Similar to our expectations that certain areas of the equity markets that have rallied strongly will begin to lag, areas of the bond market that exhibit more credit risk may also struggle. As exhibit 6 illustrates, the premium, or spread, that investors earn for owning both investment grade and below investment grade bonds has declined and may no longer represent an attractive value. Thus, we have reduced exposure to corporate bonds and mortgage-backed securities in recent weeks.

As a global investment firm who focuses on managing risk in real-time, we are finding abundant investment and risk management opportunities in this environment.

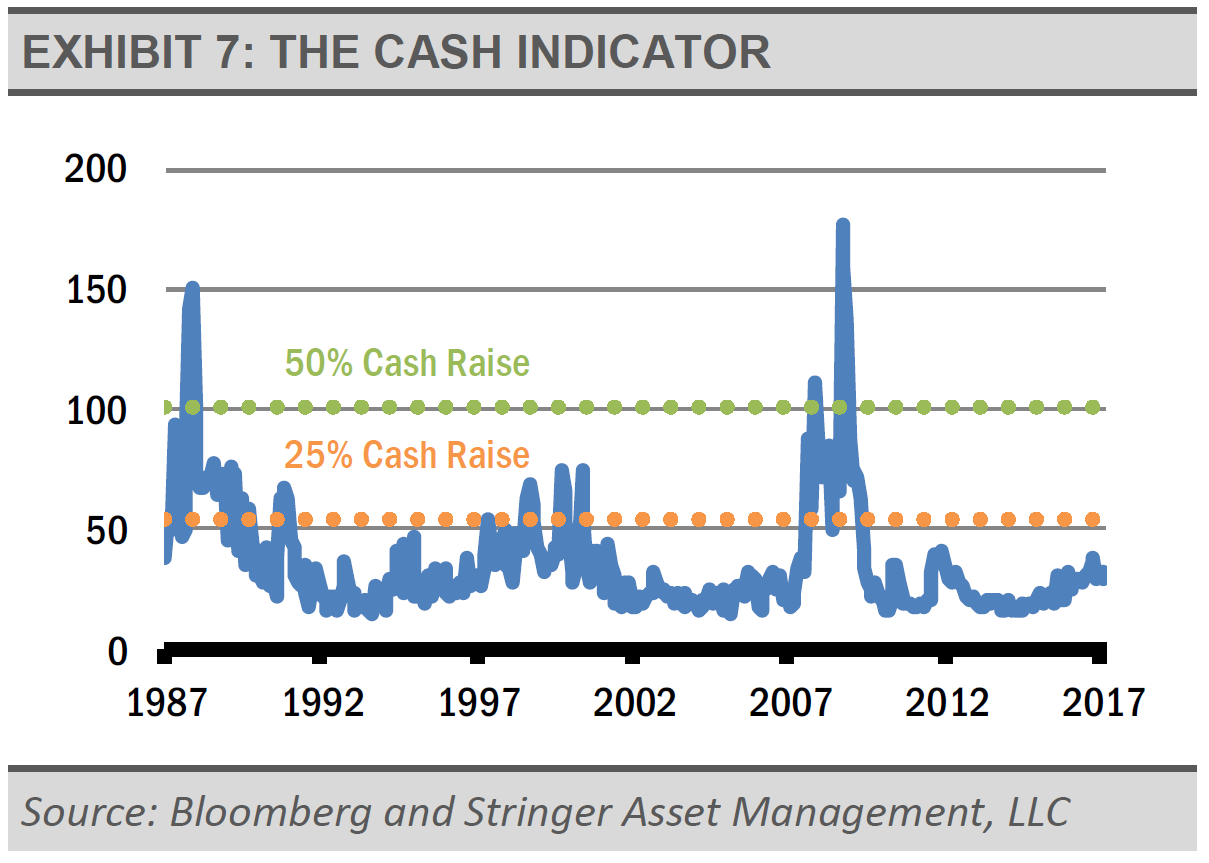

THE CASH INDICATOR

Though still elevated compared to its post-crisis average, the Cash Indicator has been receding lately. We think this tempering of risk measures reflects the positive readings that we have seen in global economic indicators. Thus, we think that market drops are buying opportunities.

IMPORTANT ECONOMIC FACTORS

We think that economic fundamentals, such as Gross Domestic Product (GDP) growth rates, and market fundamentals, such as valuations, matter over time. Clearly, history shows that earnings drive stock prices in the long-term. There are periods where prices deviate from earnings, and valuations compress or stretch, but the relationship over the long-term is telling.

Earnings growth drives stock prices, and earnings are heavily dependent on revenue. Revenue growth, in turn, is closely related to the nominal growth in economic activity, or NGDP, as the following graph demonstrates. When thinking about economic and stock market fundamentals, it is important to think about what drives NGDP growth.

Nominal GDP (NGDP) is real GDP, plus inflation. We care more about nominal GDP because revenues and earnings growth includes inflation. In generating its long-term forecast for real GDP (not including inflation), the Bureau of Labor Statistics (BLS) combines a forecast for labor market growth and productivity growth. Labor market growth is based on demographic trends, which move slowly and are relatively easy to measure. Productivity is more difficult to forecast because it is based largely on new technologies and innovation. The BLS forecasts annual growth of roughly 0.5% for the labor force, and approximately 1.8% for productivity growth, for a 2.2% real GDP forecast. To create a forecast for NGDP, we include an inflation factor using market-based inflation expectations as a proxy for what to expect going forward. We like to use the relationship between Treasury bonds and Treasury Inflation Protected Securities (TIPS) of the same maturity, known as the TIPS breakeven spread, to derive what the market thinks inflation will be over the next several years. The market expects inflation of roughly 1.5% over the next 10 years. As a result, we think that 3.7% (2.2% + 1.5%) is a good estimate for NGDP on average over the next several years.

By creating this nominal GDP forecast, we think that it is possible to create reliable expectations for U.S. economic activity, revenues, and earnings over the long-term. Obviously, short-term events can derail the economy’s near-term potential or accelerate revenue and earnings growth, but we think longer-term economic growth is rooted in these factors. Importantly, these factors suggest a positive environment for slow, but steady growth ahead.

None of these inputs to economic growth (labor force and productivity growth rates, along with inflation), corporate revenues, and earnings in aggregate are directly and significantly impacted by a presidential administration. Granted, an administration may have significant influence on specific industries through various policy measures (e.g. regulations or subsidies), but, in aggregate, what drives the U.S. economy is the stable growth rate of our labor force and productivity of the private sector. It is these factors that should be the areas of focus for broad equity market investors.

Unlike a centrally planned economy, such as China, these factors are not driven by the president. Through the wisdom of our forefathers, our system of checks and balances prevents any president from wielding too much power. The upward bias to our economy and our markets are a result of our democracy and capitalism. This has held true despite many different administrations, both republican and democratic, with very divergent economic and political policies.

GOING FORWARD

Is it different this time? Yes, the candidates are different. Still, the dominant factors that drive our economy and markets are unchanged regardless of presidential administration. The demographic, productivity, and inflationary trends that drive our economy and financial markets are well entrenched. These trends indicate slow, but steady growth ahead and a positive environment for equity market investors with appropriate time horizons.

This article was written by Gary Stringer, CIO, Kim Escue, Senior Portfolio Manager, and Chad Keller, COO and CCO at Stringer Asset Management, a participant in the ETF Strategist Channel.