By Scott Kubie, CFA, CLS Investments Chief Strategist

The recent short-term rally in global stock markets has boosted optimism towards equity investments.

While always glad to see our clients benefiting from market increases, CLS portfolio managers continue to keep a vigilant eye on market risk. In addition to our Risk Budgeting Methodology, we also regularly identify specific risks of greatest concern. (You can follow our list of key concerns by reading our quarterly CLS Reference Guide or Monthly Perspectives.)

Currently, global debt levels trouble CLS more than any other specific risk. While the risks of the 2008 global financial crisis are in the past, the debt used to help spur the economy past the crisis remains. This post seeks to explore different ways global debt levels might slow stock market returns in 2017. Before exploring the details, keep in mind the previous sentence included the word “might.” While these risks will shape markets in 2017, the most likely outcome is global governments will muddle through and markets will rise.

High Government Debt to GDP

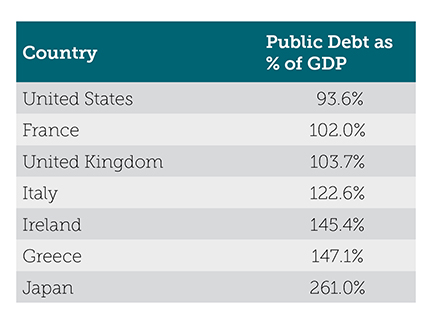

At this point in the economic cycle, moderate GDP growth should be eclipsing deficit growth, meaning government debt is becoming easier to service. Keep in mind, governments rarely pay down debt by running surpluses. Instead, GDP grows at a faster pace than the deficit. Assuming taxes grow proportionately with GDP, government debt becomes less burdensome. So debt levels are often measured as a percentage of GDP. The table below summarizes debt levels of some key countries.

Research shows that the when debt levels rise above 90%, concern about increased taxes, higher inflation, and regulation slow GDP growth by 1% per year. None of those changes benefit stock markets in the long-term. This thesis is hotly debated, but the slow U.S. recovery and anemic recoveries in Japan and Europe support the conclusion that high debts pose a risk for global economies.