By Marc Odo, Swan Global Investments

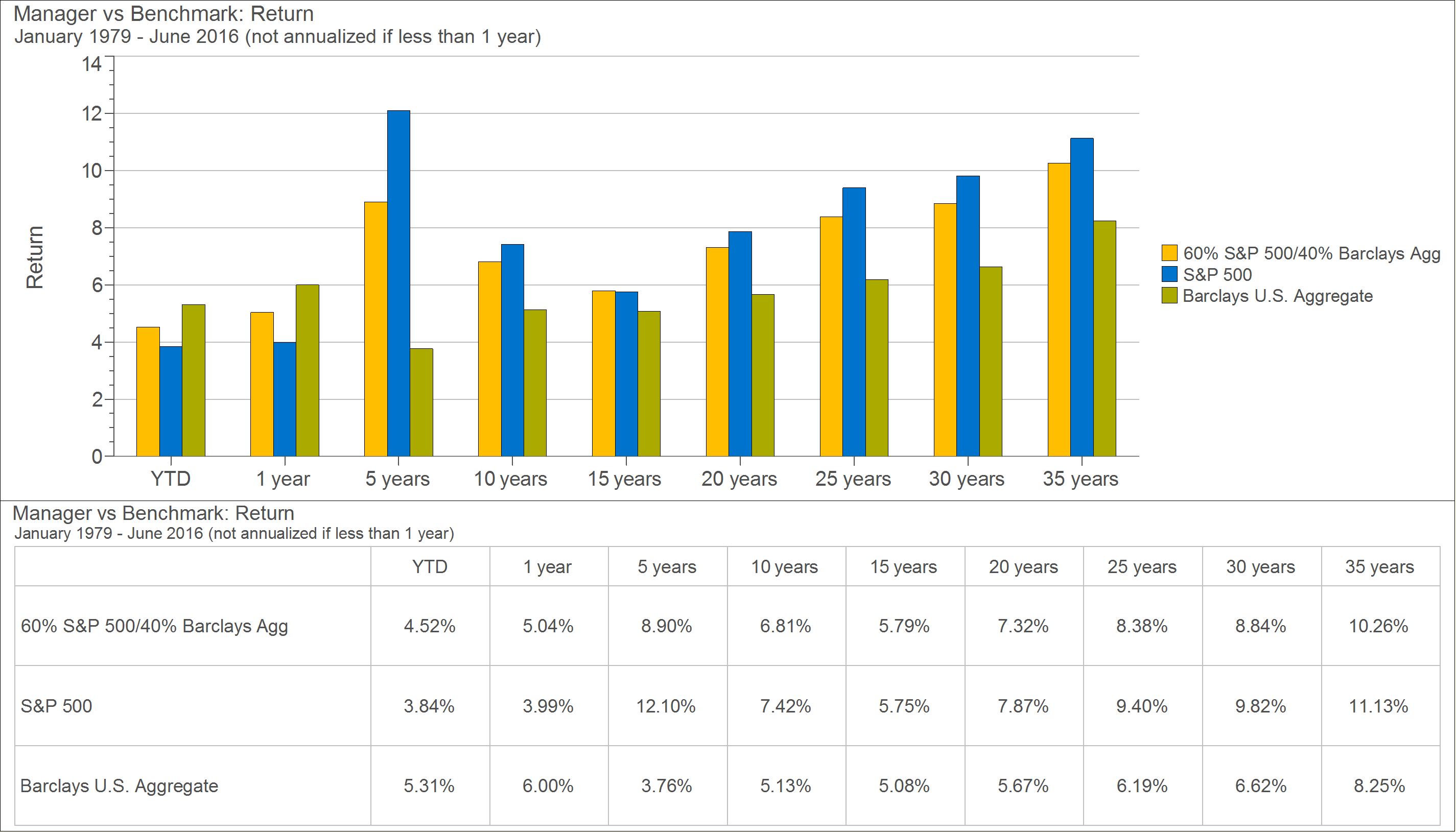

For decades the standard representation for a balanced portfolio has been the “60/40”- 60% equities, 40% bonds.

Although most investors diversified beyond this model and incorporated small caps, foreign stocks, high yield bonds, and perhaps something more exotic like REITs or commodities, a simple mix of 60% S&P 500 and 40% Barclays U.S. Aggregate Bond is often the shorthand definition of a balanced portfolio.

For a generation, this simple approach worked well. Stocks provided capital appreciation and dividends, albeit with a dose of volatility. Bonds produced yield, capital appreciation as rates fell, and acted as a volatility dampener when stocks went south. One could have met actuarial demands of 6%, 7%, or even 8% via this simple portfolio.

Source: Zephyr StyleADVISOR

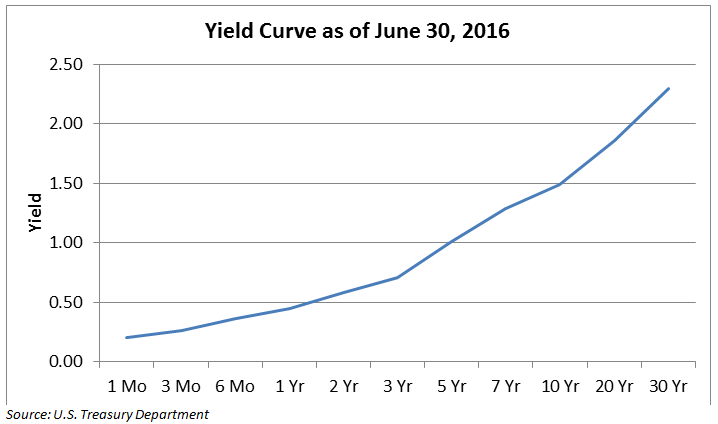

Looking at the above numbers, one might be tempted to say, “If it ain’t broke, then don’t fix it.” However, such an approach is dangerously naïve. The simple truth is that the likelihood of bonds posting returns anywhere near their historic levels is close to zero. In the graph below we can see the current yield curve. An investor purchasing 10, 20, or 30-year bonds will be hard-pressed to outperform inflation, while someone parking their money in the short end is essentially lending their money for free.

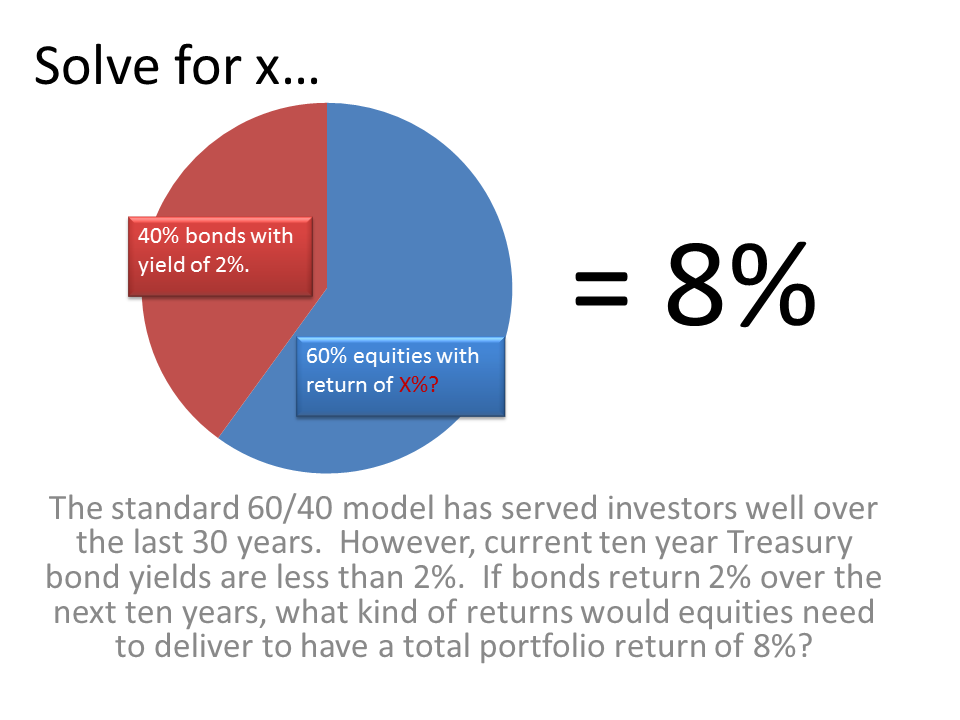

What impact does this have on the standard 60/40 mix? Let’s run a simple algebraic calculation. Assume we have a standard 60/40 mix and the target return for the overall portfolio is 8%. If we assume that the 40% position in fixed income will return 2%, what would the remaining 60% in equities have to return in order to lift the portfolio up to 8%?

Source: Swan Global Investments

The answer might come as a nasty surprise: 12%[1].