– The last major unknown in the European political sphere is the ongoing Brexit negotiations. The UK House of Commons voted this month to approve the process of withdrawal, authorizing Prime Minister Theresa May to invoke Article 50 of the EU treaty and formally begin the two year negotiation process to leave the European Union. At that point, formal negotiations will begin, with the UK seeking to maintain access to the European Single Market, and Europe seeking to extract a major “divorce payment” and demonstrate to other countries considering EU exits the high cost to do so.

Despite these risk factors, we expect the major negative outcomes to be avoided, and even see opportunity for greater European integration with positive impacts on European asset markets. The simplest rationale for this perspective is that in each case listed above, the most disruptive outcome is unlikely. However, 2016 demonstrated how fraught an exercise it is to predict elections based on polling data. We instead have developed a different thesis: the factors which propelled anti-Europe candidates no longer exist.

– In Northern Europe, successful Eurosceptic parties have been right-wing nationalists running on platforms of “European identity” based on anti-immigration rhetoric. But the European refugee crisis of 2015 has subsided, leaving the message of these “single-issue” parties rather hollow.

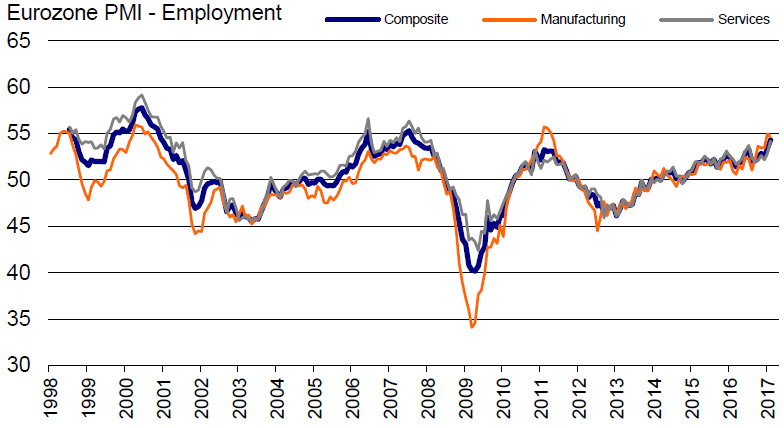

In Southern Europe, successful Eurosceptic parties have been left-wing populists running on platforms of economic revival enabled by freeing the shackles of the Euro. But after years of stagnation, the European economy has begun to accelerate, fueled by a relaxation of austerity measures, aggressive ECB policy, and rejuvenated bank lending. This renewed growth, especially its impact on employment, changes the calculus of those Europeans who previously felt conditions were bad enough to risk leaving the Union.

It’s easy to become overwhelmed by negative headlines, but it’s clear to us that the two factors which propelled Eurosceptic politics to the forefront have subsided. We therefore expect their success to subside, and with it the threat of European fragmentation. Instead, the major political forces on the continent will be empowered with fresh mandates to forge the policy reforms necessary to ensure the long-term stability of the European Union and Eurozone, a prospect which would have major positive effects on European asset markets and the global economy.