Rising rates typically negative affect fixed-income assets. Nevertheless, investors can target high-yield exchange traded funds to help cushion against any pullback.

On the recent webcast, High Yield Solutions for a Rising Rate Environment, Fran Rodilosso, Head of Fixed Income ETF Portfolio Management at VanEck, argued that investors should consider high-yield fixed-income assets if the markets continue on course in an environment of fiscal stimulus under the Trump administration, monetary tightening in response to the growing economic outlook, rising inflation, tighter credit spreads and stronger U.S. dollar.

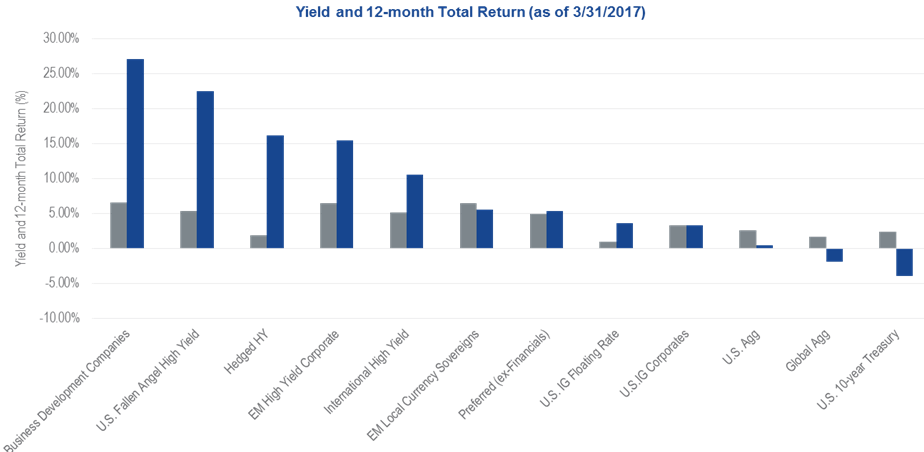

When seeking high-yield income-generating strategies, Rodilosso pointed to a number of options for various circumstances. For instance, if one is more amenable to higher risk, investors can consider something like fallen angel high-yield bonds to participate in the higher quality high-yield bond market, business development companies for exposure to loans to private companies and preferred securities for their attractive yield play.

For example, the VanEck Fallen Angel High Yield Bond ETF (NYSEArca: ANGL) was the first ETF to provide exposure to “fallen angel” bonds, speculative-grade debt securities that were initially issued with an investment-grade rating but were later downgraded to junk territory. Fallen angel issuers tend to be larger and more established than many other junk bond issuers. Rodilosso said that fallen angels have outperformed traditional high yield, investment grade and equity strategies and averaged less volatility than equity strategies.

The VanEck Vectors Preferred Securities ex Financials ETF (NYSEArca: PFXF) provides exposure to preferred securities, which may offer competitive yields with a higher payout than common stock and senior debt, has favorable tax treatment as distributions may be treated as qualified dividend income and are senior in structure or rank higher than common stock in the event of bankruptcy. Furthermore, by excluding financials, PFXF has offered similar yield to the broad preferred securities universe, provided greater diversification since financials make up almost three quarters of the broad preferreds universe and generated lower volatility historically than with financial preferreds.