By Rob Stein, CEO and Founder, Astor Investment Management

As we look ahead to what 2017 may hold, I’m predicting the end of what I call “the great experiment”—the managed economy that has dominated the fiscal and economic landscape for nearly 10 years. The reason, as we state in the Astor Outlook 2017 Report, is not political. Rather, it’s time!

Given where we are in the state of the U.S. economy and the stock market, it’s hard to believe that the great recession of 2008 (the worst economic downturn since the Great Depression) occurred nearly a decade ago. And who needs reminding of the bear market that lasted nearly a year and a half, from October 2007 to the March 2009 low? During that time the S&P 500 lost about 50% of its value.

Acknowledging that investors could not endure another 30-50% decline in stocks, housing, or general risk assets, central bankers embarked on a managed economy that “cut off the tails.” That is, the downside was limited by Fed intervention, quantitative easing (QE), and regulation, while the upside was capped in exchange. And thus began “the great experiment of the managed economy.” But now, times have changed.

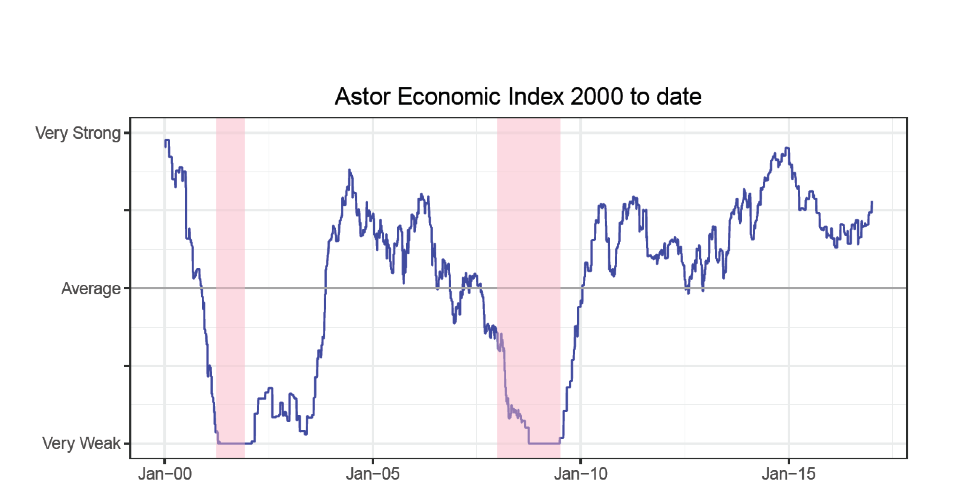

Although the Dow reached the 20,000 level on January 25, 2017, there are even more important numbers; among them an unemployment rate below 5% and an advancing GDP rate (the final reading for Q3 2016 was 3.5%, up from earlier estimates for the quarter of 3.2% and 2.9%.). Our proprietary Astor Economic Index® (AEI) shows improving U.S. economic fundamentals that we believe are supportive of investors holding higher levels of risk assets, such as equities.

Source: Astor Calculations