We think that short-term interest rates will move significantly higher from here, along with Fed policy, while long-term interest rates should be range bound at a rate a bit higher than the current level. Expectations for real economic growth and inflation have picked up, pushing long-term bond yields higher. We expect long-term bond yields to increase further, but most of the movement is likely behind us.

We think that in today’s global economy, where money flows freely across international borders, the natural level of interest rates is also influenced by global economic conditions, such as global economic growth, inflation, employment trends, and credit spreads.

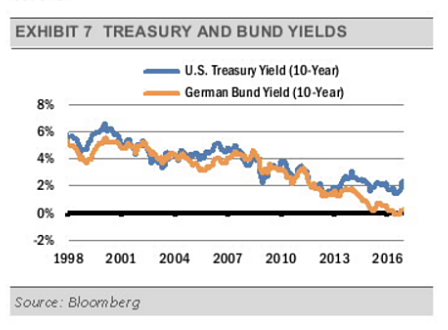

For example, if the German Bund, which is a similar credit quality as the U.S. Treasury Bond, yields 1.0%, the U.S. Treasury Bond of a similar maturity should yield a similar rate, accounting for other costs, such as currency exchanges. If the Treasury moves sufficiently higher relative to the Bund, global investors will sell Bunds and buy Treasuries. Currently, the difference in yield between the 10-year Treasury and the Bund is approximately 5 times its historical average (exhibit 7).

Unless the yield on the Bund increases significantly, possibly from a sharp increase in European economic activity and/or inflation expectations, the low yield of the Bund will help hold the 10-year Treasury yield in check.

Unless the yield on the Bund increases significantly, possibly from a sharp increase in European economic activity and/or inflation expectations, the low yield of the Bund will help hold the 10-year Treasury yield in check.

With long-term yields at higher levels, we think there is attractive value in areas that got hit the hardest when bonds sold off.

Our more optimistic outlook is also reflected in our allocations to alternative, or non-traditional, investments. We think convertible bonds can provide equity-like upside with lower volatility.

Looking at more defensive holdings, we think that the Fed’s increases in short-term interest rates will favor floating-rate bonds. Unlike traditional bonds, the coupon rate on floating-rate instruments can adjust higher with interest rates, which keeps the coupon around current market levels. Therefore, their value does not have to fall to the same degree as a fixed-rate instrument to keep the yield in-line with the market.

Overall, we think these areas will allow for appreciation, while still performing well as short-term interest rates rise.

Going forward, we expect equity and bond market volatility to continue as fiscal stimulus in the U.S. collides with Fed tightening. In summary, with an eye towards risk management, we are positioned to benefit from an accelerating global economy, rising short-term interest rates, and a strengthening U.S. dollar.

THE CASH INDICATOR

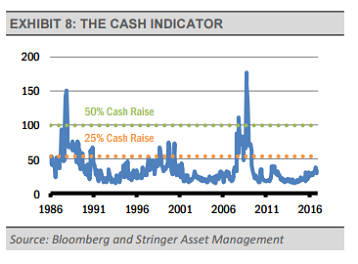

The level of the Cash Indicator (CI) has declined in recent weeks as credit spreads have tightened, confirming the recent confidence displayed in the equity markets.

Though the CI elevated throughout most of the year due to changing market and regulatory environments, the CI has consistently suggested that investors should remain invested according to their long-term plans.

Even in the depths of the January and February market volatility, the CI clearly suggested that 2016 was not going to be another 2008.

This tool has again proved valuable throughout these volatile markets.

This article was written by Gary Stringer, CIO, Kim Escue, Senior Portfolio Manager, and Chad Keller, COO and CCO at Stringer Asset Management, a participant in the ETF Strategist Channel.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

Data is provided by various sources and prepared by Stringer Asset Management LLC and has not been verified or audited by an independent accountant.