By RiverFront Investment Group

Below are the highlights from RiverFront Investment Group’s 2018 Outlook. The entire report is available at www.riverfrontig.com.

THE ECONOMY

Our 2018 Market Outlook assumes a tug of war between reduced monetary stimulus and faster global growth, with faster growth ultimately winning the contest and driving equity markets higher. We believe that over the coming year financial markets will be caught in a tug of war between accelerating economic growth and the Federal Reserve’s (Fed) slow, but steady increases in interest rates and withdrawal of quantitative easing (QE) stimulus. More global central banks are likely to join the Fed in reducing or eliminating their QE programs in 2018. As this monetary stimulus is reduced it is our opinion that we are likely to see both interest rates and overall market volatility rise.

We believe that the Federal Reserve could raise rates an additional 2-4 times during 2018, at the same time that its balance sheet reduction is scheduled to ramp up. Rising rates and market volatility will present challenges that financial markets haven’t faced in many years. Fortunately, we believe these equity market headwinds will be offset by accelerating global growth. We believe three powerful catalysts (pay increases for millennials, labor market reform in Europe, and New Silk Road expenditures in China) are likely to push global growth above the dismal “new normal” growth of the past decade.

GLOBAL EQUITIES

Faster growth and continued strong corporate earnings should allow the bulls to triumph in this tug of war and keep equity markets rising in 2018, in our view. Our positive view of the global macroeconomic cycle in 2018 is translating into the strongest and most broad corporate earnings cycle we have witnessed across the globe in the last seven years. We think this backdrop of strong corporate fundamentals, combined with low global interest rates and inflation, is a positive environment for stocks that could help power the global bull market on well past a typical ‘expiration date’.

Within our allocations, RiverFront maintains its 2017 preference for stocks outside of the US. This does not make us negative on the US, as we recognize that American companies will likely benefit from tax cuts and deregulation. Our preference for Europe and Japan is driven by cheaper valuations, more supportive central banks and our expectation of stronger economic momentum. We continue to be more cautious about the UK market than elsewhere in Europe. We start the year neutral in emerging markets (EM), where the positive macro and earnings growth trends are balanced by more demanding valuation than last year, and there is evidence that domestic economic growth in China is slowing.

FIXED INCOME

The US fixed income market is likely to face headwinds over the coming year including accelerating global growth and a less accommodative Federal Reserve, in our view. Our base case scenario forecasts Treasury yields to increase modestly and therefore we expect most fixed income assets to struggle. We expect both short- and long-term interest rates to rise during the course of the year and the yield curve to continue to flatten, as short-term rates rise more than longer-term rates. In this environment we continue to underweight higher quality fixed income assets and overweight corporate bonds while maintaining some exposure to the high-yield market. From a yield-curve positioning perspective, we favor floating rate over fixed rate shorter maturity bonds and are willing to add duration selectively.

![]()

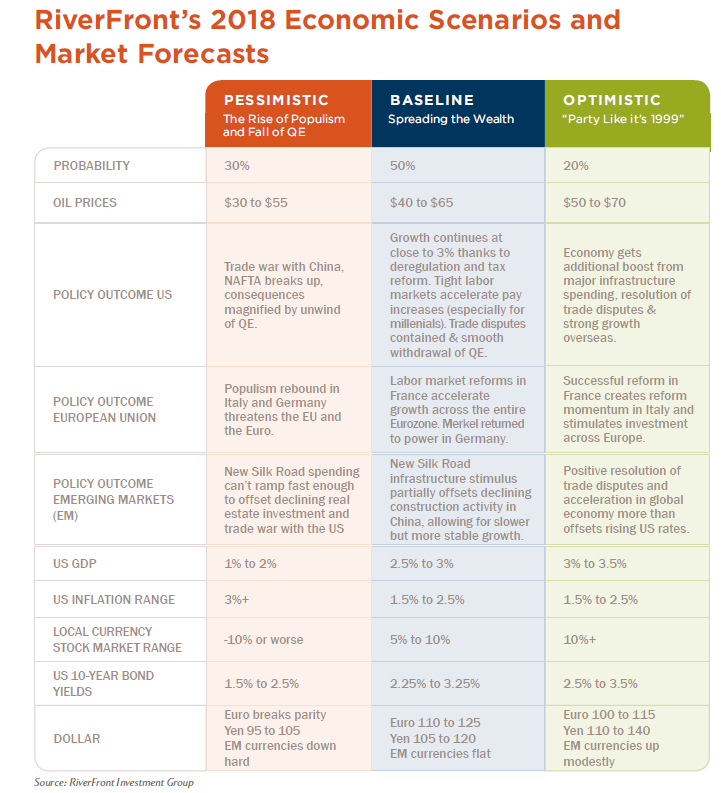

The table above depicts RiverFront’s predictions for 2018 using 3 scenarios (Pessimistic, Baseline, Optimistic). Our assessment of each scenario’s probability is also shown. Please note that these predictions reflect RiverFront’s views as of December 31, 2017. These views are subject to change and are not intended as investment recommendations. There is no representation that an investor will or is likely to achieve positive returns, avoid losses or experience returns as discussed for various market classes.

Disclosures