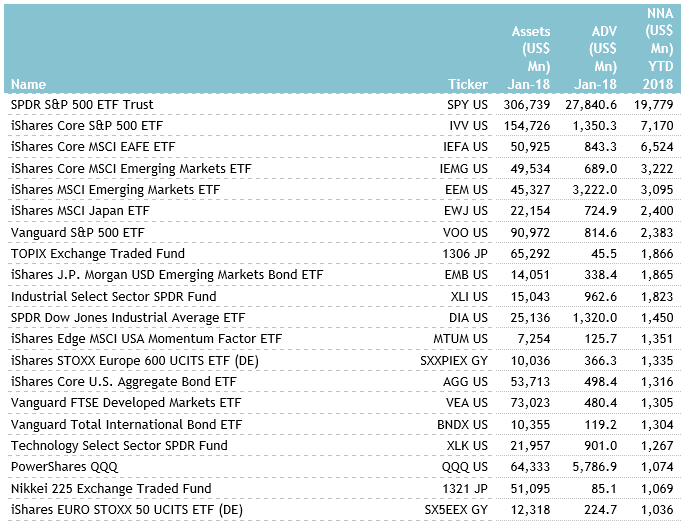

January 2018 also marked the 48th consecutive month of net inflows into ETFs/ETPs listed globally, with $106 Bn gathered during the month; 68.6% more than net inflows at this point last year. The majority of these flows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $62.6 Bn in January 2018. The SPDR S&P 500 ETF Trust (SPY US) on its own accounted for net inflows of $19.8 Bn.

Top 20 ETFs by Net New Assets: Global

Similarly, the top 10 ETPs by net new assets collectively gathered $3.55 Bn year-to-date during 2018.

Top 10 ETPs by Net New Assets: Global

Equity ETFs/ETPs listed globally gathered net inflows of $87.7 Bn in January and Fixed Income ETFs and ETPs gathered net inflows of $11.6 Bn. Investors have tended to invest in core, market cap and lower cost ETFs in January 2018.

For more information on new fund products, visit our new ETFs category.