The fixed-income momentum risk and reward benefits are also historically been consistent with those in the equities market.

Bruno also pointed out that during periods of market stress, the moment strategy has also withstood the volatility, typically outperforming or at least doing less poorly than the widely observed Barclays Agg.

Rieger argued that as we head toward a period of higher volatility with rising rates and widening credit spreads, some investors may have turned to higher yielding corporate bonds for the attractive income yields, which may help cushion any potential fallout. However, a low-volatility focus may also help diminish drawdowns.

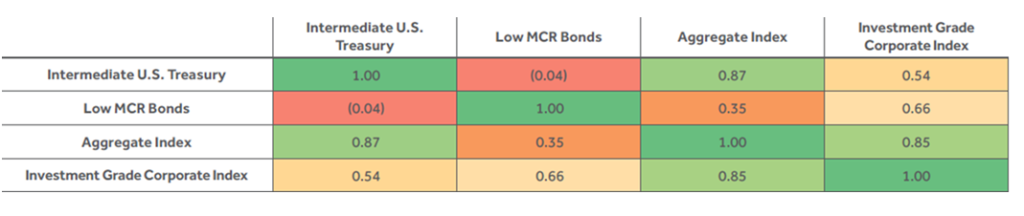

For example, HYLV’s underlying index ranks each of its holdings according to its marginal contribution to risk, or MCR, a measurement of the amount of risk a security contributes to a portfolio of securities. The measure is calculated using a bond’s duration and the difference between the bond’s spread and a weighted average spread of the bonds in the broader index universe. Those with a higher MCR will add more credit risk than debt with a lower MCR. The underlying index will then only select the 50% of bonds measured to have the least credit risk based on their MCR.

Historical data has shown that low-volatility high-yield bonds have outperformed over the long haul, preserving the yield pickup of high yield bonds while lowering the credit risk, compared traditional high-yield bond benchmarks.

“A basket of low MCR high yield bonds contains higher quality credits and has the potential to outperform the broad high yield universe during times of widening credit spreads,” Bruno said.

“With the Federal Reserve taking steps to normalize monetary policy, a high yield low volatility strategy may be an attractive option for investors concerned with rising rates.”

Financial advisors who are interested in factor-based fixed-income strategies can watch the webcast here on demand.