As we improve our quality of life through technological innovations, robotics and automation could be the next quantum step for enhancing productivity. Investors can also tap into this growing industry through a targeted exchange traded fund.

On the upcoming webcast, Plug into Robotics with an ETF Strategy, Henrick Christensen, Director of UC San Diego Contextual Robotics Institute, Travis Briggs, CEO and Partner at ROBO Global US, and William Studebaker, Head of Global Strategies and Director of Research at ROBO Global, will look at the innovative robotics industry and its impact on the economy, along with ways advisors and investors can gain exposure to the potential growth.

Specifically, the ROBO Global Robotics & Automation Index ETF (NasdaqGM: ROBO) provides exposure to global companies engaged in the business of robotics-related or automation-related industries. Robotics- or automation-related products and services include any technology, service or device that supports, aids or contributes to any type of robot, robotic action or automation system process, software or management.

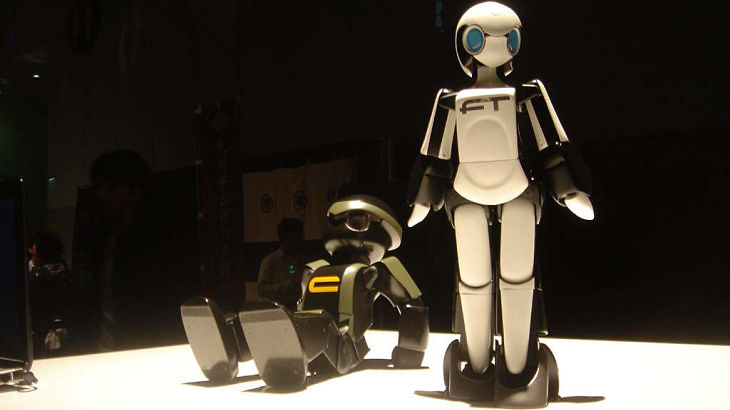

“The robotics and automation landscape is enabling a technological revolution that will fundamentally change how we work and live,” according to ROBO Global. “Robotics has transitioned from an industrial application to a disruptive force in most modern industries. ROBO Global realized that the next megatrend is here, so we created the one and only index to track this rapidly evolving space.”

For instance, robotics or automation services and products include unmanned vehicles, software that enables virtualized product design and implementation, three-dimensional printers, navigation systems and medical robots or robotic instruments.