Despite these aggressive financing terms and despite auto manufacturers’ raising the incentive spending (=discounts) on new cars to an industry average of $3,587 in February, auto sales seem to have peaked in 2016 at a 17.5 million annual rate, while Q1 2017 saw an average annualized selling rate of 17.16 million.

Auto inventories have been building and now stand at 4.0 million vehicles, up sharply from the crisis trough of 1.5 million and matching the highest level previously recorded (in 2003). As the number of vehicles coming off lease is high and rising, downward pressure on used car prices is intensifying.

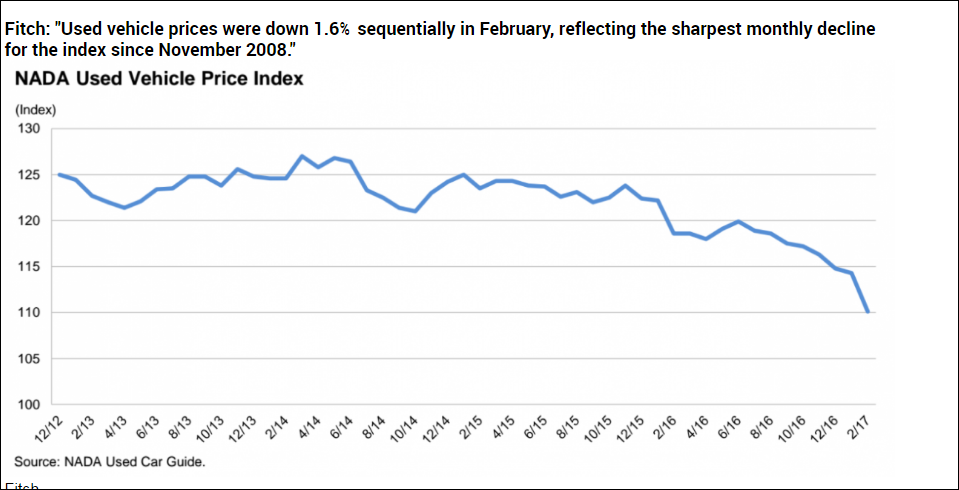

The National Association of Automobile Dealers produces a used vehicle price index shown in the chart below (courtesy NADA) depicting the falling price trend, which if extended, of course will contribute to greater losses for lenders as recovery rates on defaulted loans decline.

Courtesy of NADA

No surprise then that banks now are tightening their standards on auto loans. We believe these developments do not bode well for auto sales in quarters ahead.

This article was written by the team at Hillswick Asset Management, a participant in the ETF Strategist Channel.