By John Eckstein, CIO, Astor Investment Management

For my last economic update of the year, I will review where we are today and try to read the tea-leaves of the incoming Trump administration. The president elect is lucky in inheriting a solidly growing economy. His penchant for decisive action may run into procedural roadblocks in Washington which could significantly delay actions which require congressional approval. Overall I see few significant effects in the coming months.

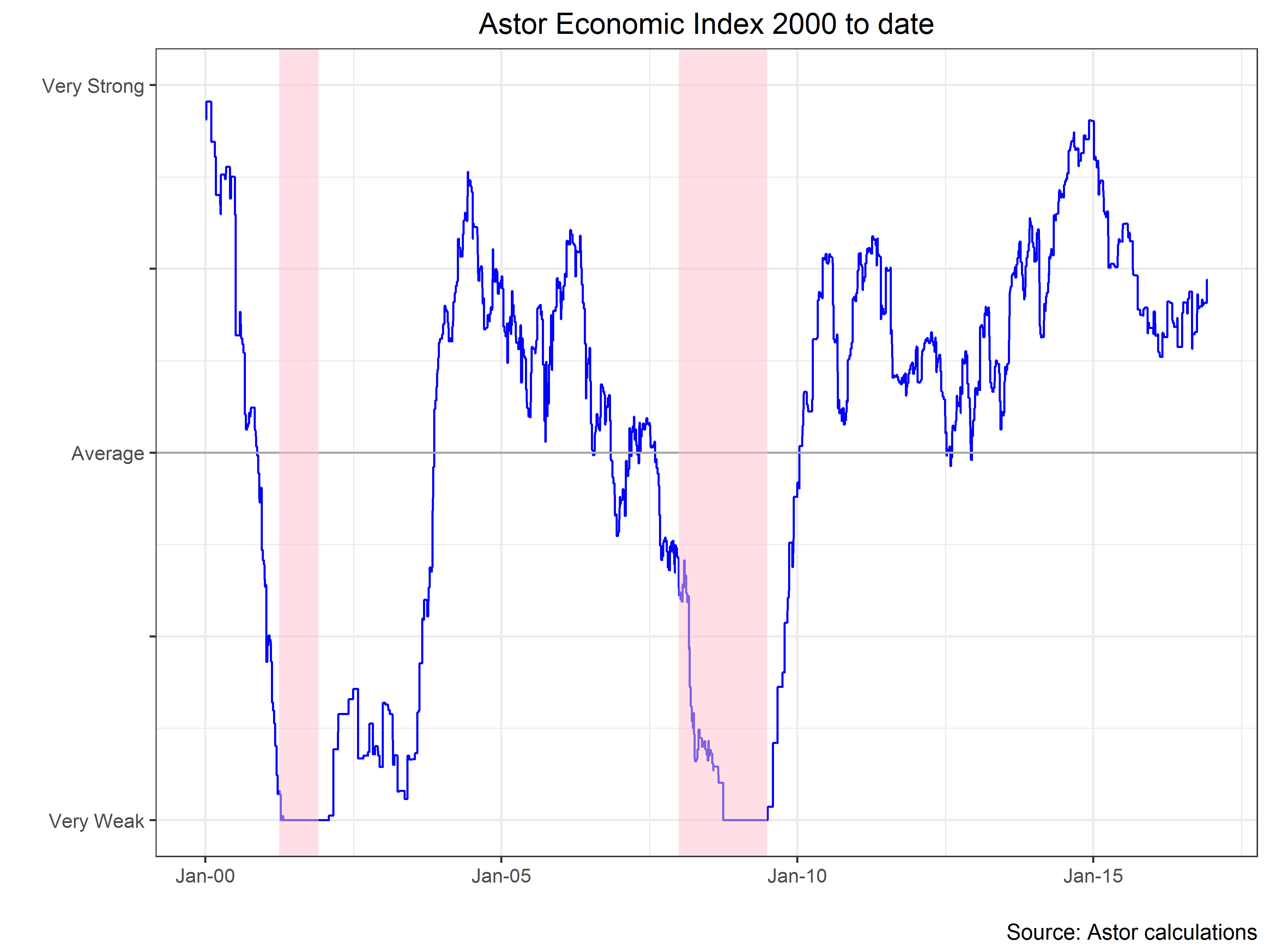

Our latest reading for the Astor Economic Index® (“AEI”) improved over the month and currently shows the US economy as growing somewhat above average. I also see modest improvement year over year. As this is the last update of 2016 I can say that I am pleased with the performance of our index as an economic gauge over the last 12 months. Memories may be dusty, but a year ago there was widespread concern about US economic weakness. The AEI was showing only minor declines at the time and, in fact, no extended decline in the broader economy occurred. The AEI is a proprietary index that evaluates selected employment and output trends in an effort to gauge the current pace of US economic growth.

The new president’s first element of luck is an economy running at full employment. Last Friday’s employment report was fairly strong – showing the economy continues to add jobs faster than the number of new entrants to the work force. Levels of both unemployment and underemployment (ie, involuntary part time work) have both dropped significantly in recent months. Recently we have seen a trend of improving wages. That trend weakened slightly this month but the year on year improvement is still significant.

The nowcasts produced by the Federal Reserve banks of Atlanta and New York are both still showing strong growth in the fourth quarter. The Atlanta Fed is currently estimating 2.6% SAAR and the New York Fed is currently forecasting 2.7%. Both somewhat above the average for the current expansion. Both estimates have been updated since the release of the employment number for November.

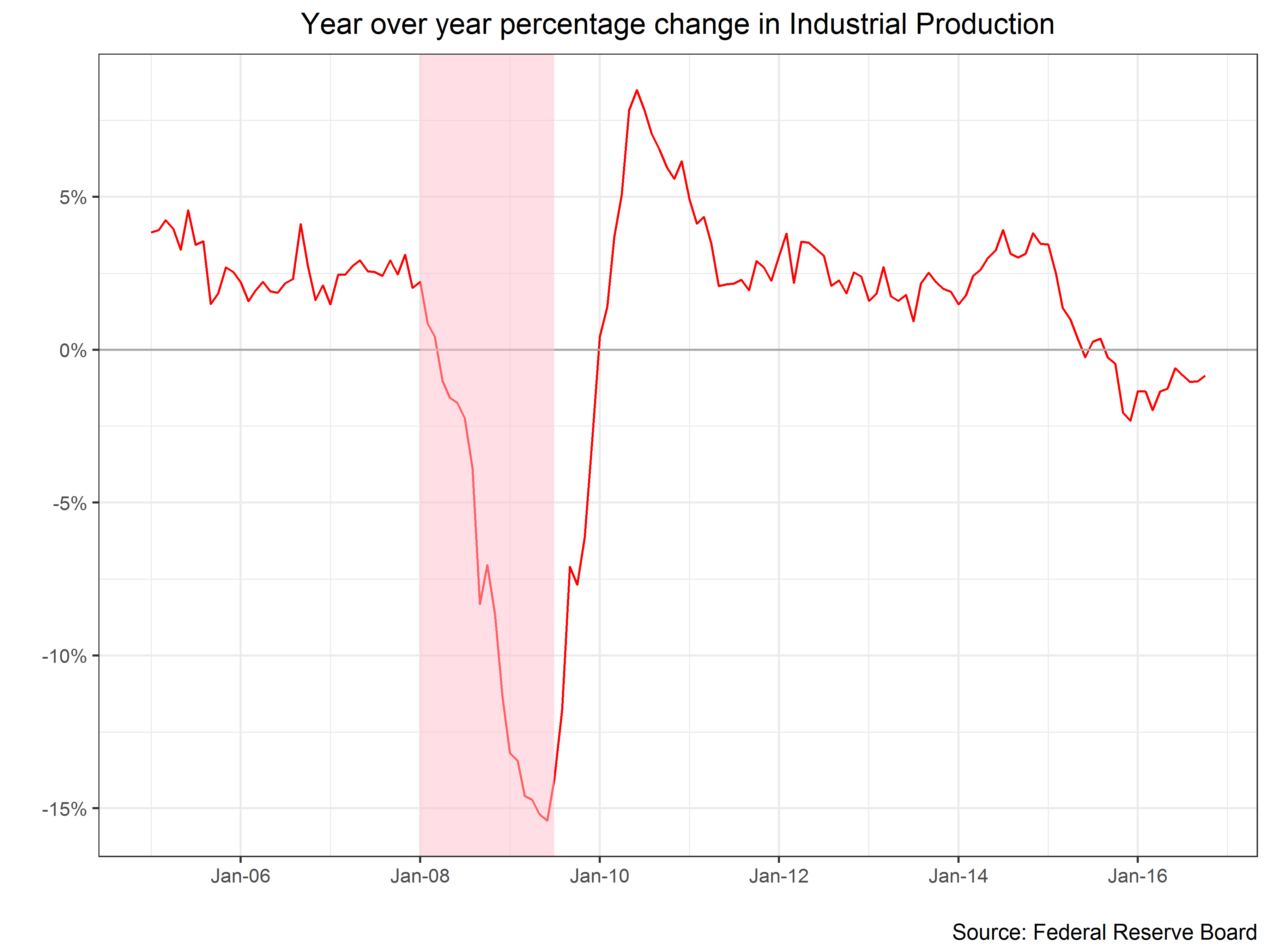

There is another element of luck in the external environment – what is going on with our trading partners around the world. I attribute the last few years tepid industrial production growth to weak external demand and the strength of the dollar.

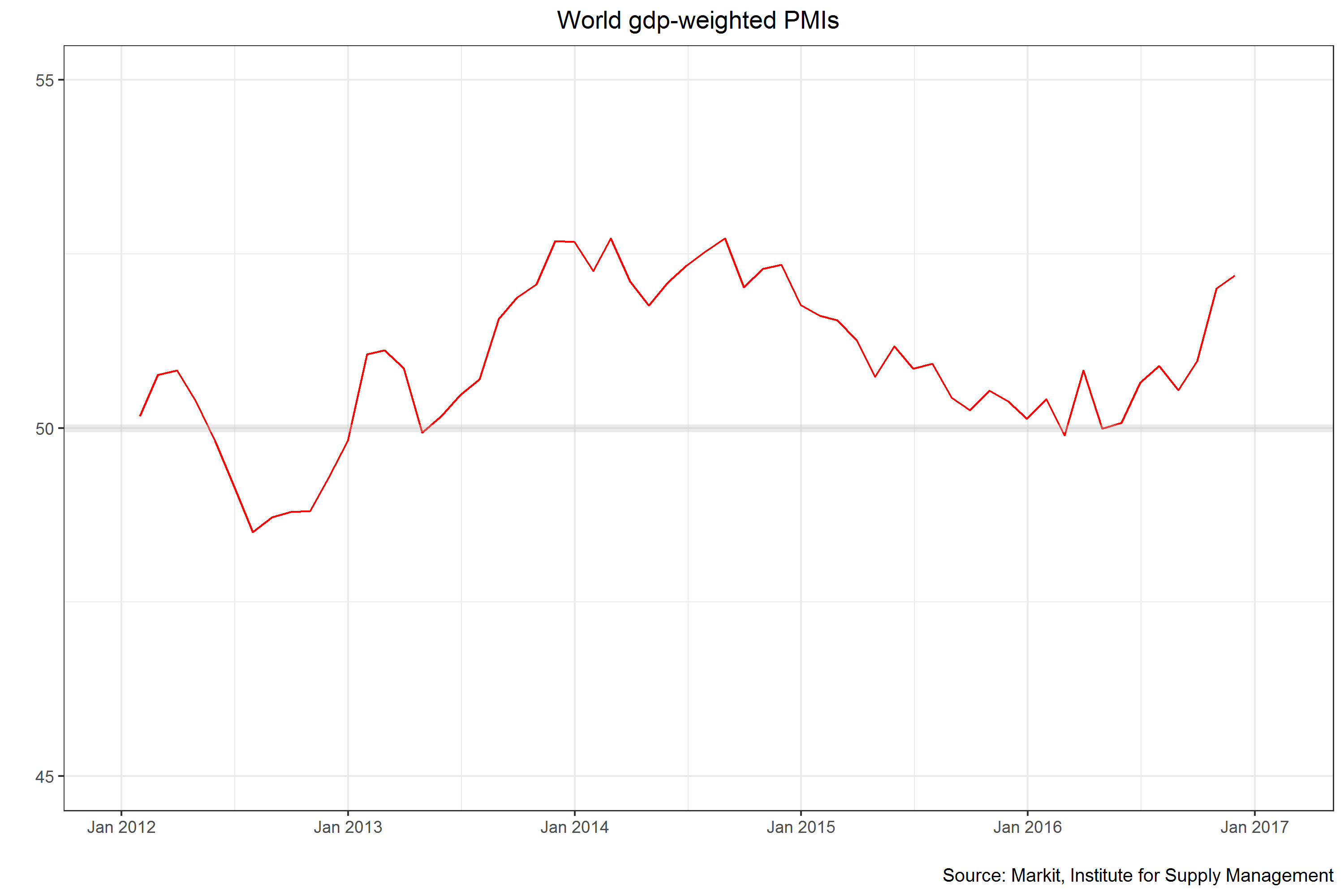

The chart below is the GDP weighted average of the individual purchasing managers indexes. I intend it to be proxy for the change in demand in the world manufacturing cycle.

This reading is now approaching its highs from 2014 – suggesting that the weak global manufacturing environment may be improving. Mitigating this global good news somewhat is the performance of the dollar which has set new highs in trade weighted terms. This makes it harder for business to export, though dollar is not seeing the sharp rise it experienced in June 2014- December 2016 period.