Volatility Smile

(Click to enlarge) Source: BloombergOne option strategy that can capitalize on volatility in a slightly more skew neutral fashion is the short strangle. A short strangle involves the sale of an out of the money put and an out of the money call. The strategy is analogous to a straddle except by widening the strikes (as opposed to selling only the at the money strike in a straddle), the probability of a profitable trade improves. Options are decaying assets and the rate of daily decay is known as theta. Option theta tends to increase as expiration approaches and thus short strangles are most often employed with shorter term maturities. Short strangles can add income to portfolios, but they are certainly not riskless and are generally not suited for the novice trader. They do require active management and strict discipline in order to minimize potential losses. The best market environment for a strangle is immediately following a volatile period that morphs into a rangebound, or quiet cycle. Short strangles can be constructed with a direction neutral profile on initiation and are considered credit spreads with the intention of falling prices by either lower volatility levels and/or time decay.

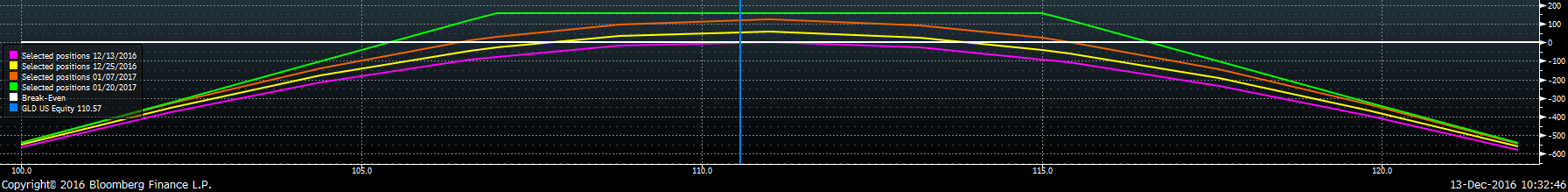

One example of a short strangle on GLD is the January 20, 2017 (38 days to expiration) 107-115 strangle. As of the close on December 12, 2016, the 105 put could be sold at the bid price at $0.85 and the 115 call could be sold at $0.75, also on the bid price for a total credit of $1.60. The $1.60 represents the maximum reward for this short strangle. The strategy is not entirely skew neutral, but does have less initial skew exposure than supply-side products. If GLD remains between the two strike prices, the trader can capture the entire premium of $1.60. In reality, a prudent trader would exit this position after some acceptable capture rate was achieved, for example 50% or 60% of the premium. There is a downside breakeven point which is the lower strike less the premium collected ($105.40) and an upside breakeven point designated as the higher strike plus the premium collected ($116.60).

Short 1 GLD JAN 20, 2017 107-115 strangle @ $1.60 credit

If the ETF begins to put “pressure” on either of the break-evens, management of the position could include rolling strikes out further away or even rolling the position out in time, or just closing the position down depending upon the outlook of the trader. The critical element in using short strangles is to have your plan in place ahead of time and be prepared for unfavorable scenarios. Taking a small loss over a large loss is essential for the success of a long-term strategy.

According to Lyrics.com, there are 70 artists and 100 albums that match the phrase “Turn the Frown Upside Down.” If properly managed, the short strangle can add value to a portfolio and ultimately leave you smiling and singing to your own tune.

Chris Hausman, CMT, is Director of Risk Management and Chief Technical Strategist at Swan Global Investments, a participant in the ETF Strategist Channel.

Disclosures:

Swan Global Investments is a SEC registered investment advisor providing asset management services utilizing the Swan Defined Risk Strategy, allowing our clients to grow wealth while protecting capital. Please note that registration of the Advisor does not imply a certain level of skill or training. Swan Global Investments, LLC is affiliated with Swan Capital Management, LLC, Swan Global Management, LLC and Swan Wealth Management, LLC. Disclosure notice and privacy policy.