As of the end of 2015, the U.S. equities made up 42% of the world stock market by market capitalization, followed by international developed 35% and rising emerging markets 23%.

“Though still the majority, the U.S. has gotten smaller as rest of world has increased,” Goei said.

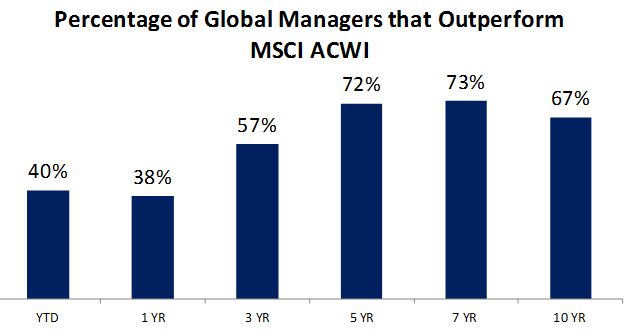

While investors may not easily and quickly access international markets through passive, index based fund options, Goei argued that active global managers may still provide alpha as active strategies outperformed the benchmark MSCI All Country World Index over longer periods – the percentage of global mangers that outperform the MSCI was 57% over the past 3 years, 72% over the last 5 years, 73% over the last 7 years and 67% over the past decade.

Investors interested in an active global strategy may consider ETF options, such as the Davis Select Worldwide ETF (NasdaqGM: DWLD), which is managed by Goei. DWLD focuses on long-term global opportunities that incorporate Davis Advisors’ judgement experience, high conviction, low turnover, accountability and alignment.

For instance, Davis Advisors have an overweight position in Safran S.A., a 100+ year old French multinational aerospace and engine component supplier. Goei argued that over the short-term, margin pressure from transition to next-gen narrowbody engines may weigh on the outlook. However, the company shows long-term opportunity through its next-gen narrowbodies over the next 15+ years and generate aftermarket for 25+ years.

Investors can also gain exposure to U.S. equities through Davis’ other active Davis Select U.S. Equity ETF (NasdaqGM: DUSA), along with targeted exposure to what Davis Advisors believes is an opportunity in the financial space through the Davis Select Financial ETF (NasdaqGM: DFNL).

Financial advisors who are interested in learning more about global opportunities can watch the webcast here on demand.